Ethereum Foundation's Justin Drake & OKX Web3 Product Head Owen: The Future of Ethereum

Conversations with core developers to help users better understand the ecosystem of different chains -Developer Stories.

Ethereum is the world's largest chain in terms of TVL and loved by many buidlers around the world. In the future, with the advancement of Eth2 and Layer 2 solutions, it will continue to lead and shape the future of crypto. Justin Drake, a key member of the Ethereum Foundation, plays a crucial role in the development and implementation of Eth2, commonly known as Eth2. He has not only advanced the technology behind Ethereum, but also brought forward innovations and insights to the entire crypto community.

As the first issue of the "Buidler Stories" series, we aim to provide our readers a better, and deeper, understanding of Ethereum from the perspectives of Ethereum Foundation's Justin Drake & OKX Web3 Product Head Owen Zhang. This issue covers topics such as technical improvements of Eth2, consensus mechanisms, scalability, security, DeFi, user experience, building an ecosystem, environmental impact, and future developments and strategies. It is our sincere hope that by the end of this issue, our readers will have a better understanding of Ethereum core developers' insights and plans.

Changes in Ethereum and L2 after the Cancun Upgrade

Justin Drake: After the Cancun upgrade, Ethereum’s throughput increased, and L2 network gas fees significantly decreased. Data shows that the Cancun upgrade has indeed made Ethereum and L2s more attractive to developers and projects.

The following L2beat chart illustrates this well: transaction activity continues to grow over time.

Moreover, the Dune chart on the "average number of Blobs per block" shows that the usage of Blobs has grown from about 1 Blob/block in March to approximately 2.3 Blobs/block today. This steady growth is largely due to Ethereum's guidance toward L2s. In a few weeks, we should see Blob demand reach the target of 3 Blobs/block, and Blob fees will reach a fair market level.

The reduction in gas fees has stimulated user demand. From an economic perspective, when the supply curve shifts from S1 to S2, the equilibrium price decreases from P1 to P2, triggering an increase in demand from Q1 to Q2.

Owen: So far, although the overall transaction volume on Ethereum and L2 hasn't shown an explosive growth trend, assets are shifting to L2, and Total Value Locked (TVL) in L2 continues to rise. L2 activity has surged; for example, Base’s Daily Active Users (DAUs) increased by 560% after the upgrade, and Daily Transaction Volume (DTXs) increased by 540%. Similarly, Optimism and Arbitrum saw a 70% and 200% increase in DTXs, respectively. In terms of transaction volume and daily activity, the upgrade has indeed attracted some traders, especially those making small transactions.

Foundation’s ETH Reserve Reduction is a Good Thing, Promoting Decentralization in the Long Term

Justin Drake: EF is often seen as taking a "hands-off" approach in promoting ecosystem development, a style that has faced some controversy. I believe that the reduction of EF's role in the ecosystem is a good thing.

Today, the EF's responsibilities are mainly limited to:

1. Hosting one Devcon or Devconnect annually, which is now just one of many conferences, with numerous side events that are often more important than the main event.

2. Maintaining one execution client: Geth, which is one of the five execution clients, and EF does not maintain any consensus clients.

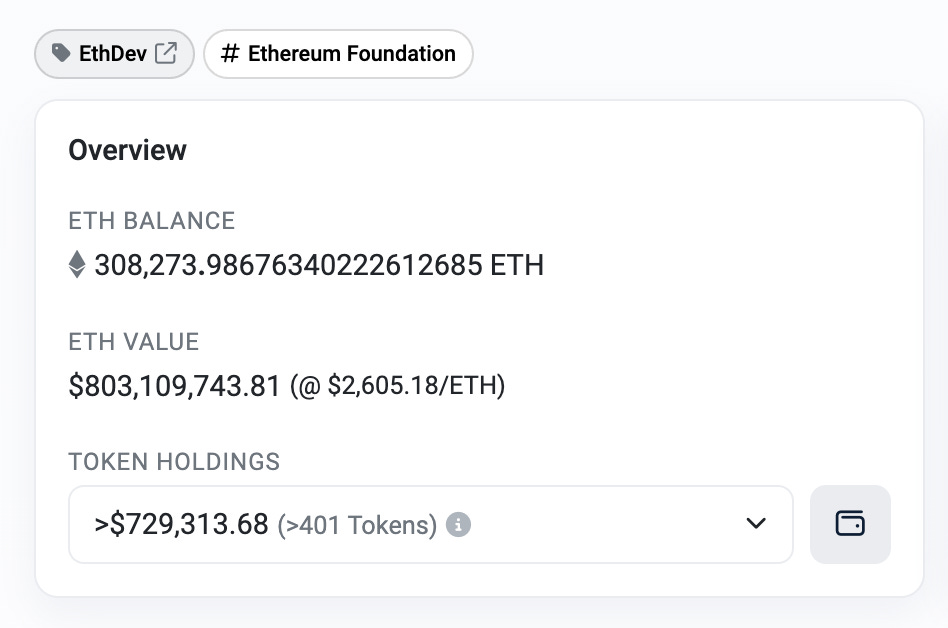

3. Providing grants: EF provides millions of dollars in unconditional grants to the broader community each year, leading to a reduction in EF's ETH reserves. In the long term, the reduction in ETH held by the Ethereum Foundation is a good thing; EF currently controls 0.23% of the ETH supply, and it would be healthy for this figure to approach 0% over the coming decades as it promotes decentralization in the Ethereum ecosystem.

4. Call coordination: Many calls are hosted by EF members, such as the All Core Devs (ACD) call hosted by Tim Beiko, the All Devs Consensus (ACDC) call hosted by Alex Stokes, the RollCall call hosted by Ansgar Dietrichs and Carl Beekhuizen, and the Sequencing and pre-meeting call hosted by me, as well as the MEV-boost call hosted by Alex Stokes.

5. Research: This may still be a centralized area, but some EF research teams might become independent.

6. Roadmap development: Vitalik updates the roadmap diagram, and then dozens of tasks are developed in parallel by different teams.

Owen: EF should play more of an advisory role. The ecosystem has gained enough attention to continue developing without relying on certain individuals. This means discussions can take place in an open and fair environment, making Ethereum a project recognized by all, rather than being influenced by a single party. This aligns with the spirit of blockchain, which is community-driven governance and transparency.

Ethereum DeFi & Future Large-Scale Application Scenarios

Justin Drake: Currently, the Ethereum community has a very pure technical atmosphere, always tackling various technical challenges, but in the end, technology needs to serve user needs and application scenarios.

Firstly, I believe that existing DeFi will see a 10x growth over the next five years:

1. Stablecoins: I hope to see $1 trillion in stablecoins, with a significant portion being decentralized.

2. DEX: The ratio of DEX to CEX trading volume is increasing, and I expect this trend to continue.

3. Lending markets: Projects like AAVE and Compound should grow about 10x.

4. Prediction markets: Projects like Polymarket should grow about 10x.

5. Derivatives: Perpetual contracts, options, futures with ample liquidity, etc., will all be available on Ethereum.

Secondly, beyond DeFi, I hope to see decentralized frontends using ENS and IPFS become more popular.

Lastly, a simple application I would like to see is a world lottery:

1. Fairness: Verifiable randomness.

2. Global: World-class scale.

3. Cheap: Far below the approximately 50% government cut.

Owen: In terms of data, decentralized exchanges (DEXs) still have the largest Total Value Locked (TVL) on Ethereum, but this figure has decreased significantly compared to two years ago. We believe that the biggest obstacle for Ethereum in DeFi is the high transaction fees. The same transaction executed on Ethereum can cost hundreds more compared to L2s, so market behavior will always move towards higher efficiency.

The recent technological advancements in the Ethereum community are also considering practical needs. For example, everyone is pushing EIP4337 Account Abstraction, which aims to lower the entry barriers for Web2 users when using Web3. This will be a cornerstone for all applications in the future.

In the foreseeable future, I believe that everyone will be able to easily self-custody their Web3 virtual assets with a user experience close to that of Web2.

Global Adoption of Ethereum 2.0 & Developer and User Attraction

Owen: Ethereum 2.0 is now widely adopted globally and is highly attractive to both the blockchain world and traditional financial institutions.

In terms of network scale and staking, the total amount staked in Ethereum 2.0 has reached a scale of hundreds of billions of dollars, with over 50,000 independent validator nodes participating in Ethereum 2.0's consensus mechanism worldwide. From the perspective of DeFi market development, Total Value Locked (TVL) has also significantly increased after Ethereum 2.0, as the PoS mechanism allows more DeFi projects to operate with lower transaction fees, attracting more users and capital. From the perspective of international enterprises and institutions, many large companies and financial institutions (such as Microsoft, JPMorgan, IBM) are actively adopting Ethereum 2.0 technology. These companies use Ethereum 2.0 for supply chain management, financial transactions, and other applications.

For new users and developers, Ethereum 2.0 offers faster transaction speeds and lower fees, making the Ethereum network more attractive to regular users. For developers, Ethereum 2.0's improvements make it more efficient to build and deploy decentralized applications (dApps). The new consensus mechanism and sharding technology allow them to build more complex and innovative applications without worrying about high costs or performance bottlenecks.

All of this demonstrates the strong confidence people have towards Ethereum 2.0.

However, Ethereum 2.0 still faces several obstacles in attracting a larger scale of new users and developers.

Firstly, the entry cost is relatively high for ordinary users. The ease of access to wallets, the "Web3 entry point," is crucial for general users.

Secondly, the overall learning curve is relatively steep. Ethereum 2.0 introduces many new concepts such as Proof of Stake (PoS), sharding, Rollups, etc., which may have a high learning curve for new users and developers. Developers need to spend time and effort to understand and adapt to these new technologies. Additionally, Ethereum's infrastructure and tools are still maturing, requiring continuous learning and follow-up.

In terms of market and competition, the entire market is becoming increasingly competitive, with new platforms and technologies constantly emerging. Other blockchain platforms (such as Solana) are also actively developing and promoting their technologies, offering different technical advantages or lower entry barriers to attract a large number of users and developers.

Finally, in terms of regulation and compliance, the regulatory policies for blockchain and cryptocurrencies are still constantly evolving, and policies in different countries and regions may impact the adoption of Ethereum 2.0.

The Most Significant Technical Advances & Concerns in Ethereum 2.0

Owen: Staking and Restaking.

In Ethereum 2.0, after adopting the PoS consensus, staking has saved Ethereum a lot of energy, while also providing a playground for restaking. Providing security guarantees for other projects has become one of Ethereum's missions, and only Ethereum's scale can take on this responsibility.

Additionally, Vitalik recently proposed EIP-7702 as a solution to allow user wallets to support smart contracts, making it more convenient for users to use wallets. It also allows for more login methods and can provide many convenient features that ordinary EOA wallets cannot, such as social recovery and paying gas fees with non-native tokens. This paves the way for large-scale Web2 users to enter Web3 in the future.

The Impact of PoS on Ethereum Decentralization

Owen: We approach this question from multiple angles, including the impact of PoS consensus on decentralization, whether the incentives and penalties for validators participating in Ethereum 2.0 are effective enough, and how to ensure fairness for small validators under the PoS mechanism.

Firstly, regarding the impact of PoS consensus on decentralization, this has been a long-discussed topic. In the long run, the consensus mechanism shift in Ethereum 2.0 is beneficial for its development. Ethereum's goal is to become the "world computer," so all its improvements and upgrades must move towards this goal, making it a better platform for running decentralized applications (dApps). The shift from PoW to PoS in Ethereum 2.0 helps effectively balance the "impossible triangle" of decentralization, scalability, and security.

Furthermore, when discussing decentralization, we need to consider the real-world situation. PoW is a permissionless participation method that theoretically maximizes decentralization. However, in reality, mining is a highly specialized activity, giving rise to mining pools, mining machine manufacturers, and mining farms. Before Ethereum's transition to PoS, the top five mining pools controlled over 75% of the total network hashrate, with the largest single mining pool controlling over 33% of the total network hashrate. Ethereum mining consumes electricity comparable to that of a small country, and for professional mining farms, electricity costs are one of the most sensitive factors. As a result, mining farms are often concentrated in regions with low energy prices. This geographical concentration makes hashrate supply vulnerable to regional government intervention, which threatens the security and stability of the blockchain network. We saw a similar situation during China's "environmental" mining ban in 2021 when Bitcoin's total network hashrate plummeted by over 50% in two months. Additionally, professional mining relies on specialized hardware. Before Ethereum's transition to PoS, mining required the use of GPUs, and there are very few companies globally that can produce these chips. If hardware suppliers interfere with mining activities, network security could be at risk. For example, NVIDIA once limited the Ethereum mining efficiency of its RTX 3060 graphics card by half to force miners to seek alternative solutions. Therefore, we believe that simply discussing "decentralization" without considering real-world factors is unrealistic. The shift to PoS in Ethereum is a step in the right direction.

Secondly, we want to discuss whether the incentives and penalties for validators participating in Ethereum 2.0 are effective enough. The Ethereum 2.0 upgrade has been in place for over two years, and from the current results, the incentive and penalty mechanisms are effective. Attack scenarios that were heavily discussed before the upgrade, such as Short Range Re-orgs, Bouncing and Balancing, Avalanche Attacks, and Denial of Service, have all been effectively mitigated.

Lastly, the issue of how to ensure fairness for small validators under the PoS mechanism has already been included in Ethereum's mid-term roadmap. For example, by lowering hardware requirements: using Verkle trees combined with EIP-4444, staked nodes can run with extremely low hard drive requirements. This allows staking nodes to sync almost instantly, greatly simplifying the setup process and the transition from one implementation to another. These proposals also make light clients more feasible by reducing the bandwidth required for proof data with each state access. Alternatively, economic measures such as allowing a larger validator set (lowering the minimum staking requirements) while reducing the overhead of consensus nodes could be implemented. These measures make validation more equitable while also making light clients more secure.

The Current State of Ethereum L2s & the Potential of Rollup Technology

Owen: Regarding the current state of Ethereum L2s, the Layer 2 track on Ethereum is currently overcrowded, to the point of contradicting the original purpose of creating Layer 2 for Ethereum scaling. The competition has led to liquidity fragmentation and UI fragmentation, which are becoming increasingly apparent. Users find it difficult to navigate the Layer 2 ecosystem through a single entry point. The OKX Web3 wallet is researching corresponding solutions. From a product development perspective, the head effect itself will cause liquidity and interactions to concentrate on the top few Layer 2s, eventually leading to a long-tail situation where Layer 2s without user volume will gradually be eliminated. From a technical solution perspective, we are seeing the rise of chain abstraction technical solutions, where users can access Layer 2 seamlessly through a single entry point, with atomic cross-chain exchange service providers enabling seamless Layer 2 usage.

Regarding the potential of Rollup technology in the Ethereum ecosystem, it can be viewed from two aspects, as Rollup has dual characteristics.

Advantages of Rollups:

1. Scalability: Significantly increases transaction throughput and reduces gas costs.

2. Security: By using ETH as the DA layer, it retains the security and decentralization characteristics of Ethereum.

3. Ecosystem Support and Compatibility: The Ethereum community and developer ecosystem provide extensive support for Rollups.

4. Flexibility and Innovation Potential: Rollups support complex smart contracts and decentralized applications.

5. Future Scalability Development Direction: With the gradual implementation of Ethereum 2.0 and the introduction of sharding technology, Rollups are seen as a complementary scalability solution to the Ethereum main chain.

6. Cheaper on-chain data after the Cancun upgrade.

Disadvantages of Rollup:

1. Data Availability Issues: To ensure data availability, compressed data and state roots must be published on Ethereum, which requires ensuring that all data is accessible and verifiable.

2. Latency and Exit Time: Exiting a Rollup chain typically requires waiting for a challenge period.

3. Compatibility Issues: There are some incompatibilities between different Rollups networks, such as EVM OP_CODE.

4. Centralization Risks: With fewer nodes, it becomes more centralized.

Overall, Rollups mainly drive Ethereum’s development by enhancing scalability, reducing transaction costs, increasing security, and supporting complex applications. Despite facing some disadvantages, they remain an important driver of Ethereum's growth.

How OKX Web3 Wallet Views Ethereum 2.0's Security, Community Governance, Energy Efficiency, and Privacy Technology

Owen: Firstly, Ethereum 2.0's security challenges are still significant, including:

1. Proof of Stake (PoS) Mechanism Security: Although PoS is more energy-efficient than PoW, there is a risk of ETH whales acting maliciously.

2. Decentralization Degree of Validators: Staking projects like Lido occupy too high a proportion of the staking network, significantly reducing decentralization.

3. New Attack Risks Introduced by Sharding: Ethereum 2.0 introduces sharding technology to increase network throughput. Sharding divides the network into multiple shard chains, each processing a portion of transactions, greatly improving performance but also increasing complexity and introducing new risks.

4. Economic Incentives and Attack Costs: In the PoS mechanism, validators have economic incentives to maintain network security. However, if the potential rewards of an attack outweigh the risks and costs, it may attract malicious actors to carry out attacks.

5. Smart Contract Code: Issues like EVM upgrades leading to incompatibilities with older Solidity features.

Secondly, the future of Ethereum 2.0's community governance is full of potential. As the network moves toward greater decentralization and scalability, governance will become more decentralized. The influence of proof-of-stake participants has increased since Ethereum's transition from PoW to PoS. For example, during the first upgrade after Ethereum's transition to PoS, the priority of staking ETH withdrawals was mainly influenced by the interests of Ethereum stakers.

As the Ethereum ecosystem matures, the governance process will become more structured and formalized, and social governance will continue to play an important role in the network's development. Additionally, as Layer 2 solutions become more widespread, governance will need to address the interaction between Ethereum 2.0 and these scalability solutions.

The future of Ethereum 2.0's community governance will be more decentralized, but it will require careful design and continuous innovation to maintain the network's decentralization and ensure that the community has a voice in governance decisions.

Next, regarding whether there is more room for improvement in Ethereum 2.0's energy efficiency: we observe that Ethereum has reduced its power consumption by over 99% after transitioning to PoS, but storage costs can still be optimized, such as transitioning Ethereum’s state management from Merkle Patricia trees (MPT) to Verkle trees (VKT), etc.

Lastly, regarding the development of Ethereum's privacy technology, we believe that future privacy technology in Ethereum will focus on enhancing transaction privacy, protecting user data, and balancing decentralization with regulatory compliance. Key development directions include the broader adoption of zero-knowledge proof technology. Most importantly, with advances in quantum computing technology, research on resisting quantum attacks will drive the development of quantum-resistant encryption technology to ensure Ethereum's privacy and security in the long term. The Ethereum community has already begun to research and discuss how to prevent quantum computing attacks.

Challenges Ethereum Will Face in the Next 10 Years & Whether Ethereum Will Exist in the Next 30 Years

Owen: If we categorize Ethereum and its corresponding EVM L2s (Layer 2s built on top of Ethereum) as Ethereum, then the main challenge over the next 10 years will be to reduce friction between L1 and L2, thereby improving cross-chain interaction user experience and reducing liquidity fragmentation. The L1 and L2 ecosystems should be seamlessly integrated like a single chain, which is the challenge that Polygon's AggLayer team is working on solving.

In the next 30 years, Ethereum should still hold significance, as it has established itself as one of the most decentralized and enduring networks.

About the Developer's Story Series

Web3 developers have made significant contributions to the advancement of the crypto industry. Their innovation and technical capabilities have injected lasting vitality and motivation into the entire industry, not only improving the technology itself but also providing support for future applications and business models. However, despite their active contributions, they often receive little to no attention. The "Developer Stories" series, launched by OKX Web3 in collaboration with Chain Catcher, aims to help readers understand the roadmaps, technical insights, latest trends, market dynamics, and comments on hot topics of the day from the perspectives of different chains' core developers. It seeks to enhance the voice of Web3 developers, bring these most active and interesting people closer to the audience, and provide them with the greatest support.

Disclaimer

This article is for reference only. The views expressed in this article are solely those of the author and do not represent the position of OKX. This article is not intended to provide (i) investment advice or investment recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risk and may fluctuate significantly. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/investment professional for advice on your specific circumstances. You are responsible for understanding and complying with applicable laws and regulations in your local area.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish