Interesting research: the "World Cup effect" in the stock and crypto markets

Author: @0xMavWisdom

There has been a magical World Cup spell in traditional financial markets, where the markets perform poorly during most World Cups, and this effect still holds true in the cryptocurrency market.

From a year-to-year perspective, the poor performance of the cryptocurrency market during the World Cup year may be related to the fact that the deleveraging cycle after the inherent bubble of the market coincides with the hosting cycle of the World Cup (every four years); In terms of months, the cryptocurrency market during the 2014, 2018 and 2022 World Cups all performed poorly. The poor performance of the cryptocurrency market during this World Cup was especially reflected in the recent slump of tokens of football fans represented by LAZIO and PORTO. During the World Cup, the performance of the cryptocurrency market is like a poisonous spell imposed on it, with the fan Token of the corresponding team plummeting before the start of the tournament, and even goals becoming the best time to “dump”, and even worse when they are scored or lost.

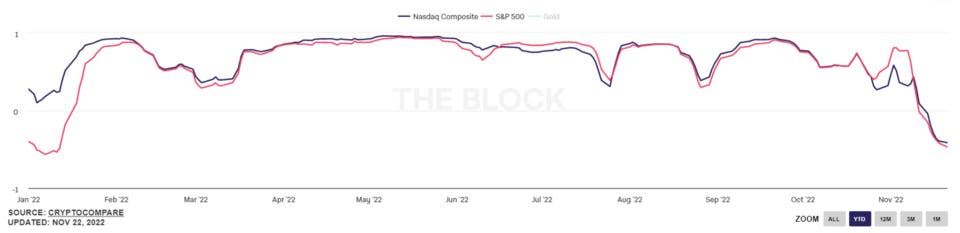

As the cryptocurrency market matures and traditional financial capital enters, the cryptocurrency market continues to strengthen its linkage with the global equity market. According to THE Block data, the cryptocurrency market has remained highly correlated with the U.S. stock index for a longer period of time year-to-date, so we have to focus first on the impact of the World Cup on global equity markets, especially U.S. stocks.

A study by academics led by Alex Edmans, entitled “Sports Sentiment and Stock Returns,” investigated how global risk markets tend to underperform during the World Cup, not only in terms of lower-than-average market volume, but also in terms of poor returns. In the case of U.S. stocks, for example, the study found that the average stock market return during the World Cup was -2.58%, while the average return for all days during the same period length was +1.21%. Although the survey data is older, from 2007, the statistics on average stock market returns during the World Cup since 2002 to the present (chart below) still confirm that the negative effect of the World Cup held on U.S. stocks is not an empty one.

The scholars also found that after a country’s soccer team lost the World Cup, low investor sentiment in the losing country transmitted to the stock market, so that the stock market returns in that country were significantly lower than average the next day, while in the winning country, the researchers did not find a corresponding positive impact of the team’s win on that stock market, perhaps related to the price in of investors’ optimistic expectations. In conclusion, the point scholars are trying to make is that investors’ emotions play a powerful role in investment decisions. During the World Cup, investors’ sentiment fluctuations in each country are the hands behind the ups and downs of the local capital market, and as a cryptocurrency market where multi-national investors can participate and is highly transnational, the market volatility caused by investors’ sentiment in each country has a compounding effect in the market, exacerbating the volatility of the cryptocurrency market.

In a study titled “Predictable Irrationality That Can Be Exploited,” two scholars suspect that the World Cup effect is due to the seasonal effect that occurs in June and July, which affects returns, and add variables to control for this, but statistically, the seasonal effect does not explain the World Cup effect. The original authors, Guy Kaplanski and Haim Levy, argue that because this effect is predictable, by recognizing and understanding this phenomenon, investors may find some means to exploit this effect. In this case, the most natural strategy for investors is to sell the market short before the World Cup begins, explaining the sharp pullback in soccer fan Tokens ahead of either Euro 2021 or this year’s World Cup, as well as the poor performance of the cryptocurrency market in the month of the World Cup year. Investors taking advantage of the World Cup effect will only exacerbate World Cup-induced declines, and may also cause declines to start earlier, even before the tournament begins. Thus, World Cup utility is like options irrational mispricing that does not go away over time.

In addition to research by academics on investor sentiment, the shift in investor attention is also a factor in the market downturn during the months of the World Cup, which attracted more than 3 billion viewers in Russia in 2018, during which investors’ attention will shift to the betting market and their behavior will be more socially oriented, resulting in less frequent trading in the relatively formal financial markets and more “quiet” speculative hot money than usual.

All in all, for the financial markets represented by cryptocurrencies and stocks, the World Cup only showed them a “yellow card” warning with less impact, but the World Cup fever could not drive the cryptocurrency market, and even the plunge should be attributed more to the “red card” events like the FTX crash and aftershocks.

Reference articles:

《Sports Sentiment and Stock Returns》 Alex Edmans, Diego Garc´ıa, and Øyvind Norli

《Exploitable Predictable Irrationality: The FIFA World Cup Effect on the U.S. Stock Market》Guy Kaplanski and Haim Levy

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish