An in-depth analysis of Bitcoin's buying and selling pressure: Is the short-term bottom here? What lies ahead?

Author: SoSoValue Research

Translation: WuBlockchain

This article was written on July 4, and some information and data are delayed.

Today, after Bitcoin's price quickly broke through the crucial support level of $56,000, it has become difficult to make investment judgments from a traditional technical perspective. Where is the bottom of this downturn? This has become the most pressing question for all investors. Whenever the market faces such large-scale panic moments, we return to first principles and analyze the fundamental mechanisms of price formation by examining the supply and demand dynamics of Bitcoin. Through studying the state and motivations of buyers and sellers, we hope to help investors find the best buying point in a market filled with diverse opinions and emotions.

● Selling Pressure: The German government's sell-off, Mt. Gox exchange repayments, potential early-year profit-taking, and miner follow-up selling are mainly occurring on crypto exchanges and can be monitored and tracked through on-chain behavior.

● Buying Pressure: Investors in the US Bitcoin spot ETF, mainly participating through stock accounts (with the US Independence Day holiday from July 3rd to July 4th, trading resumes tonight), can be tracked through intraday trading volumes and post-market net inflow/outflow indicators.

Buying Pressure: Driven by optimistic sentiment in the US stock market, the Bitcoin spot ETF might bring the first wave of bottom-buying. With July 5th being the first trading day after the holiday, the ETF's trading volume and net inflow are most worth watching.

Regarding selling pressure, there is already a lot of information available, so we will not elaborate further. Let's start our analysis from the potential buying side.

Firstly, we believe that the strength of long-term buying will remain throughout this year, mainly due to the macro backdrop in the second half of the year: 1. US interest rate cuts leading to rising prices of risk assets; 2. Trump's high chances of winning the election, which is favorable for the cryptocurrency regulatory environment. So, what is the specific relationship between the macro environment and BTC prices? As shown in the chart below, by comparing the correlation between BTC prices and US stocks over the past six months, we can conclude that the recent rapid decline is related to the main buying force of this Bitcoin rally, the Bitcoin spot ETF, being in a holiday closure, making purchases impossible.

Figure 1: Correlation analysis between Bitcoin prices and the NASDAQ-100 (Data source: SoSo Value)

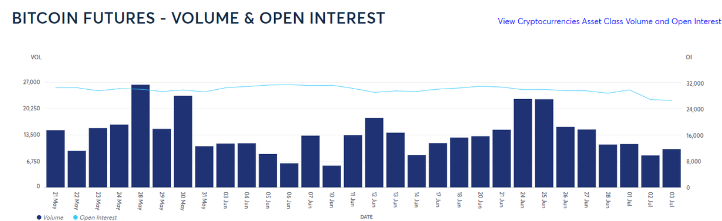

From CME futures trading volume, institutional investor sentiment remains stable, possibly waiting to buy the dip. The trading volume of CME Bitcoin futures today did not fluctuate significantly with the price, indirectly proving that institutional investors are still relatively calm and in a wait-and-see state. Given the macroeconomic positives and the specific selling pressures left over from historical reasons, we believe that these unique, non-repetitive events will motivate long-term Bitcoin investors to buy.

Figure 2: CME Bitcoin Futures Trading Volume on July 5th (Data Source: Bloomberg, as of July 5th UTC 8:00)

Figure 3: Historical Trading Volume and Open Interest of CME Bitcoin Futures (Data Source: CME)

So, when will the buying point be? The Bitcoin spot ETF on July 5th might provide a signal. After the 1.5-day closure for the US Independence Day holiday from July 3rd to July 4th, Bitcoin spot ETFs resume trading tonight. Recently, sentiment in US stocks has been very optimistic, with Nvidia, Microsoft, and Apple hitting record highs and investors buying the dip in Tesla, yielding nearly 40% returns within two weeks. Will buyers of the Bitcoin spot ETF follow the price drop or follow the US stock market in buying the dip? We will see. Among them, intraday trading volumes and post-market net inflow data are the core indicators to observe. Higher trading volumes represent stronger dip-buying enthusiasm, which could signal a halt in the decline; if it directly brings net inflows of funds onto the chain, reversing the slight net outflows of the past two trading days (see Figure 4 below), it will further boost the confidence of crypto investors by bringing actual incremental funds onto the chain.

Figure 4: Historical Net Inflows of Bitcoin Spot ETFs (Data Source: SoSo Value)

Selling Pressure: Nearly 200,000 Bitcoins from the German government and Mt. Gox?

On the clearly defined selling side, the two main sources of key sell-offs are: 1. Bitcoins seized by the German government 2. Bitcoins for the repayment of creditors by Mt. Gox.

The German government might be the largest short-term selling force, and the timing of its cessation of selling is crucial. The German government seized a total of 50,300 Bitcoins and has transferred approximately 8,080 Bitcoins since June 19th through July 5th, with a remaining balance of 42,270 BTC. Thus, 83.94% of the holdings have yet to be sold, and it remains uncertain whether there will be continued large-scale selling in the short term, leaving a significant uncertainty in the selling pressure.

Figure 5: Summary of BTC Transfers from the German Government Wallet (Data Source: Arkham)

Figure 6: Bitcoin Holdings and Transfers by German and US Governments, and Mt. Gox (Data Source: Public Information Aggregation)

Regarding Mt. Gox, the selling pressure might be far less than the market expects. It is anticipated that 142,000 Bitcoins will be compensated to creditors. According to the Japanese crypto community, over 70% of the claims have likely been transferred through several rounds of OTC deals to institutional buyers. This portion of the Bitcoins acquired is not expected to cause significant selling pressure. The remaining 30%, which could bring significant selling pressure, amounts to approximately 40,000-50,000 Bitcoins. On-chain data monitoring shows that today, July 5th, Mt. Gox has transferred about 50,000 Bitcoins, with 1,544 transferred to exchanges and 47,228.7 Bitcoins moved to a new address starting with 1L7Xbx, with no further action observed yet. Overall, the actual selling pressure from Mt. Gox might be less than the market anticipates.

● July 4th: Multiple Mt. Gox wallets conducted small test transfers.

● July 5th: Mt. Gox transferred over 47,228.7 Bitcoins (approximately $2.71 billion) to a new address starting with 1L7Xbx. This address then distributed these Bitcoins to two addresses: 45,000 BTC (worth $2.55 billion) to address 16ArP3...VqdF and 2,700 BTC (worth $154.8 million) to address 1JbezD...APs6. These two addresses have not made further moves.

● July 5th: 1,544 Bitcoins, worth $84.87 million, were transferred to address 1PKGG, which belongs to the exchange Bitbank. Bitbank is one of the five platforms supporting Mt. Gox's repayments.

● July 5th: Several Mt. Gox creditors in Japan told crypto media Deep Tide that they had received their BTC/BCH repayments from Mt. Gox, with the funds already entering Bitbank or Kraken exchange accounts. Additionally, some reported receiving cash payments via international wire transfers.

Potential miner sell-offs have also been an influencing factor in this downturn, but this selling pressure is expected to stop with Bitcoin stabilizing. Due to the halving of Bitcoin mining rewards at the beginning of the year, miners' profitability has dropped to the lowest level in two years. According to F2pool data from July 4th, based on the current Bitcoin mining difficulty and electricity costs of $0.06 per kWh, mainstream mining machines like the Antminer S19 have reached the "shutdown price." Some unprofitable miners are being squeezed out, and their liquidation may bring additional selling pressure.

Figure 7: Bitcoin Miner Shutdown Costs (Data Source: F2pool)

In summary, the buying pressure is based on long-term positive factors, while the selling pressure stems from panic caused by unique events. We believe these non-repetitive events will provide buying opportunities for long-term Bitcoin investors. Historically, the market's digestion of panic from unique selling events typically lasts no more than two months. This Bitcoin downturn started on June 7th and is likely to be fully digested by August 7th. The largest single-day drops in the past two days might represent the lowest point of this downturn.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish