How Two High-Frequency Traders Exploited an Exchange Loophole to Make $43 Million

In the recent VOXEL incident, the market maker “qntxxx” gave an exclusive interview to Wu Blockchain. He stated that he made $43 million using 100 sub-accounts, withdrew about $10 million, and had several hundred thousand dollars frozen by Binance. He emphasized that he would not compromise and had already hired legal counsel. According to him, the profits were earned through fair trading practices by interacting with the order book — not by exploiting vulnerabilities or attacking BG’s servers — so the $43 million should rightfully belong to their team.

Bitget’s Response: The eight accounts in question appear to be associated with a professional arbitrage syndicate, which was the main instigator of the VOXEL incident, illicitly profiting over $20 million. Bitget has pledged to distribute all recovered funds back to platform users via airdrops. For all retail users who traded VOXEL between 16:00–16:30 on April 20 and had already withdrawn (about $19 million in total), their accounts were restored by Wednesday and will not face any further action.

Interview with the Accused Market Maker

Colin Wu: Could you briefly introduce your background?

qntxxx: There are two of us on the team. We started high-frequency trading in early 2022, but didn’t perform very well at the beginning. It wasn’t until the LUNA collapse that we made a breakthrough — we were contract market makers on Binance and made over $1 million in profits. We continued market making on Binance until early 2024. Last November, we started trying out smaller exchanges like Bitget and Gate.

Colin Wu: Was contract market making not allowed on BG previously?

qntxxx: There were no absolute restrictions. BG’s spot liquidity was relatively poor, so to apply for contract market making, you also had to apply for spot market making. We started in November 2024 and continued until now. Their official site has an application portal. Anyone — individual or institutional — can apply, and the bar is quite low. You just need proof of trading volume from other exchanges.

Colin Wu: Let’s get to the core of the issue — how did you discover the opportunity that day, and what strategy did you use?

qntxxx: There was little market movement — it was basically a sideways market. Our strategy involves placing orders across many trading pairs and contracts. When a token suddenly pumps or dumps, that’s the ideal scenario for our HFT strategy. So, when we spot such a move, we scale up our position size and increase the number of sub-accounts.

qntxxx: We noticed the token VOXEL was experiencing high trading volume, so we were already trading it. But then we saw profits scaling dramatically, so we ramped up to around 100 sub-accounts.

qntxxx: We saw a similar scenario during the LUNA incident — we used several hundred accounts simultaneously. This VOXEL event was quite similar: the order book showed chaotic candlestick movements. That type of volatility matches our profit strategy perfectly. That’s how we ended up making $43 million.

Colin Wu: BG claimed $20 million was taken out. Were other market makers involved?

qntxxx: We withdrew around $10 million. Binance froze several hundred thousand. There must’ve been others, but the trading window was very short. Out of the 9 legal notices BG sent, 2 went to us; we don’t know about the rest. But I believe the total amount withdrawn exceeded $20 million.

(BG response: Before risk controls were triggered, a total of $38.31 million in abnormal profits were withdrawn. Besides the $20 million involving the 8 flagged accounts, Bitget will not pursue any other already-withdrawn funds.)

We’re just two people managing three accounts. The trading volume on VOXEL surged for at least half an hour. At that time, the token wasn’t halted, and no risk control measures were triggered. Some accounts were frozen briefly but withdrawals resumed two hours later — and remained open into the night and the next day.

qntxxx: At its core, I believe this is a case of BG’s internal market makers losing to us on the order book. That falls under the principle of fair trading. We interacted with the book, not exploited bugs or attacked servers. So the $43 million is legitimately ours.

Colin Wu: BG sent you legal notices. Have you consulted lawyers?

qntxxx: Yes, we hired a lawyer. The advice was to sue their Singapore entity for unauthorized fund seizures. BG’s rollback process was chaotic — many users had mismatched balances. They even deducted money from wealth management accounts. After the first rollback, many users found inconsistencies, especially because fees were incorrectly included, resulting in overcharges.

(BG response: The rollback aimed to reverse abnormal profits/losses. Users’ principal and fees were unaffected. Some users were mistakenly overcharged fees, but all of those have since been refunded. No users lost principal or fees.)

Colin Wu: Some argue that this is similar to discovering a bug in a bank — like if a bank accidentally credits millions to your account, you’re legally required to return it.

qntxxx: Our position is this: BG has never publicly stated that it acts as a counterparty to users. So users assume BG simply matches trades. The money we made came from other traders losing to us — it was real volume, real trades. Our orders were normal. We didn’t exploit any bug. If BG now claims it was a bug, they must provide evidence. They can’t just unilaterally accuse us of exploiting a loophole.

If this really was a bug, then none of the trades should have been executed at all.

Claiming we committed theft is absurd. We made profits and withdrew them — normally. We didn’t hack their systems. Their risk control and compliance teams didn’t stop the withdrawals.

(BG response: A full incident report will be released soon. As for whether this constitutes theft, reference can be made to previous legal cases, such as the 2015 Maoming, Guangdong case — Case No. (2015) Maonan Criminal First Instance №112.)

@Boywus Dissects the High-Frequency “Money Printing” Algorithm Behind the VOXEL Incident

Original Post: https://x.com/Boywus/status/1918941848728658129?s=19

This article reflects the author’s personal views and does not represent those of Wu Blockchain.

This article presents a simplified breakdown of a high-frequency algorithm that allegedly generated tens of millions of dollars in profits during the VOXEL/USDT incident on Bitget. In fact, on that day, all you had to do was run the program with minimal configuration — Bitget’s market maker effectively activated a money printer and scattered profits across the entire market.

The strategy is a practical variant of the Lead-Lag model in high-frequency trading, and it still remains viable. Several points to note:

1. This is a high-frequency trading strategy, which may result in higher order cancellation and taker rates.

2. If profits are large, you may trigger exchange-level risk controls and not be able to withdraw everything. The author has negotiated with several exchanges, and in some cases, only the original deposit was returned.

3. It requires low-latency servers, high-performance programming, and multi-account operations. Multi-account setups also require multiple IPs, making distributed deployment essential.

Basic Setup

We use Bitget as the execution market and Binance as the reference market. In practice, there may be multiple reference markets. We’ll use long positions as an example and simplify some indicators.

Theoretical Basis

We assume that the reference market (Binance) leads Bitget by several ticks and carries higher signal strength. Even a macro uptrend (or flash crash) is composed of micro-level peaks and troughs, so the goal is to perform micro-trades that follow the reference market and buy low, sell high.

Define the following:

● TTL (Time-To-Live): The lifespan of an order before it’s canceled and refreshed. For simplicity, we set it to 100 ms.

Understanding “Basis”

1. Subscribe to the orderbooks of both Binance and Bitget.

2. Instead of using last trade price, use the midprice as the market price.

3. Take 60 samples of midprices from both Binance and Bitget.

4. Compute the basis (the price spread) between the two exchanges and smooth it to obtain a stable reference.

We then use this to calculate a “fair price” on Bitget:

Bitget Fair Price = Binance Price — Basis

This reflects the assumption that Bitget’s price should track Binance’s.

Next, define the order price as:

Order Price = Fair Price × (1 — delta)

Where delta is a small dynamic buffer (to make the system more adaptive). For simplicity, we fix delta at 0.2% here.

Simplified Execution Loop

Every 100ms:

1. Cancel all existing orders.

2. Calculate the Fair Price using Binance data.

3. Apply delta to generate a new order price.

4. Place the new order on Bitget.

Example Scenario

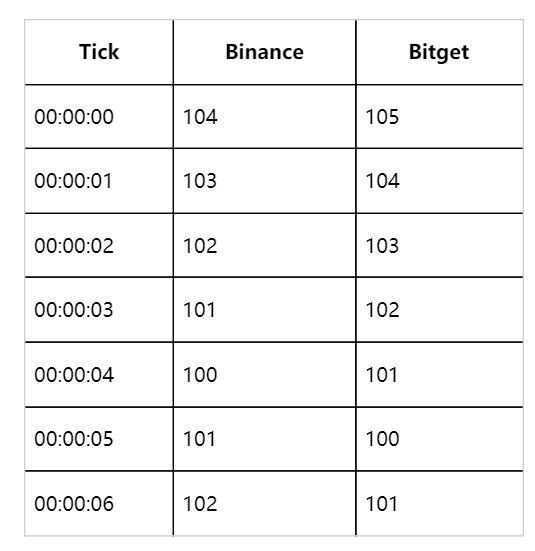

Assume prices decline from 105 to 100, then rebound to 102. Binance leads Bitget by 1 tick.

At 00:00:04, your Bitget order price = 100 × (1–0.002) = 99.8, which is below Bitget’s market price (101), so it queues on the bid side without executing.

At 00:00:05, you cancel the 99.8 order and re-submit at:

101 × (1–0.002) = 100.798

Bitget’s market price is 100, so your order executes immediately at 100. You later sell at 101 and profit.

Strategy Insights

Most of the time, prices on both markets track closely and the basis remains stable. But when the reference market moves sharply (especially down then up), price deviations from the normal basis spike, creating arbitrage opportunities.

The strategy ends up taking from the book, sniping wick candles, and eating liquidation orders — core behaviors of a lead-lag HFT model.

Real-World Case: VOXEL on April 20

From 16:10 to 16:25, Binance’s price ranged from 0.1340 to 0.1459, with a brief spike to 0.14888. Bitget’s price, however, was tightly controlled by market makers between 0.1263 to 0.1573, and total trading volume soared into the billions of USD.

This led to a situation where:

● Buying based on Binance prices = instant fill on Bitget

● Selling based on Binance prices = also instant fill on Bitget

In effect, Bitget’s market maker was not following the reference market and ended up buying high and selling low, creating a technical arbitrage due to misconfigured market maker parameters.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish