Hong Kong's Stablecoin Ordinance Released: Strict KYC Requirements Spark Controversy, Ultra-Conservative Approach Shuts Out DeFi

Author | Aki Chen WuBlockchain

This article was organized with the assistance of GPT and is intended solely for informational purposes. It does not constitute any investment advice. Readers are advised to strictly comply with local laws and regulations and refrain from participating in illegal financial activities.

Introduction

On August 1, 2025, Hong Kong’s Stablecoin Ordinance officially came into effect. The regulation stipulates that any entity issuing or offering fiat-backed stablecoins to retail users in Hong Kong must obtain a license from the Hong Kong Monetary Authority (HKMA). Licensees are required to comply strictly with reserve backing mechanisms, AML/KYC obligations, and transparency standards.

The HKMA has simultaneously opened the application process for stablecoin licenses, with the first round of submissions due by September 30. The first batch of licenses is expected to be issued in early 2026. This move is widely regarded in the industry as a “major milestone in global stablecoin compliance.” However, due to its strong real-name (KYC) requirements and high-threshold, exclusionary design, the ordinance is also considered one of the world’s most stringent stablecoin regimes, triggering heated debate among Web3 project teams and communities.

Meanwhile, the U.S. SEC unveiled its Project Crypto initiative, advocating for an “innovation exemption” to avoid a regulatory “Procrustean bed,” offering a stark contrast to Hong Kong’s approach.

Overview of Core Provisions in the Stablecoins Ordinance

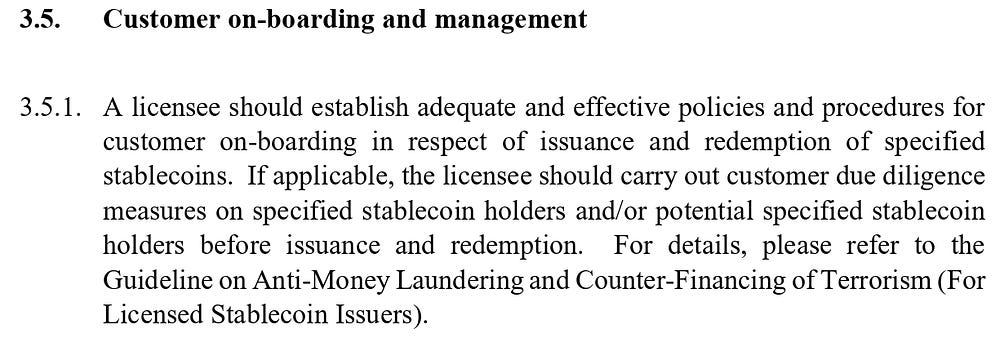

Under the new regulatory framework, any entity issuing, circulating, or offering fiat-backed stablecoins to retail users within Hong Kong must obtain an exclusive license granted by the Hong Kong Monetary Authority (HKMA). The core requirements include:

● Capital Requirement: Minimum paid-up capital of HKD 25 million.

● Reserve Mechanism: 100% backing with high-quality liquid assets (e.g., cash and short-term government securities); assets must be segregated under custody, and rehypothecation is strictly prohibited.

● Redemption Mechanism: Users must be able to redeem stablecoins at par value within one business day.

● Real-Name (KYC) Requirement: Identity verification is mandatory; user records must be retained for over five years; integration with DeFi protocols and anonymous wallets is explicitly prohibited.

● Marketing Ban: Unlicensed stablecoins are barred from public promotion; violations may result in fines and criminal liability.

Among all regulatory provisions, the KYC real-name verification requirement has emerged as the most contentious issue within the Web3 community. According to the HKMA’s guidelines, stablecoin issuers are not only required to verify user identity and retain data records for more than five years, but are also prohibited from offering services to anonymous users. In the initial stage, issuers must conduct identity verification on every holder of a compliant Hong Kong stablecoin.

In response, members of Hong Kong’s Legislative Council noted that while the HKMA does intend to enforce KYC rules, the specific implementation details remain under discussion, and a full real-name regime is only one of the options being considered.

Chan King-hung, Deputy Executive Director of the HKMA (Regulation and Anti-Money Laundering), added that the current approach is stricter than the “whitelisting mechanism” proposed in earlier anti-money laundering consultation papers. However, he also remarked that as relevant technologies continue to mature, there may be room for a gradual relaxation of these rules in the future.

This implies that, at least in the initial phase, stablecoins issued under Hong Kong’s framework may lack the ability to interact directly with DeFi protocols. Decentralized wallets and permissionless addresses will be excluded from the compliant ecosystem, and such interactions will be legally classified as “unauthorized usage.”

It is evident that, compared to the scalability and openness of on-chain protocols, Hong Kong regulators are placing greater emphasis on asserting control over the circulation layer of stablecoins. This regulatory posture has been interpreted by some industry participants as pouring cold water on the potential for stablecoins to be used in open financial scenarios on-chain.

The approach stands in stark contrast to that of existing mainstream stablecoins such as USDT and USDC, which support free transfers between wallets and seamless integration with DeFi protocols. Such divergence is expected to negatively affect user experience and adoption.

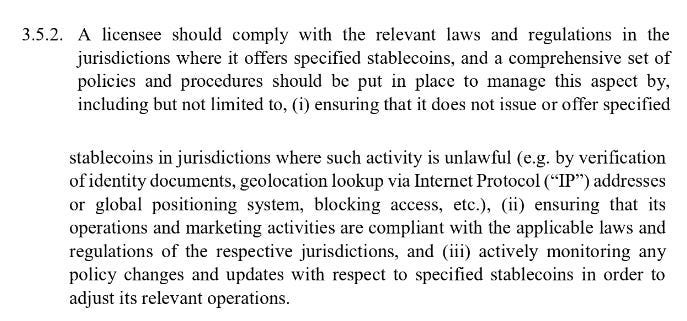

To make matters worse, under the provisions of the Hong Kong Monetary Authority’s Regulatory Framework for Stablecoin Issuers, licensed entities must comply with the laws and regulatory requirements of relevant jurisdictions when making an “offer of a specified stablecoin.”

This rule underscores that compliance is not limited to issuance within Hong Kong — it also requires the establishment of a comprehensive institutional safeguard system covering cross-border operations, identification of prohibited jurisdictions, and proactive blocking of unauthorized access.

Specifically, licensees are subject to the following three obligations:

1. Prohibition on Offering Services in Restricted Jurisdictions

Licensees must ensure that they do not issue or offer stablecoins in jurisdictions where such activity is prohibited. The regulatory framework recommends a multi-pronged approach to compliance, including:

● Verifying user identity documents (such as national ID cards or passports) to determine nationality or residency;

● Using IP address tracking or GPS-based geolocation technologies to assess users’ actual locations;

● Implementing technical blocks to restrict access from prohibited regions, thereby preventing downloads, registrations, or purchases.

In essence, this requirement mandates that licensees act as a form of “geolocation risk firewall,” cutting off access from the source to prevent potential breaches of foreign laws or the triggering of cross-border regulatory conflicts.

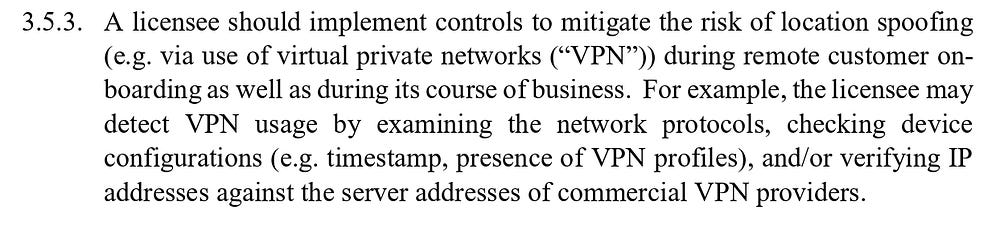

Section 3.5.3 of the framework also explicitly requires licensees to detect whether users are employing virtual private networks (VPNs) to bypass geographic restrictions. In other words, if stablecoin usage is prohibited in a user’s jurisdiction, accessing it via VPN would still constitute a violation.

This significantly raises the barrier to entry: every user must submit identity documentation, and the onboarding process becomes cumbersome — undermining the seamless “just-open-and-use” experience typically associated with crypto wallets. It may also hinder global accessibility, as non-Hong Kong users who are not explicitly covered under the policy might, in practice, be unable to access Hong Kong-issued stablecoins.

Transfers are also tightly regulated. Licensed stablecoin issuers are treated as financial institutions and must comply with the Financial Action Task Force (FATF)’s Travel Rule requirements. This means that, prior to executing a transfer, the platform or smart contract must verify that both the sender and recipient have completed KYC procedures and that the relevant identifying information is attached. Otherwise, the transaction may be blocked.

This regulatory requirement in Hong Kong essentially transforms stablecoins into a form of controlled-circulation electronic money or bank-issued digital vouchers. Their defining characteristics are no longer those of universally accessible, decentralized on-chain assets, but rather of digital instruments that are: tied to verified real-world identities, geographically restricted, and embedded with regulatory attributes.

2. Full Compliance Required for Overseas Marketing and Operations

Beyond the obligation to block access in prohibited jurisdictions, the framework also mandates that licensees ensure all operational and marketing activities — including advertising, partnership channels, and app deployments — comply with the applicable laws of their target markets. This means that:

● Marketing content must not be pushed to jurisdictions where the licensee is not authorized to operate;

● Overseas partners should be assessed for their compliance qualifications;

● Website language options, terms of service, and other public-facing materials must be carefully managed to avoid constituting a de facto “provision of services” under foreign law.

3. Ongoing Monitoring and Dynamic Adjustment Mechanism

The regulation further requires licensees to establish a mechanism for ongoing monitoring, closely tracking regulatory developments across countries and regions, and promptly adjusting their business strategies and technical measures accordingly. For instance, if a jurisdiction introduces a new ban on stablecoins, the issuer must immediately suspend relevant services. Similarly, if regulatory standards tighten — such as the introduction of additional licensing or real-name requirements — issuers must update their KYC procedures and compliance review systems in tandem.

On this point, Dr. Xiao Feng, Chairman and CEO of HashKey Group, once remarked that in traditional finance, anti-money laundering (AML) mechanisms heavily rely on identity-based data retrieval and interbank account information sharing. However, in practice, such systems face significant limitations in multi-bank, multi-jurisdictional, and cross-border scenarios.

By contrast, the crypto industry has in recent years developed on-chain tracking and address-labeling mechanisms that offer a different approach to AML. In blockchain systems, every transaction is publicly visible and the fund flow history of any given address is fully traceable. From token minting and initial circulation to cross-chain transfers and final ownership, all data on-chain is immutable, globally accessible, and synchronized in real time — enhancing the efficiency and accuracy of money laundering detection.

Industry Impact Analysis: Reactions from Projects, Users, and the Market

According to on-site reporting by Techub News, on August 1 — the day Hong Kong’s Stablecoins Ordinance officially came into effect — several crypto OTC storefronts, including One Satoshi, temporarily suspended operations out of concern over potential regulatory violations. Meanwhile, some OTC shops opted to continue normal business, reflecting differing interpretations within the industry regarding the scope and applicability of the new rules.

Following the implementation of the ordinance, responses from the local Web3 industry have been mixed. Some welcomed it, saying, “We finally have regulation,” while others admitted, “This isn’t the kind of regulation we were hoping for.”

The introduction of real-name verification, a licensing regime, and high entry thresholds has effectively shut out many native Web3 projects. In particular, the ban on direct integration between stablecoins and DeFi, along with the exclusion of anonymous wallets and permissionless smart contracts from the compliance framework, has been widely interpreted as a clear signal: stablecoins licensed in Hong Kong will not support free on-chain circulation.

For teams that once saw Hong Kong as a potential base for their Web3 operations, this is clearly a setback. If you want to issue a token, you must apply for a license; if you want to build a wallet, every address must be linked to a verified identity. This diverges from the traditional concept of “Web3,” resembling more of a “Web2.5” environment — or what some have termed permissioned-chain finance.

A more pressing concern is that the ordinance effectively sidelines smaller startups and independent developers. While the HKMA publicly claims to support innovation, in practice it seems to favor banks and large institutions. Only invited platforms or entities are eligible to apply for a license. The entire framework appears designed to position “established players” as the drivers of stablecoin development, leaving smaller actors either on the sidelines or forced to relocate.

If Hong Kong’s Web3 ecosystem once thrived in a state of unregulated experimentation, it is now entering a phase of wholesale “order restructuring.” Yet in the pursuit of compliance and financial stability, there is a growing sense that Hong Kong may also be losing the very spirit of freedom and openness that once attracted builders to its shores.

Comparison with Other Regulatory Frameworks

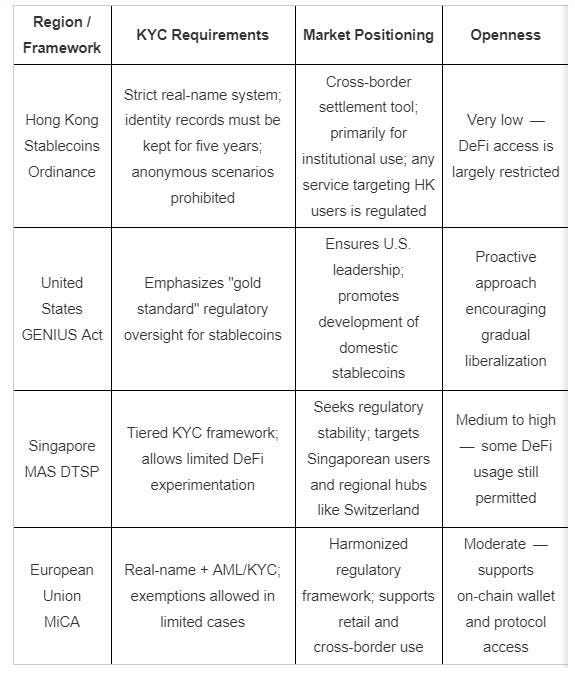

In contrast to the recently unveiled Project Crypto initiative across the Pacific — which advocates for “innovation exemptions” — Hong Kong’s new stablecoin regulations are characterized by regulatory clarity, a robust real-name KYC regime, and stringent anti-money laundering (AML) enforcement.

It is evident that Hong Kong’s current strategy leans toward building a “quasi-sovereign settlement tool,” emphasizing regulatory dominance and financial security. Core features of Web3 — such as permissionless architecture, smart contract composability, and decentralized wallets — are deliberately excluded from the regulatory framework. This approach implicitly assumes that stablecoins are meant to serve only regulated financial institutions, rather than functioning as neutral infrastructure for on-chain ecosystems.

In contrast, while the EU’s MiCA framework also emphasizes KYC compliance, it permits a degree of flexibility — for instance, by exempting low-value transactions or allowing the use of anonymous wallets under certain conditions. Singapore’s DTSP regime adopts a more “layered sandbox” model, inviting DeFi projects with sound risk controls to gradually engage in regulated trials.

In the United States, although regulatory action has historically lagged behind, momentum is building following the signing of the GENIUS Act, the release of the PWG Report, and the launch of the Project Crypto initiative. These developments signal a shift toward modernizing on-chain legal structures while balancing financial innovation. The current SEC Chair even emphasized in a public speech: “We do not regulate for the sake of regulation — let us not commit a Procrustean error.”

This comparison highlights a core divergence in strategic orientation: Hong Kong is betting on stablecoin compliance infrastructure; the United States is moving toward on-chain regulatory modernization; the European Union is aiming for a unified and universal standard; and Singapore is preserving its openness to financial experimentation.

Hong Kong’s current path is better suited for permissioned-chain finance geared toward offshore settlement. However, for the Web3 model that values open ecosystems and anonymous circulation, its compatibility and appeal appear significantly more limited.

Conclusion: Can Compliance and Openness Be Balanced? Hong Kong Is Still Testing the Boundaries

Regulation must advance — but it must also leave room for flexibility. As a major financial center in Asia, Hong Kong serves not only as a testing ground for technological and regulatory innovation, but also bears the responsibility of setting paradigms for the region and even the world.

Yet as the Stablecoins Ordinance pushes forward with real-name KYC, anti-money laundering, and traceability requirements, the long-term challenge lies in how to preserve a degree of openness and scalability without entirely erasing the space for on-chain privacy. Achieving financial security without compromising the foundational openness of blockchain systems is the true balancing act. As Dr. Xiao Feng once noted, the essence of blockchain’s growth lies in its permissionless nature. Anyone can join or exit the network freely. In this light, Hong Kong’s emphasis on identity verification and approval-based mechanisms may, in some respects, run counter to that very logic of openness that underpins the Web3 ethos.

At its core, a stablecoin is a tool of institutional innovation — bridging on-chain and off-chain systems, and connecting traditional finance with the future of digital assets. However, overly paternalistic regulation risks not only alienating the existing DeFi ecosystem, but also undermining Hong Kong’s potential role in reshaping the global digital financial order.As the ordinance moves from enactment to implementation and interpretation, how Hong Kong balances regulatory rigidity with technological flexibility will remain a critical issue — and one that deserves close attention from all corners of the industry.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish