China's crypto news of the week (April 5 to April 11)

Highlight of the week: Carbon emission issues trigger restrictions on China's Bitcoin mining

Chinese scholars published a paper on Nature Communications, saying that the growing energy consumption and carbon emission of Bitcoin mining in China could undermine its efforts to reduce carbon emissions. In future, China's Bitcoin mining may be severely restricted as a result.

Reaseach shows that annual energy consumption of the Bitcoin in China is expected to peak in 2024 at 296.59 Twh and generate 130.50 million metric tons of carbon emission. Internationally, this emission output would exceed the gas emission output of the Czech Republic and Qatar.

This research was forwarded by Caixin, the most recognized media in China by professional officials. It is expected that Bitcoin mining in China will be hit by the government due to carbon emissions issues in the future.

Read more: https://idp.nature.com/authorize?response_type=cookie&client_id=grover&redirect_uri=https%3A%2F%2Fwww.nature.com%2Farticles%2Fs41467-021-22256-3

Other important news

1 Bitmain sued Microbt (Whatsminer) and its founder Yang Zuoxing again on April 7th. Prior to this, Police arrested Yang for infringing on trade secrets. But Yang was released on bail pending trial and was free. After Micree Zhan returned, he attacked Whatminer again. This may have an impact on Whatsminer's financing and listing.

2 Hindenburg released a short report on Ebang, which led to a drop of nearly 20% and a collective decline of mining. Hinderburg questioned points include the use of financing, the competitiveness of mining machines, historical issues, and the new exchanges.

Read more: https://hindenburgresearch.com/ebang/

3 Chinese listed company Meitu’s 10mln dollars of Bitcoin was purchased on Hong Kong’s first compliant exchange OSL. Previously, 90mln were purchased on Coinbase. This is of great significance to the development of the crypto ecosystem in Hong Kong and Greater China. But Meitu's stock price did not rise as a result. Other companies in Asia and China did not follow up.

4 NKN is the third Chinese project to launch Coinbase, focusing on distributed transmission. The first two are LRC and Ankr. NKN plunged by 80% and even returned to zero during the Huobi IEO in 2019, which caused investors to criticize. But in 2021, the price was nearly 40x.Some outstanding Chinese projects from 17-18 are expected to land on Coinbase one after another

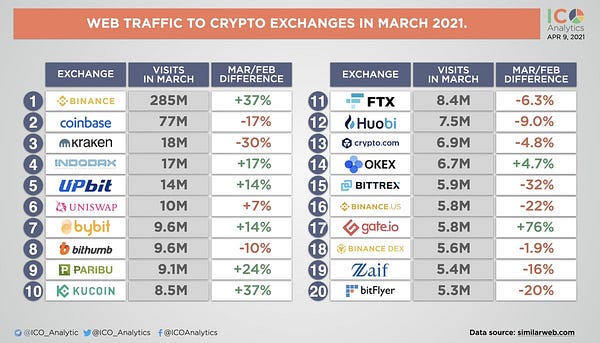

5 Traffic of Binance and Bybit, Kucoin from China but main customers are outside China is growing rapidly. It may be related to the increase in Turkey Vietnam Indonesia Russia. But traffic is not equal to the transaction. Main transaction still comes from the US, China and Korea.

WuBlockchain is China's most influential cryptocurrency industry media and KOL. It is mainly engaged in original reports and analysis on China's cryptocurrency industry.

If you have any questions, please email us at wuhongliang1@gmail.com

Follow us

twitter: https://twitter.com/WuBlockchain

telegram: https://t.me/wublockchainenglish