Airwallex Founder's Critique of Crypto Stablecoins Sparks Debate: Revolution or Illusion?

Author:

@awxjack;@kkone0x;@EarningArtist;@alexzuo4;@BroLeonAus;@bonnazhu;@0xHY2049;@codeboymadif

Compiler: WuBlockchain Aki_Chen

(This article seeks to accurately present viewpoints from all sides. Whether supportive or critical, these perspectives reflect the diverse market thinking surrounding the debate between stablecoins and traditional cross-border payment systems.)

Intro

In June 2025, Jack Zhang, co-founder and CEO of Airwallex, sparked heated debate across both traditional finance and the crypto community by posting a series of tweets questioning the real value of stablecoins in B2B settlements among G10 developed economies. His remarks ignited discussions on cost efficiency, financial sovereignty in emerging markets, and regulatory frameworks surrounding stablecoins.

On the surface, the debate appeared to center around differing technical approaches to cross-border payments. However, at a deeper level, it revealed a fundamental clash between the philosophies of the traditional financial system and the open blockchain ecosystem.

This article presents Jack Zhang's core arguments while contextualizing them within Airwallex's development path, global licensing footprint, and business model. It also outlines both supportive and critical responses from the Twitter crypto community and traditional finance professionals. Through a multi-dimensional lens, we analyze the role of stablecoins in the global payments landscape, Airwallex's regulatory and competitive positioning, and the broader industry power dynamics underpinning the controversy.

Jack Zhang :Stablecoins Fall Short of Existing Cross-Border Payment Systems

Jack Zhang, co-founder and CEO of Airwallex, recently took to Twitter to question the practicality of stablecoins in cross-border payments between major developed economies.He first argued that for B2B cross-border transactions among G10 countries, stablecoins offer no real advantage in terms of FX costs or settlement speed. For instance, if a payment starts in USD and the recipient ultimately needs to receive EUR, the "off-ramp" cost of converting stablecoins back into fiat often exceeds that of a direct FX conversion via the traditional interbank system. In other words, stablecoins do not effectively reduce costs in this context.

Zhang went further, stating that in his 15 years of experience in the crypto space, he has yet to see cryptocurrencies solve any real-world problems. While many have made fortunes investing in crypto assets, the underlying technology, in his view, has not created tangible value.Even though stablecoins tend to have lower volatility compared to other crypto assets, Zhang remains unconvinced of their large-scale utility in inter-enterprise transactions—unless the trade involves "exotic" or less commonly used currencies with limited liquidity. He contrasted this with the pervasive real-world applications of AI, suggesting that crypto use cases remain marginal by comparison. Furthermore, he noted that much of the trading volume in stablecoins is not tied to actual economic activity.In his view, the frequency and value of stablecoin usage in mainstream economies remain very limited.

Zhang emphasized that even in 2025, he still "doesn't see how stablecoins improve cross-border transactions involving G10 currencies," given that Airwallex already offers real-time—virtually zero-cost—cross-border settlement services. According to him, the company's current cross-border transfer fee is below 0.01%, making it essentially "free" and "instant."As he put it: "You can't be cheaper than free, and you can't be faster than real-time."

The only use case for stablecoins that Zhang acknowledged as reasonable was the business model of Bridge—an infrastructure provider for stablecoin wallets in Latin America and Africa—recently acquired by Stripe. However, in his view, this represents more of a regulatory arbitrage opportunity than a truly disruptive innovation. Rather than being transformative, he sees it as simply taking advantage of gaps between jurisdictions.

Company Overview & Business Model of Airwallex

To fully understand Jack Zhang's position, it is essential to first examine Airwallex's product model and business rationale.

Airwallex was founded in 2015 and is now headquartered in Singapore. The company operates in 23 countries and regions, with a workforce of nearly 1,500 employees. Its services span the entire cross-border transaction lifecycle, including international collections, global payouts, and foreign exchange, leveraging technology to reengineer traditional cross-border capital flows.Airwallex's global payments infrastructure covers over 180 countries and regions and has served more than 100,000 businesses worldwide, processing over $100 billion in annual transaction volume.

The company was co-founded by Jack Zhang and three fellow alumni from the University of Melbourne. At the time of its inception, most traditional banks still relied heavily on the SWIFT network—established in the 1970s—for cross-border transfers. Airwallex set out to build a faster and more cost-efficient global payments system using internet and fintech innovations.From the beginning, the founding team envisioned solving long-standing inefficiencies in traditional financial infrastructure, with the ambition to build a next-generation global banking system.

Global Licensing Footprint and Compliance Strategy

Unlike many crypto-native startups that emphasize "decentralization," Airwallex has positioned regulatory compliance and licensing as core pillars of its competitive advantage since its inception.Currently, the company holds payment licenses or financial business authorizations in over 60 jurisdictions globally—including Mainland China, Hong Kong, Singapore, the United Kingdom, Australia, the European Union, and most U.S. states.

These licenses include a Major Payment Institution (MPI) license from the Monetary Authority of Singapore (MAS), an e-money license from the Dutch Central Bank, and a prepaid card license in Mainland China obtained via a joint venture.

Such authorizations grant Airwallex the legal capacity to operate cross-border payment and foreign exchange services across multiple countries, enabling the company to build a regulated, secure, and reliable global settlement network.

On the foundation of this compliance-driven infrastructure, Airwallex connects directly with local banking systems to provide enterprise-grade account management and treasury solutions, while ensuring adherence to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Global Liquidity Pools and Batch Settlement Mechanism

Airwallex offers an integrated suite of global financial services for businesses, including multi-currency corporate accounts, international collections and payouts, foreign exchange, corporate cards and expense management, as well as online acquiring.Specifically, corporate clients can open global receiving accounts within minutes online, access local account details, and set up local accounts in over 60 markets to collect payments in more than 20 currencies. All incoming funds are automatically consolidated into a multi-currency digital wallet that supports holding over 23 currencies with on-demand conversion.

To reduce the cost and latency of cross-border transactions, Airwallex—after securing relevant licenses—built its own proprietary global banking network, establishing direct relationships with institutions such as Standard Chartered, DBS Bank, MAS-licensed entities in Singapore, and ICBC in China.Airwallex maintains local bank accounts and deposits across jurisdictions to form a distributed "liquidity pool." When a customer initiates a cross-border payment, funds are not transferred individually through the SWIFT network. Instead, Airwallex uses its local pool in the destination country to settle the payment directly with the beneficiary—achieving "localized" fund delivery and avoiding the high fees and delays of traditional SWIFT-based transfers.

Simultaneously, an equivalent amount is deducted from the originating country's pool. This "pre-funding + in-pool netting" mechanism bypasses the layered intermediaries typical of conventional cross-border remittances.Through these local clearing channels, Airwallex can directly settle payments in major markets. Its API enables businesses to integrate the payment process into their own systems, intelligently selecting and routing payment paths—for example, automatically choosing the optimal route (local rails or SWIFT) based on destination country and executing FX conversions in batches using real-time exchange rates in the background.

To further reduce currency conversion loss, Airwallex uses AI-driven algorithms to determine the optimal timing for executing bulk FX trades, balancing cost and execution speed.This automated financial routing ensures that funds move globally with minimal cost and near-instant speed, allowing Airwallex to claim "near real-time, near zero-cost" transfers in major currencies.

Stakeholders and Strategic Partnerships

As it expanded globally, Airwallex established partnerships with several industry-leading organizations.In the card issuance space, it entered a global strategic partnership with Visa to launch the "Airwallex Visa Card," enabling Airwallex to issue multi-currency virtual and physical cards as a Visa BIN sponsor. Visa also participated in Airwallex's subsequent funding rounds.

Airwallex partnered with Discover to enhance its presence in the UK payments market by integrating virtual accounts and local payment channels to improve local service capabilities.In the enterprise software sector, Airwallex has a deep strategic partnership with Xero, a leading New Zealand-based cloud accounting platform. Their integration allows Airwallex accounts to sync directly with Xero ledgers, enables payment links to be embedded into Xero invoices, and helps SMEs accelerate their receivables process.

Through this collaboration, businesses using Airwallex can automatically reconcile incoming payments in multiple currencies, and issue invoices in over 170 currencies with direct settlement into Airwallex accounts—eliminating unnecessary currency conversions.In e-commerce, Airwallex is an official payments partner of Shopify, providing a dedicated plugin for Shopify merchants to accept payments from global customers and receive settlements directly into their Airwallex multi-currency wallets—bypassing FX losses. Shopify also selected Airwallex as one of its payment gateways to help merchants lower the cost of cross-border FX and improve cash flow efficiency.In addition, Airwallex has established API integrations with major cross-border e-commerce platforms such as Amazon, eBay, Lazada, and Shopee, enabling sellers to link their Airwallex accounts to receive sales proceeds instantly and perform batch settlements.

For financial management, Airwallex offers native integrations with ERP and accounting systems including Oracle NetSuite and QuickBooks, allowing enterprises to embed Airwallex's payment functionalities directly into mainstream finance systems.

These extensive ecosystem partnerships enhance Airwallex's product stickiness and user acquisition channels, reinforcing its positioning not merely as a payments tool—but as an embedded financial infrastructure network across vertical industries.

Revenue Model Breakdown

As a fintech platform, Airwallex primarily generates revenue through transaction fees and FX spreads. Its business model essentially operates as "Payments-as-a-Service," serving as B2B financial infrastructure.A key revenue stream is foreign exchange conversion. While Airwallex advertises near-mid-market rates for customers, it typically applies a markup of approximately 0.2% to 0.5% as a service fee during currency conversion. Given the high volume of multi-currency transactions processed on the platform, this margin contributes significantly to its income.

Secondly, international payment fees are another revenue source. While Airwallex offers free local transfers in most markets, customers opting for SWIFT rails or sending non-major currencies are charged a flat fee per transaction. Additionally, in certain regions, inbound transfers from third-party payers incur a 0.3% processing fee, which also accumulates substantial revenue in large-scale operations.

Third, the company earns merchant acquiring fees through its payment gateway. When merchants accept payments via Airwallex, the company charges 2.8% to 4.3% per transaction (depending on card network and region), plus a fixed fee. This segment is similar to players like Stripe, profiting through per-transaction commissions.

Fourth, in its card issuance business, although there are no card issuance or international transaction fees for customers, Airwallex, as a Visa card issuer, receives a share of interchange fees from card transactions. The enterprise card product also increases customer retention, indirectly driving more revenue across its other services.

Fifth, as the platform scales and more client funds are held in multi-currency wallets, interest income becomes a meaningful contributor. The balances held by customers generate interest returns for Airwallex, and this has grown significantly since global interest rates began rising in 2023. The company has disclosed that part of its revenue acceleration stems from this interest yield.

Lastly, Airwallex monetizes value-added services and API integrations. For large enterprise clients, custom solutions and higher API usage limits are priced through negotiated contracts.Overall, Airwallex's business model relies on scaling transaction volume—offering near-free core services to attract users and profiting from small margin fees across a vast number of transactions.

Real Costs in Practice: Pricing & User Feedback

According to Airwallex's publicly disclosed fee policy, the company states that it charges no account opening fees, no monthly maintenance fees, and no hidden charges.Customers can open local accounts in various jurisdictions through the platform and receive domestic transfers free of charge.

However, in certain specific scenarios, users have reported encountering unexpected charges.For example, in Hong Kong, Airwallex imposes a 0.3% fee on inbound transfers from third-party payers. This fee was not clearly disclosed in advance, and at one point, the company's automated customer service even incorrectly stated that such transactions were "free."

In terms of international transfer fees, cross-border payments via Airwallex are free in most cases—especially when using its local payment network instead of the SWIFT system.Fees are only incurred in specific scenarios, such as when the destination country is not covered by a local payout channel. In such cases, payments are routed through SWIFT wire transfers, and a flat fee of approximately USD 15–25 per transaction is charged.

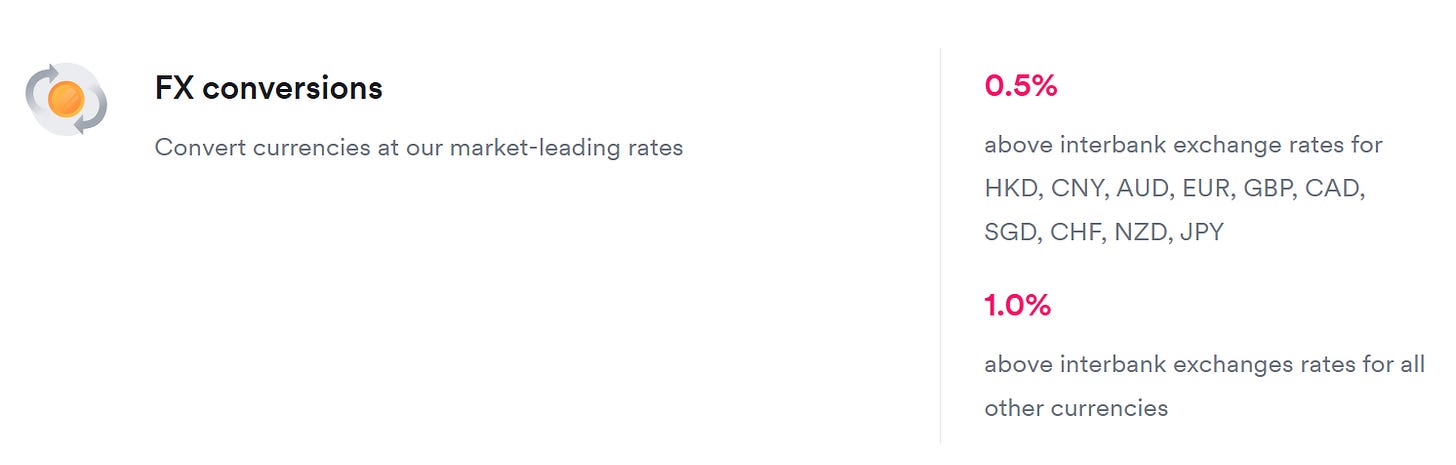

In terms of foreign exchange (FX) fees, Airwallex offers highly competitive exchange rates, typically applying a markup of around 0.2%–0.5% above the mid-market rate.

The exact spread varies by currency and region, with major currencies generally subject to a 0.5% markup.This rate is significantly lower than the 1%–3% FX margin commonly charged by traditional banks.

For merchant acquiring, Airwallex charges a percentage-based fee on online transactions.For payments made with locally issued bank cards, the typical fee is approximately 2.8% + a fixed $0.30 per transaction.

For international card payments, the fee is around 4.3% + $0.30 per transaction.

For alternative payment methods such as local e-wallets or bank transfers, Airwallex generally charges $0.30 per transaction, plus any applicable processing fees specific to each payment method.

In the area of corporate cards and expense management, Airwallex offers both virtual and physical multi-currency cards to clients free of charge, with no monthly fees or transaction fees.The accompanying expense reimbursement and control software is also offered free of charge in most regions to encourage adoption.

In some cases—such as in Hong Kong—a fee of HK$40 per card per month was previously charged for advanced expense management features, though this charge has since been removed in later versions.

Overall, Airwallex's publicly advertised pricing model emphasizes a "low-fee" value proposition: zero cost for basic operations, transaction fees significantly lower than those of banks and mainstream competitors, and a stated commitment to "no hidden charges."By pre-positioning liquidity across global markets and building distributed funding pools, Airwallex enables localized processing of cross-border transfers. This model avoids the intermediary bank fees typical of traditional financial institutions and lowers the marginal cost per transaction.

However, behind this model lies a substantial fixed cost structure—including the compliance expenses of acquiring licenses in multiple jurisdictions, capital costs from maintaining thousands of local bank accounts, and ongoing operational and technical overhead.To remain profitable while offering low fees, Airwallex relies on achieving sufficient transaction volume to dilute these operating costs. As such, its business model is fundamentally scale-driven: the more transactions processed, the lower the unit cost.

For potential competitors, replicating this globally distributed network would require massive capital investment and significant time, creating high entry barriers that protect first-movers like Airwallex and allow for a degree of pricing power embedded in its cost structure.That said, user feedback suggests that despite the attractive fee structure, some cost disclosures remain unclear. For instance, in Hong Kong, the system applies a 0.3% fee on inbound payments from non-linked accounts, but automated customer support had previously stated that such transactions were "free", leading to confusion over the actual cost and making it difficult for users to assess fees in real time.

On the other hand, emerging on-chain stablecoin payments follow a different path.For example, using stablecoins like USDC for cross-border transfers on blockchain networks can cost less than $1 in gas fees and settle instantly. However, since stablecoins ultimately need to be converted into fiat currencies, users often rely on OTC desks or centralized exchanges to cash out, during which they may incur a 0.2%–0.5% spread along with withdrawal fees.If regulatory uncertainty increases compliance costs, these implicit costs could exceed those of traditional financial channels.All things considered, Airwallex has helped push down the traditional pricing benchmark for cross-border payments, offering businesses a middle-ground solution between the conventional banking system and blockchain-based networks.

Twitter Community Reactions: Support and Skepticism Side by Side

Jack Zhang's public questioning of stablecoins has sparked widespread debate across tech media, financial analysts, and social platforms.From the range of commentary, opinions largely fall into two camps:One side argues that licensed financial networks like Airwallex will continue to suppress the rise of stablecoin-based cross-border payments in the foreseeable future.The other side believes that stablecoins are well-positioned to gradually replace traditional payment rails in certain use cases.

Supporters' View: Stablecoins Unlikely to Disrupt Traditional Cross-Border Payment Networks

Argument 1: Legacy Systems Have Already Achieved Significant Efficiency Gains

Many industry professionals have expressed support for Jack Zhang's perspective, viewing his critique as a rational assessment grounded in real-world data and operational experience.Supporters argue that in developed economies—particularly within the G10 countries, where efficient payment infrastructures are already in place—stablecoins currently lack a clear disruptive advantage.

They point out that interbank payment systems have significantly improved in both speed and cost. In some regions, instant payment solutions such as SEPA Instant in Europe and FedNow in the United States now allow near real-time cross-border transfers with fees approaching zero.Rather than taking on regulatory risks by adopting unproven alternatives, these supporters believe it is more pragmatic to fully leverage existing financial systems.

Argument 2: Hidden Costs and Tax Compliance Risks Undermine Stablecoins

@alexzuo4 commented that Jack's viewpoint reflects a realist perspective:

In B2B payment scenarios—particularly in markets with well-established banking infrastructure—the existing systems already offer high efficiency and low costs, leaving little room for stablecoins to add value.

@EarningArtist echoed this view, summarizing the core of Jack's argument:

In B2B payments, the off-ramp cost of converting stablecoins back into fiat is still high, offering no clear advantage over interbank remittance solutions provided by platforms like Airwallex.Moreover, stablecoins cannot be directly integrated into tax systems, and in some cases, may even facilitate tax avoidance, raising regulatory compliance concerns.

Argument 3: Regulatory and Trust Challenges Limit Stablecoin Adoption

Many supporters have raised concerns about the regulatory legitimacy and lack of credible backing behind stablecoins, arguing that "currency issuance is the responsibility of central banks, while privately issued stablecoins operate on the fringes of regulation."They worry that large-scale adoption of stablecoins could disrupt financial stability, and that mainstream enterprises tend to trust payment networks backed by central banks.

Recent risk events involving stablecoins—such as the collapse of algorithmic stablecoins and ongoing issues around reserve transparency—are frequently cited as evidence of their unreliability.

Argument 4: Limited Use Cases for Stablecoins in Mainstream Finance

Compliance risk remains the primary concern.When businesses attempt to move funds from highly regulated jurisdictions onto unregulated blockchains and then convert them back into local fiat currencies, the entire process introduces significant legal and regulatory uncertainty.Jack is not outright rejecting stablecoins, but rather emphasizing their limited applicability depending on context.

For instance, it is true that users in certain emerging markets have turned to USDT due to local currency instability. However, these markets are often associated with heightened risk profiles and money laundering concerns, making it difficult for legitimate businesses to engage in such ecosystems.

Supporters argue that stablecoins primarily serve crypto trading and grey-area use cases, and have limited relevance to the day-to-day operations of mainstream enterprises.The existing financial infrastructure already meets most of the cross-border payment needs of compliance-focused businesses, and in established markets, stablecoins are not a necessity.

In regions without access to banking services or where local currencies are unstable, stablecoins may indeed serve a purpose.However, in mainstream fiat markets, where comprehensive and compliant financial infrastructure is already in place, stablecoins are unlikely to replace the existing networks.Overall, supporters argue that the application of stablecoins should be focused on areas underserved by the traditional financial system—such as underdeveloped regions or unbanked populations—rather than attempting to compete head-on with established banking systems in mature markets.

In summary, this camp believes that regulated financial networks, as exemplified by Airwallex, have already brought significant efficiency gains to cross-border payments.

Compared to these systems, stablecoins do not offer disruptive advantages, and due to regulatory and trust-related concerns, are unlikely to be adopted by mainstream enterprises at scale.

Opposing View: Stablecoins Will Overtake in Specific Use Cases Over Time

Argument 1: Lower Fees and a Structurally Superior Settlement System

Many crypto advocates have pushed back against Jack Zhang's comments, offering contrasting views.Supporters of this position argue that the value of stablecoins lies not merely in cost savings, but in offering a superior payment and settlement architecture.

Simon Taylor remarked that Jack's understanding of stablecoins was superficial, focusing only on transaction fees while overlooking their fundamental innovation: peer-to-peer instant settlement with full transparency, eliminating the need for funds to pass through multiple layers of accounts and intermediaries—naturally reducing friction in the system.Even if stablecoins have yet to fully replace legacy systems, many believe their underlying design is already superior.

Some users also point out that Airwallex's services are not entirely free from cost or delay.For example, @kkone0x noted that although Airwallex advertises low FX fees, there are still potential hidden costs such as account opening charges and inbound deposit fees.In practice, settlements are not always real-time, and certain international transfers can take several days to process.

These hidden costs and time lags suggest that in specific cross-border use cases, stablecoins remain highly competitive.As one example, users cited overseas Filipino workers remitting funds via USDT, where recipients convert the stablecoins into local fiat through OTC markets—resulting in overall fees lower than traditional remittance services.This illustrates that stablecoins have already demonstrated cost and speed advantages in targeted remittance scenarios.

Argument 2: A New Financial Paradigm, Not Just an Incremental Upgrade

Some observers have framed this debate as part of a broader struggle between traditional finance and the emerging crypto-native financial paradigm.

Commentators like @BroLeonAus and @0xHY2049 argue that Jack's remarks highlight an ongoing contest over "settlement authority" and "unit of account control".

While fintech innovators like Airwallex introduce improvements within the existing financial infrastructure, stablecoins and decentralized finance (DeFi) aim to fundamentally rewrite the rules of the game.They assert that the so-called compliance barriers facing stablecoins are essentially protectionist structures embedded in legacy finance—and that these barriers will erode as stablecoin adoption scales.Others focus on the long-term technological vision.Users like @xiaoxoca and @bonnazhu contend that stablecoins are still in their early stages, but as adoption grows, network effects will eventually enable the formation of true on-chain settlement systems that bypass traditional banking entirely.This, they argue, is where stablecoins hold genuine revolutionary potential.

Although stablecoins currently require fiat off-ramps via OTC markets or banking channels, a shift is underway: as more merchants accept stablecoins directly and more financial operations move on-chain, a closed-loop payment ecosystem may emerge.In such a system, end-to-end payment, storage, and settlement would occur entirely within the stablecoin and blockchain framework—without relying on fiat bank infrastructure.If realized, this model would dramatically reduce costs, increase settlement speed, and potentially displace traditional cross-border payment networks.

This vision is particularly compelling in underbanked or infrastructure-poor regions.For example, African fintech startup Juicyway has already facilitated over $1.3 billion in cross-border payments using stablecoins, without laying down any traditional banking rails.Likewise, cross-border transactions between Nigeria and Brazil, which traditionally take days and require multiple intermediary banks, can now be completed in minutes via stablecoins—with much lower fees than wire transfers.

Stepan Simkin, CEO of fintech startup Squads, echoed this perspective on X (formerly Twitter).He argued that the true disruption of stablecoins lies in enabling a new generation of startups to build financial services that are faster, cheaper, and globally scalable.Simkin compared the traditional banking system to a "high-cost, high-latency legacy network," and praised stablecoins for allowing leaner teams to launch financial products in shorter cycles—a level of agility that incumbent institutions simply cannot match.

Argument 3: Financial Inclusion and Disintermediation

Paolo Ardoino, CEO of Tether and a prominent figure in the crypto industry, also weighed in—framing the debate from the perspective of financial sovereignty.He criticized the banking sector's resistance to stablecoins, arguing that it reflects a desire to preserve its monopoly over financial infrastructure.

In his view, in countries suffering from high inflation and heavy capital controls, stablecoins offer everyday people financial independence and a way to hedge against policy risk.Their value lies not merely in payment efficiency, but in their potential to restructure the global financial power dynamic.

Ardoino pointed out that over 1 billion people worldwide remain excluded from basic financial services—not because of technological limitations, but because the current system's compliance costs and profit motives discourage serving the long-tail population.He argued that stablecoins, when combined with smartphones and internet access, allow anyone—anywhere in the world—to hold USD-denominated value, remit funds globally, and transact directly, without intermediaries.From this standpoint, what Jack Zhang refers to as "regulatory arbitrage" is, in fact, the emergence of a new financial order—taking root in places where the legacy system has failed to reach.

Conclusion: Institutional Struggle or Market-Driven Choice?

Beneath the surface of the clash between Airwallex CEO Jack Zhang and stablecoin advocates lies a deeper divergence—one rooted in institutional pathways and user segmentation.

On one side stands the regulated financial system, defending its boundaries and expressing caution toward emerging models; on the other is the open crypto network, challenging legacy monopolies and pursuing a vision of financial inclusion.From a systemic perspective, this debate underscores the fundamental tension between centralized and decentralized finance.Traditional finance operates within regulated, institution-centric frameworks, prioritizing security, stability, and control.

In contrast, the crypto ecosystem is built on borderless, user-sovereign architecture, emphasizing efficiency, transparency, and accessibility.Stablecoins, situated between these two paradigms, naturally provoke conflicting interpretations:Regulators and incumbents often question their legitimacy and necessity, while crypto advocates view them as tools to disrupt the old order.This is, at its core, a clash of financial paradigms: the ledger moves from banks to blockchains, and trust shifts from institutional guarantees to algorithms and consensus.The dispute thus becomes a contest over who will shape the future of finance.

As stablecoins become more compliant—with regulatory frameworks gradually emerging across jurisdictions—this institutional friction may ease, but competitive pressures will likely intensify.From a market perspective, the divergence reflects differentiated user bases and use cases.Airwallex caters to globalized enterprises that need legally compliant, bank-integrated, and operationally efficient cross-border financial services.By solving these pain points, Airwallex has carved out a strong commercial niche.

Stablecoins, by contrast, appeal to marginalized markets and individual users—those underserved by traditional systems or disillusioned by local currencies (e.g. in hyperinflationary economies) or capital controls.For these users, stablecoins are not optional—they are lifelines.

Rather than being direct substitutes, Airwallex and stablecoins currently coexist within different market segments, each addressing distinct financial realities.At least for now, both Airwallex and USDT have found their own fertile ground.Perhaps both sides of the debate could benefit from a measure of perspective-taking.For those from the traditional finance world, it's important to recognize that stablecoins represent more than just a new financial tool—they hint at a structural transformation in how value moves.They reflect the rise of a flatter, more open financial architecture, whose long-term implications may far exceed what current market dynamics suggest.

After all, no matter how low DVD rental prices fell, they could not withstand the paradigm shift introduced by streaming—not because of price, but because the model itself changed.In the same vein, even if banks and payment companies manage to bring cross-border fees down to zero, the complexity and exclusivity of account-based systems remain unresolved.Blockchain-native architecture offers an alternative paradigm, not merely a cheaper one.

Conversely, the crypto industry must also acknowledge the importance of financial stability and institutional trust.Technical superiority alone is not enough to win broad adoption.Any financial instrument aiming for mass use must address issues like regulatory compliance and consumer protection.If stablecoins are to become a true cornerstone of future finance, they must eventually integrate into human trust systems, rather than remain isolated on an ideological island.

@codeboymadif offered a more holistic perspective on the debate, breaking it down into dimensions such as product form, network effects, and applicability across different use cases.He argued that under the current conditions, Jack Zhang's skepticism toward stablecoins is reasonable—because interbank networks and compliant platforms like Airwallex already deliver near-optimal solutions in mainstream markets.However, he also acknowledged that the long-term outlook remains open-ended.As technological capabilities evolve and the market landscape shifts, tools like stablecoins may eventually find new entry points and unlock different value propositions.

Therefore, any evaluation of stablecoins' potential should avoid absolutist conclusions.There is ample room for discussion between short-term pragmatism and long-term vision.These views converge on one key insight:While stablecoins currently occupy a marginal role in enterprise-grade payments, their growth trajectory in select verticals has been remarkable.Over time, they may expand from niche markets into the mainstream.Especially as regulatory clarity emerges, and if trust and compliance challenges can be addressed, stablecoins could become a major cross-border payment rail—and potentially displace parts of the traditional network infrastructure.

Link:

https://x.com/awxjack/status/1931239220204486879?s=19

https://x.com/kkone0x/status/1931673643995824332?s=19

https://x.com/EarningArtist/status/1931647964772229521?s=19

https://x.com/alexzuo4/status/1931680650584891761?s=19

https://x.com/BroLeonAus/status/1931750507611374070?s=19

https://x.com/bonnazhu/status/1931708632598757493?s=19

https://x.com/0xHY2049/status/1931674658182500740?s=19

https://x.com/codeboymadif/status/1931722361843470773?s=19

https://x.com/portal_kay/status/1931946852276150405?s=19

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish