Binance Alpha Research: How Do Projects Perform After Listing? Are Professional Studios Squeezing Out Ordinary Users?

Author: Frank,PANews

Translation: WuBlockchain

Original Link:

https://www.techflowpost.com/article/detail_25664.html

Binance Alpha’s points game is pushing “involution” to the extreme at an unprecedented pace. As the points threshold once soared past 200 while airdrop rewards plummeted to around $25, the declining return on investment has sparked widespread discussion within the community.

Beneath this seemingly winner-takes-all frenzy, some believe the massive traffic is “spilling over” into other ecosystems like Sui and Solana, injecting new vitality into them. But how real is this spillover effect? And what lasting impact will this airdrop rush — ignited by Binance Alpha — ultimately have on the broader industry?

The Illusion and Reality of “Traffic Spillover”: Observations on the Alpha Effect in the Sui Ecosystem

The mechanics of the Binance Alpha points game have already been discussed in detail in earlier analysis, so we won’t repeat them here. In essence, as more users join, each airdrop ends up having a clear earnings ceiling, while the entry threshold keeps climbing. In this context, users are forced to further compress costs to maintain profit margins.

Recently, Binance Alpha began listing Sui ecosystem tokens and subsequently announced several Sui-based Alpha projects. The inclusion of the Sui ecosystem conveniently provided users engaged in volume manipulation a new low-cost arena. On May 14, KOLs such as @lianyanshe noted that projects like NAVX on Sui incurred lower gas fees during volume operations and were less vulnerable to sandwich bot attacks, resulting in lower slippage. Thus, some believe that certain Sui projects may become the new “volume farming battleground” for Binance Alpha users.

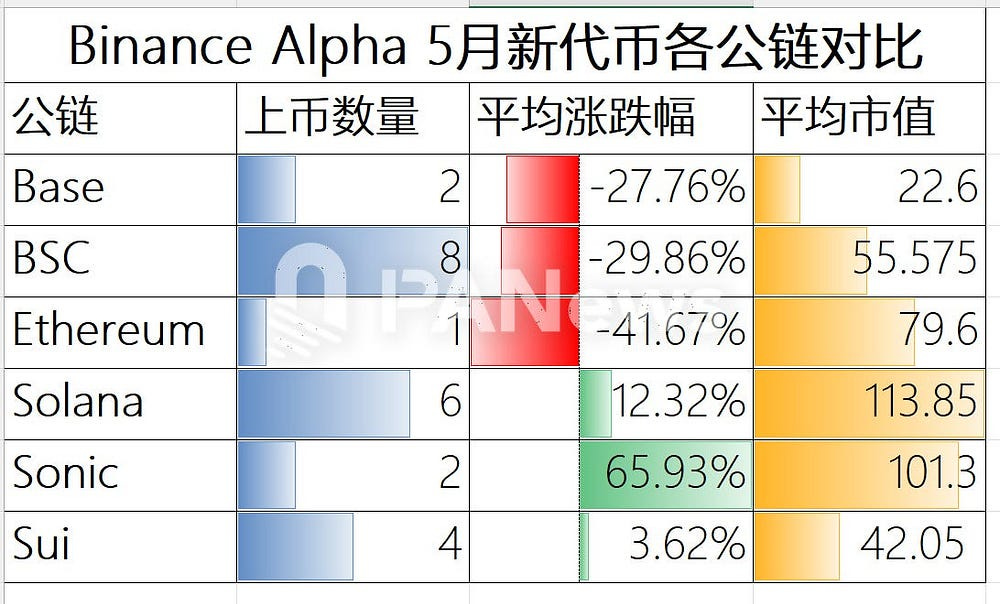

If most users opt for this approach, it could indeed generate significant trading volume and token visibility for the Sui ecosystem. However, this effect has not materialized in practice. According to PANews research, the trading volumes of Sui tokens on Alpha are relatively low. The highest, NAVX, only recorded a 24-hour trading volume of $3.34 million, while others like HIPPO, BLUE, and SCA hovered in the tens or hundreds of thousands. In contrast, projects on the Solana chain routinely exceed $10 million in daily volume, and some top projects on BSC even surpass $200 million.

That said, for NAVX, listing on Binance Alpha has indeed boosted its activity. On May 13, NAVX’s main liquidity pool recorded $1.6 million in trading volume, compared to just a few thousand dollars the day before.

In actual trading workflows, one key issue emerges: Binance Wallet’s official cross-chain bridge currently does not support asset conversions between the Sui ecosystem and BSC. Users cannot directly swap BNB for USDC on Sui. To avoid additional slippage, they must endure the friction of using third-party bridges.

Top Solana Memecoins Unexpectedly Attract Capital Inflows

Solana has become one of the most active ecosystems on Binance Alpha, second only to BSC in terms of project listings. Since early May, Solana’s overall DEX trading volume has seen a significant uptick. On May 4, Solana’s DEX volume was $2.2 billion, and by May 15, it had risen to $4.59 billion — more than doubling. Several top tokens launched via Binance Alpha, such as MOODENG and jellyjelly, have experienced a substantial increase in trading volume and notable price surges. MOODENG, for instance, rose 140% from launch to May 14. On average, the six Solana-based tokens launched on Binance Alpha in May gained 12.32%, making Solana one of the few ecosystems showing positive performance.

Beyond Sui and Solana, the Sonic ecosystem — Fantom’s new branding — has perhaps benefited the most from this spillover trend. Currently, only three Sonic ecosystem projects have been listed on Binance Alpha, but price performance has been exceptional. The two tokens launched in May recorded an average price increase of 65.93% (as of May 14), the highest among all ecosystems. However, due to the limited number of listed tokens, this does not necessarily indicate that Sonic tokens have higher long-term potential.

Nevertheless, on May 1, when Binance Alpha announced the listing of two Sonic projects, Sonic’s DEX trading volume surged significantly — from over $73.4 million the previous day to $194 million.

The Project Dilemma: Peak at Launch or Real Value Discovery?

From a project perspective, does listing on Binance Alpha lead to skyrocketing success? Data suggests otherwise. Among the 23 tokens launched in May, the average price change was -5.04%, with the steepest drop reaching 75%. While most tokens showed a brief price spike immediately after listing, they generally experienced sharp corrections shortly thereafter. This indicates that listing on Binance Alpha does not guarantee the birth of a “golden token,” but rather just opens another trading venue.

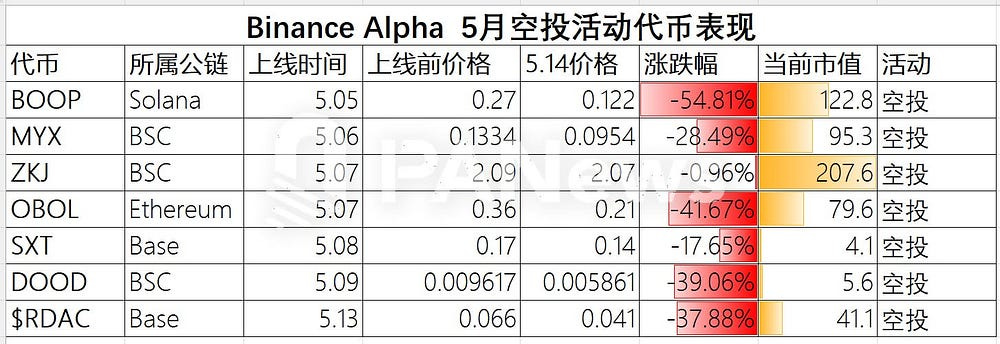

Projects that launched with airdrop campaigns fared even worse. Of the seven airdrop tokens listed in May, all were down as of May 14, with an average decline of 31.5%. This suggests that airdrops and wash trading campaigns alone are insufficient to sustain upward price trends.

On average, tokens listed via Binance Alpha hold a market cap of around $70 million, ranging from as low as $1.6 million to as high as $271 million for MOODENG. Solana’s newly listed tokens average over $100 million in market cap, indicating that the bar is higher for participation in the Solana ecosystem.

The Endgame of Involution: A Battleground for Pros, Exit for Casual Users

For ecosystems and projects, Binance Alpha represents exposure and traffic concentration. But for users, the increasingly competitive environment is pushing out ordinary participants, transforming Alpha into a battleground for professional studios and whales. With the points threshold rising to 205, users must earn at least 15 points per day to keep up. Assuming 2 points from a $1,000 principal, users must generate $8,000 in daily trading volume to earn enough points. The combined daily slippage and gas fees can exceed $10. If they miss the next threshold or receive minimal airdrops, they risk both financial and mental loss. For instance, the most recent RDAC airdrop only yielded around $25 in value — nowhere near the cost of achieving 205 points.

Looking ahead, the points threshold is expected to continue rising. Under current rules, the more points required, the more exponentially higher trading volume is needed. Either Binance Alpha must raise airdrop rewards per address or witness a mass exodus of users, which would lower the threshold back to sustainable levels. Regardless, this race to the bottom seems to be nearing its end. On May 15, BSC DEX volume dropped to $2.64 billion — down 16.4% from $3.16 billion on May 12.

In summary, Binance Alpha’s “traffic spillover” effect shows significant variation across ecosystems. Sui has not absorbed the expected wash trading volumes, while Solana has demonstrated more robust interaction and growth. For project teams, the brief spotlight from Alpha rarely translates into lasting value. “Peak at launch” followed by price declines has become the norm, and airdrops have failed to reverse this trend. In the end, the teams offering airdrops are footing the bill for Binance’s wallet product marketing.

The more fundamental issue lies in how this points-driven frenzy is ruthlessly forcing ordinary users off the table. The ever-rising entry thresholds, combined with exponentially increasing trading requirements and shrinking rewards, are turning Binance Alpha into a zero-sum game for professional traders. The recent decline in BSC DEX volumes may well signal that this high-intensity “involution” model is approaching its limit of sustainability.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish