Element, a new NFT market invested by Sequoia, can it succeed?

Author: @0xMavWisdom

After more than three months of exploring the 1.0 phase, Element 2.0, the multi-chain aggregated NFT marketplace with its founder Wang Feng and Sequoia Capital investment ring, has drawn on the strengths and weaknesses of the three mainstream NFT marketplaces, OpenSea, LooksRare and X2Y2, in terms of interface/functional design, airdrop rewards and mining mechanisms. It has been two months since the launch of the Element 2.0 marketplace on 18 August, and the end of the Element Storm ELE rewards event on 5 November is approaching. When the rewards campaign ends, there could be a strategic change regarding the positioning of the ELE, which now acts as a reward for points, and the introduction of new incentives.

In terms of overall trading volume, after the launch of Element 2.0 and the launch of the Element Storm campaign, Element went through the following phases: the coupon clipping, deal-hunter cooling off period, aggregated trading period, and downturn period. The Element Storm campaign mainly consisted of listing rewards, trading rewards and invitation rewards.

After the first few days of the airdrop campaign, which did not attract much attention from deal-hunters and traders, Element trading volume rose sharply between 10 and 11 September after some Chinese crypto KOLs promoted the campaign. As trading rewards were limited to Ethereum and mainly focused on the proprietary market, Element Ethereum’s proprietary market volume was driven by the frenzied woolsters to over $4.3 million on September 11, nearly 1/2 of OpenSea’s volume on the same day. Unexpectedly, September 11th was already the peak trading volume on Element Ethereum’s proprietary market. Since then, daily trading on Element Ethereum’s proprietary market hasn’t reached a tenth of its peak. The $4.3 million frenzy behind this was created by just 1043 traders, with an average trade of over $4,000.

The deal-hunter’s crazy move took the Element team by surprise and left them torn between being “bubbly” and “real”. In the end, Element chose the latter, hoping to attract more loyal users with high-quality products. The next day, the coefficient of volume rewards and listing rewards was significantly reduced, and the influence of Element Storm’s positioning of Token as an incentive measure was gradually weakened in subsequent publicity and marketing. Many deal-hunters also left the scene. Ethereum’s proprietary trading volume fell 97% on 12 September compared to the previous day, and for a number of days thereafter it traded at less than $5k per day.

Around the end of September and the beginning of October, Element saw a shift from its proprietary marketplace to an aggregated marketplace, and on October 1st, the volume traded on the Element aggregated marketplace reached $5.8 million, setting a new daily record for the platform as a whole. It is interesting to note that on the same day Element’s proprietary marketplace traded less than $40 million. The Element aggregated marketplace includes OpenSea, LooksRare, X2Y2 and other major exchanges, in addition to the OKX NFT trading marketplace and the Reservoir API-based aggregated NFT liquidity marketplace. The huge swings in the volume growth of the Element aggregator market are mainly driven by the boom in ENS domain trading.

Trading domain names as NFT places high demands on the liquidity and attribute classification of the marketplace due to the large number of domain names and complex segmentation types. Single marketplaces like OpenSea, for different types of domains, and price preferences, struggle to meet investors’ needs for both liquidity and price balance; aggregators like Gem, for example, have too coarse a breakdown of domain names into categories and a poor user experience. In contrast Element, the provider of most of the depth of transactions for domains such as .bnb and .bit, has ample experience in this area and can easily meet the needs of investors both as a liquidity aggregator and a comfortable domain name category, making it a natural first choice for users. But the wind of domain names comes and goes quickly, and after a round of changing hands, domain volumes gradually returned to routine, and the aggregated trading market waned. But since then, Element has been at the forefront of domain name trading depth and volume. As a key component of the DID, Element may use domain names to explore personal data identity, e-commerce socialisation and more as a way to build a different platform in the future.

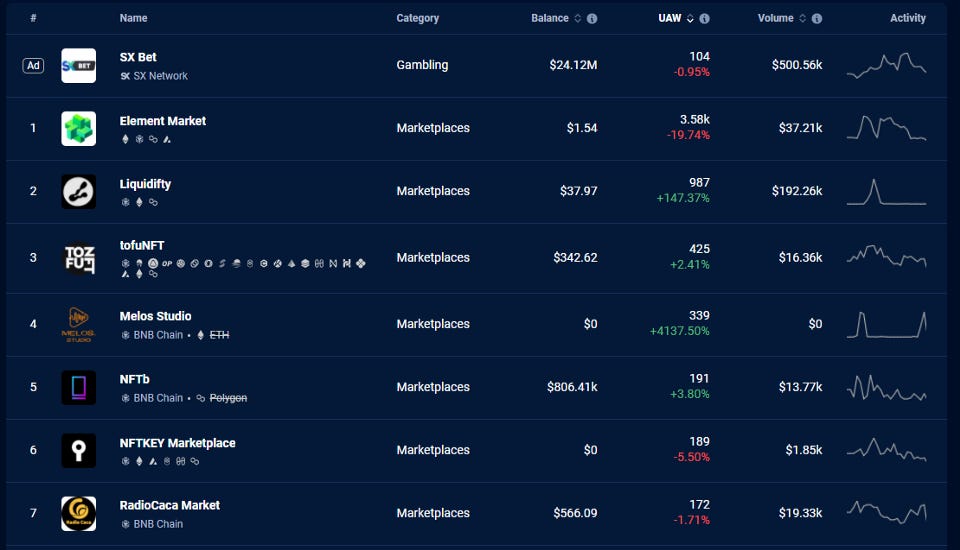

As a cross-chain aggregator, Element has been a success on the BSC, although it has not been able to capture much of the Ethereum market. Element is currently in the top five in terms of daily trading volume on BSC, behind only the game-focused trading marketplace Liquidifty; it has surpassed the former leaders NFTb and NFTrade in terms of combined trading market volume; it is also number one in terms of average daily trading numbers and new users, with over 4,000 daily trading users thanks to its quality user experience and trading aggregation.

However, BSC NFT as a whole is still in a desert state, and the volume of NFT transactions on the whole chain is only about a million dollars, which is still a very limited contribution to the overall trading volume of Element. In the future, if the chain can make a breakthrough in the sustainability of its economic model, MVB’s plan to support NFT projects that incentivise more games, as the BSC chain with a large number of users and a strong reliance on Binance, is still full of potential on the NFT, which is undoubtedly beneficial for Element, which has a first-mover advantage.

Back to the overall picture, this cross-chain aggregated trading marketplace of Ethereum, BSC and Avalanche maintains a daily trading volume of roughly $250,000 with an average of around 5,000 daily users, with Ethereum users accounting for less than 10% of those trading. Compared to the three mainstream platforms, Element is a long way off, and with rewards to boot. The NFT marketplace, which was heavily promoted by Wang Feng and his media outlet MarsBit and received $11.5 million in Series A investment from Sequoia Capital, TikTok’s largest investor SIG and others, may have faced problems from the inside out since its launch, including:

(1) Token reward expectations were not able to counteract the sluggish market, with blank Tokenomics and fading rewards, making it easy for project owners and investors to create a perception bias. As the challengers of OpenSea, LooksRare and X2Y2 almost synchronized the launch of Token for mining when the market went online. In the subsequent trend, LOOKS and X2Y2 both showed a trend of high opening and low moving. At that time, the NFT market situation and liquidity were not as bad as they are now. Element staggers the launch time of the market and the Token, but at the same time, it starts pre mining. The advantage of this is to avoid going online under bad market conditions and facing more continuous mining pressure.

However, ELE rewards are becoming less and less of a stimulus to trading volume, and Element’s “Buddha-like” approach to ELE Tokenomics tends to leave investors worried about the future value of the ELE. For the project owner, the hope is to gain real users, and the growth in trading volume driven by real user growth, but the arbitrage opportunities presented by Token rewards and mining mechanisms will inevitably lead to wash-trading, which Element does not want. For investors, the rewards received are just a number on a page, and from 1.0 to 2.0 there has been very little information about the ELE, which makes it easy to feel “appetised”.

(2) Community building is dominated by Chinese users, and for the time being it is difficult to compete with X2Y2, while overseas marketing is even weaker. In terms of user distribution, OpenSea has the largest user base by virtue of its first-mover advantage in transaction depth, while LooksRare and X2Y2 are silently absorbing English and Chinese users respectively. Marsbit, the propaganda arm of Element, has a weak overseas marketing focus as its audience is mainly Chinese users; the Discord is also clearly focused on Chinese users.

X2Y2, which has a first-mover advantage, has accumulated a lot of loyal users thanks to its excellent pledge yield driven by trading mining, and its considerable marketing capabilities (regular weekly Chinese Space audience of over 100 people), which makes it difficult for Element, which is not good at marketing, to get a share of the Chinese user base. In the future, Element may need to put some effort into social media marketing, and it is important to share the team’s current direction and exploration with users, communicate with them in the public domain more often, and offer some benefits when appropriate.

(3) Still facing the challenge of excessive homogeneity. Combinability and building social around domains could be the breakthrough. As the NFT market as a whole is deep in a liquidity bear market, the market has limited capacity and basic volumes can already be met by the three predecessor marketplaces and two aggregators. For a market with only tens of millions of volumes, too many platforms seem crowded. In addition, LooksRare and X2Y2, as challengers to OpenSea, understand the pain points of OpenSea in terms of user experience and have optimized features such as batch listing and quoting to give a more comfortable user experience. LooksRare and X2Y2 are naturally enjoying the dividends of this shift in user experience. element has a good user experience, but is not yet able to win on the basis of user experience.

Combinability can take the user experience to the next level. For example, in the project data analysis level, at present, the platform is mainly built-in simple charts, or can try to aggregate the project itself or by the community to create data panels based on Dune or Footprint, etc., to provide more detailed analysis of data; the launch pad function is introduced to provide more artistic creators with easier access to list their works, etc. In addition,socialising around domain names, such as building a chat channel for buyers and sellers to act as a forerunner for quotations; a customer service system similar to Taobao, allowing the community to socialise, opening up a way for projects to gain customers from public domain traffic, and even managing listings, introducing floating price ranges, and even live streaming.

Once the Element campaign is over, the ELE, which is temporarily used as points, may also see a change in positioning, which may also include listing for trading, uploading to the chain, redeeming points, and pass. If the ELE is listed, the price may not be particularly good given the low market conditions and the overall low trading volume. The early circulation will mainly consist of 1/2 of the 25 million for the Element campaign (half unlocked at launch and the remaining half unlocked linearly over twelve months), about 18 million for the airdrop, and some unlocking by institutional investors in a possible private placement round, etc. The initial circulation may not exceed 50 million. This is still relatively small compared to the total of 2 billion, and based on the 11.5 million funding, the valuation could reach $100 million. For deal-hunters, the potential for profit is still relatively large, with the cost of each ELE mainly ranging from $0.1 — $0.2. However, for the team, judging from the founder’s tweets, community updates about the team, and the fact that they cut most of the Element Storm campaign reward factors, I speculate that ELE may not be in a hurry to go live, and Element’s determination may still be focused on building a great product.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish