Internal report about StepN: The temptation to wrestle with the death spiral

Author: Coral from First.VIP

Link: https://mp.weixin.qq.com/s/G-7FwZEBeR5p6sj5-BC7sA

The other day, an article compared StepN to that beautiful Sicilian woman, who everyone wants to take advantage of, who is jealous of, and who wants to stigmatize and humiliate her. Objectively speaking, this metaphor is very appropriate to describe the ecology of Gamefi: everyone wants to make a huge profit, and everyone is very critical of the game after its collapse. Everyone wants to make a fortune, and everyone is lambasting the game after the collapse of the natural Ponzi model. Most voices praised the game model as mechanically innovative when it was on an upward cycle, and after the collapse, a group of people insisted that it was a Ponzi from the beginning, and together with the players who didn’t flee, they stomped on it from the public opinion.

But do not forget that this is a product made by two founders who are not the least bit new to operating mechanics games, they are very clear game operators, the moment the model collapsed, the project party extracted profits and sold in the BNB rally top position to recover hundreds of millions of dollars of profit operation, changing the previous practice of buying back and destroying GMT.

This is an immature game, compared to the Web2 masterpiece with a beautiful economic model that we enjoy, compared to “Star Wars Eve”, the economic model has existed for 20 years continuously without collapsing the masterpiece “Fantasy West”, it is too young to operate, too fierce to start, too fast to collapse.

But this is a very typical game operation case, just like the previously dead counting stable and public chain, provides a very good project sample: ecological participation parties, in addition to the beginning and now this collapse still continue to enter the real runner, basically can be divided into three categories: project side, shoe factory, small and medium-sized players. These three aspects, no one innocent, all belong to the “know plate play plate”, the game creates prosperity, this is in fact the essence of the mechanism of the game, but also it is very easy to die the root cause.

Web2 game will be a success, there are only a few games with long-term viability. This law in the Web3 inside, may directly to the big project ups and downs of the way to present.

For games that rely on “game mechanics” and economic models to bring the outbreak (which is also the type of game that I think has the best chance in Gamefi), the death spiral is like a Damocles sword, always hanging overhead, and many actions are vowed to pull it not to fall, but most projects, the sword eventually fell, the difference is how long it pulled.

But the gravitational force of the death spiral is constantly circling, wrestling and dancing with it, which is the real process and fun of project management.

Product

When we saw the StepN product, we have to say it was amazing. It’s something that has the qualities of a GameFi, SocialFi and Web3 Keep sports app at the same time.

And but where such a slightly unexpected and effective combination of products, the probability of its hot is high.

StepN has been claiming to be a sports app, and indeed a large number of players have claimed to have lost a few pounds or more in the past few months, and this attribute has been verified to be tenable by the market.

SocialFi, this attribute in addition to high-grade shoes to show off, similar to BAYC, luxury cars, and the project side is operating in various cities around the world “offline about running”, the long-term social platform planning, and the community’s own imagination. This is also considered tenable, after all, a random hand game can be offline group black, not to mention the need to physical offline out running shoes.

But the most important attribute is actually the Gamefi attribute of this Ponzi model + Cassino model (open blind box). This point is actually greatly underestimated in the beginning of the discussion, the project said they invited the economist of EVE (Star Wars Eve), and rumors that the team has “Fantasy West” former team members, are ignored by the market, of course, the last also rumored “team has a former fun step executives” such unverifiable claims.

In short, relying on the first two tenable sports apps + SocialFi attributes as a tenable fundamental, effective narrative, superimposed on the back of the real enable it to “its rise also boom” ponzi and blind box, this is the basic comprehensive model of StepN.

The community has a very clever analogy that StepN is a casino in a stadium with a full house — that really sums up the above three attributes very well.

The sports thing provides a huge base and stickiness, the casino provides a way to consume in-field currency and an explosively inflated Ponzi model, and the SocialFi property provides a natural spreading force: mutual amenity infects each other, leading to buying shoes and walking together, and opening boxes together to show off.

Outbreaks, Struggles and Accident

June shoes are like a nuclear bomb explosion after a mess, a variety of voices have come out to question: is not the outbreak too fast?

The number of users develop too fast, the team makes money too fast, the situation changes too fast, resulting in the project party can not grasp the project, and even financial freedom does not want to work hard to do the project, resulting in the project collapse …… in fact, not, if a project can fire, there is bound to be an outbreak period, this outbreak period is the volume and price, the pace is oddly fast, at any time Storm …… accident and tomorrow do not know which came first, said such a period.

But if a project has been no outbreak period, it is basically a dud.

Even if a market expectation is very high huge financing luxury team big project, you can give great expectations, just on line can come a wave of PR to get the suspected boom, but the game real admission data on line that top, the market never for the lineup of gorgeous to buy.

In short, a game, do not explode that is dead, you are configured in all aspects of good no use, the market does not buy is all for nothing, this Web2 game cruel law to the Web3 is still valid.

Good Gamefi project is bound to experience a burst of fire, the outbreak is bound to be a life and death test, the outbreak and not die is a bullish enough project and enough bullish project side of the necessary experience. (Because it is a ponzi model of the bottom of the game project, it is inconvenient to use the limited term of great project here, can only be downgraded to bull X)

Spend so many words to pull “fire”, it is Defi and the public chain of such projects is excellent that the perception of explosive volume is too deep, and Gamefi, closer to “up to buy can not afford to look cute aesthetic pull full”, “not up to look good, but also useless”. NFT project “not up and then good-looking also useless”, soaring and explosive fire is the reason, soaring and explosive fire somehow more than “good” and “bad” — for NFT, monkeys and moon birds (MoonBird), two blue chips before the surge, we all feel quite ugly, after the surge, we aesthetic “have followed up”, think monkey very aesthetic level and style, and the moonbird where all look Lovely and show the value. The game is the same, fire you can analyze why the fire, not fire is not necessary to analyze how good in the end.

StepN has experienced at least two truly explosive rounds.

One round was the explosion on Solana, where the growth curve went from flat to steep from the beginning of March to the end of April. within 50 days, player accounts grew from a total of 10,000 to over 10,000 per day, and the total went from 10,000 to 300,000, achieving an explosion in the circle and an initial exit from the circle. This round was basically not out of control, with only the last few days showing anomalies.

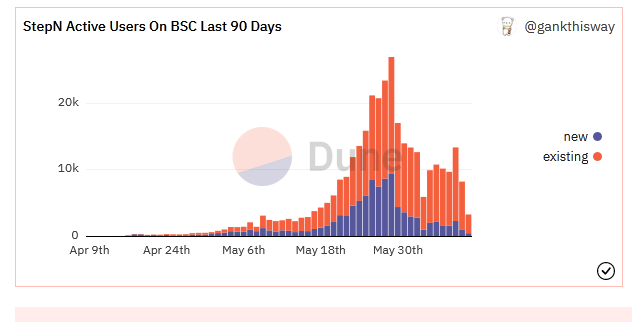

The second round is almost crazy, controversial BSC on the outbreak, the time is about a whole month in May.

And what’s actually most important about this period is that it actually experienced stable and controlled growth, as well as four uncontrolled outbreaks and a not-so-surprising crash.

Most people are under the impression that the shoe price on the Solana chain had been as steady and controlled as it was when I entered in mid-April, until June when a collapse by the shoe price on BSC caused a drop. Actually, it wasn’t.

Despite several subsequent dizzying spikes on BSC, the market force that became known to the outside world as Shenzhen Lao was first revealed on Solana and engaged with the project, just a short history that was forgotten by most of the shoe crowd.

At the end of April, BSC shoes just experienced a lottery sale on BA, 10 BNB a co-branded shoes at a prohibitive price, most people waiting with their fingers crossed for BSC shoe prices to fall, when the gst and shoe prices on Solana suddenly began to skyrocket with regularity.

Within three days, GST from less than 4 suddenly pulled up to 9, the price of a pair of floor gray shoes, from the previous stable for nearly a month around 11SOL, was wildly pulled up to 18, accompanied by a small wave of enthusiasm: my companions around me or gritting their teeth high pike, or gritting their teeth to take the gray shoes in the high position for the green shoes starting at 7000u. Then everyone joined together in a stunned pose to keep refreshing the GST price — and each refresh went up some more.

The project quickly struck, announcing a triple twin event — the probability of Mint giving birth to two shoeboxes at a time went up to three times the usual rate: the shoeboxes said to have shoes, then came more shoes.

Soon, in the face of soaring GST, and announced to speak GST online FTX — and is on the spot and contract together, apparently, shorting mechanism to suppress the price of GST, which is obviously controlled, to suppress market forces, is considered a smart approach.

More importantly, it was announced that 10,000 pairs were airdropped on BSC to Solana’s Genesis shoe holders.

This wave of operation down, Solana on the gst and shoe prices fell in response, held up for a few days and then did not look back, GST all the way down to 0.6u now.

And the shoes on BSC opened the first round of plummeting after the plunge, the first 2,000 pairs of shoes plummeted from 38BNB price to 5BNB because of the announcement of the airdrop, attracting most people’s attention.

No one knows that this wave of control GST and shoe prices lost the first battle of “Shenzhen Bro”, has quietly moved to the BSC, and quickly control this baby plate.

(Note: Since the real existence of the group “Shenzhen Brother” has not been 100% confirmed, this is a generic term to refer to an obvious market force)

The mutual game of Shenzhen Bro, other small and medium-sized shoe friends and project parties, staged several waves of capital goblins and macro-control, created several waves of ups and downs for the wild growth of the BSC shoe market, and eventually became a mess.

The owner of Genesis shoes recalled that the early Solana shoe market ecology was also like an active volcano like BSC, with shoe prices and GST erupting to 20, and then regulated by the project side. Then it was regulated by the project. Every day was precisely regulated below 1100U, according to the then roughly 100u SOL billing, probably always in the 11SOl or so. Walk and Mint earnings are quite certain, most people are very disciplined in the daily walk and upgrade in the countdown to return to the capital cycle, earnings are determined as if to work to play gold, Work To Earn.

Probably this is exactly why the project side didn’t care enough when the second round of shoe prices and GST started to pull up on BSC.

Before the 10,000 pairs of airdrop on BSC landed, everyone expected the airdrop would bring a plunge, and even 1 billion big brothers in the 500 big group advised people: sell it, there are cheaper and more excellent shoes to pick up tomorrow airdrop down.

The result is that the day before the airdrop, the shoe price bottomed out and rebounded, and the mysterious flipping hand in the market began to operate quietly. Along with the airdrop and the next batch of shoes everyone synchronized upgrade, two days a Mint, GST significant demand than supply, began to soar, from the beginning of the already sideways 11U, all the way up to 45U. at this time to play gold the most people can reach a group of shoes a day 5000U, “a day walking more than 30,000, really a little embarrassed. “

It should be noted that GST on Solana and GST on BSC are not interoperable across chains, and are effectively two tokens that have nothing to do with each other from supply and demand to value.

At the same time, the gray shoes floor price from the bottom of 5BNB, soared to 45BNB, soaring 9 times, while next door Solana players have been hit gold two thousand U three thousand U a day of windfall profits alarmed, want to take a pair of Sol green for a BSC gray, sorry, can not change.

At this time a pair of excellent gray Jogger asking price can go to more than 50BNB, “100,000rmb a pair of shoes, you guys are crazy?” SOL players are very angry.

It is said that this round of Shenzhen old brother has been shipping, shoes crazy surge, the early entry BSC people are gaining not small gains.

At the same time, the bizarre feeling of shoes selling, but also clearly shows the presence of the controller: If you hang out shoes according to the floor price of similar properties, instantly there will be a few pairs of shoes slightly lower than your price hanging in front of you, if you lower the price, and will then pop up a few pairs of lower …… until you hang out shoes at a price significantly lower than the market, it will be seconds . A pair of shoes listed at about 60BNB on the market will take 40BNB to even actually sell. The market liquidity is weak comparable to the NFT picture market during the plateau.

At the moment when GST skyrocketed 40% to 45 in one day, the project side struck again, announcing a modification of the ratio of GST and GMT required for Mint, from 200GST directly to 100GST+100GMT (later further modified to dynamic rationing, such as 40GST+160GMT, currently 360GST+GMT), GST suddenly plummeted and the price of shoes followed The price of the shoe plummeted. The lowest place reached 12BNB, a well-deserved knee chop.

At this point a logic really emerges: the price of shoes actually fluctuates around the price of GST, what really supports the price of shoes is the price of GST, because this is the real output and actual cost of shoes as a means of production — shoes Mint and upgrade need GST as the main cost, shoes output is also GST, if shoes are shovels then GST is the gold it can dig out.

This one particular moment was also accompanied by a major market crash in May: BNB dived from around 300 to a low of 210, then quickly pulled back; while SOL slid directly from 100 for a few days, then waisted to 50 and kept going down to 30.

The double killing of the shoe price and the local currency almost led to a dead market silence.

But there was one statistic that foreshadowed what would later be the wildest and largest spike in the shoe on BSC, and the reason it failed to spike again after its third plunge, as well as the reason the shoe on SOL went all the way down: the number of entrants.

SOL on the number of entrants, from January to March a few hundred a thousand a day, to April a few thousand a day, as well as the end of April surge that wave of daily growth field over 10,000, it achieved a three-stage jump in the number of entrants, the last wave, Shenzhen old brother’s control of the market to test the water and small players market sentiment, boosted the project crossed the threshold of daily growth of 10,000.

And this six-month-long process on SOL was shortened to two months on BSC.

During the two aforementioned rounds of BSC where the shoe skyrocketed from 10BNB to 38B, plummeted back to 5B, then skyrocketed to 45B, and then plummeted to 12B, the daily additions never exceeded 1,000, while always hovering between 500–800 new additions per day. I even guessed for a while how long it would have to hatch eggs.

I didn’t expect the outbreak to come so quickly.

It took about 20 days to wait for the daily additions to break 1,000, but once it broke 1,000, it surged at the rate of 1,000+ on the first day, 2,000+ on the second day, 3,000+ on the third day …… and 7,000+ on the seventh day, after an article analyzed that the total additions were 2% per day, controlled by the project side with invitation codes, and 2% invitation codes were issued every day, and then More is not available. But the new addition on BSC is largely the migration of the original account on SOL, no invitation code is needed at all, the existing hundreds of thousands of users, a day to move over 10,000 people is entirely possible.

Along with the explosive opening of the new number of people migrating, as well as the general stability of the market, the price of shoes opened another round of unbridled surge, again from 12B to 35B, and then a rapid retracement to 25B, and in this position actually achieved a few days of price stability.

And at this time, the whole network crazy spread a simple arithmetic screenshot: a pair of shoes Mint cost is about 3B, the floor price is 25B, a pair of shoes almost earn 22B, every 48 hours Mint a pair of shoes — that is, buy two pairs of shoes, 4 days back, 8 days doubled, exponential fission, a month tens of times ……

That week at the end of May, the whole circle is this kind of talk, at this time the selloff has reached irreparable data: nearly 10,000 people enter the market every day, these people buy shoes in a few days will return to the market tens of thousands of pairs of shoes selloff, this does not count the field already players that tens of thousands of pairs of shoes selloff …… and the selloff of GST …… will not be able to catch this kind of pressure unless the number of people entering the market reaches tens of thousands a day.

At such a precarious moment, when the players in the field are “earning a hundred thousand or so a day in fear”, the NFT players and Defi players in the circle began to send private messages asking to enter the field …… some were stopped, some looked at the price of 25B shoes Defiantly down to take over the plate.

The highest point of this round of revelry is Zhu Xiaohu, as a traditional capital big brother, Zhu sent a circle of friends said he bought a pair of BSC’s gray Runner, and said StepN “is not exactly Ponzi”.

BSC’s shoe price lasted for almost a week at the unprecedented high point of 25BNB, a huge bubble.

When everyone was singing and dancing in the brutal joy, rumors started to appear in the market, the project side’s disinformation and AMA could not stop the shoe price from plummeting with the rumors of “technical team being arrested”, and finally, less than 3 hours after the end of a positive AMA from the project side, at 12:30 am, the announcement of clearing out Chinese users came. The announcement came.

In the following days, the shoe price broke 1BNB all the way, dropping 98% from the high point.

The StepN project side was continuously transferring tens of thousands of BNBs and hundreds of thousands of SOLs to various centralized exchanges to sell.

The community is still imagining that the project side is taking the funds from the sale of coins to pull up the GST or pull up the shoe price, and even after a few days, the community still has expectations because of the fact that the update is severely crotch-pulling and the fact that the “technical team is having problems with the green and yellow” is basically default.

But in essence, even if the change of the domestic technical team is shocking — it is a bit like the core developers of V God died in a collective car accident that led to the stagnation of Ether, but in essence, the reason that makes the shoe price swoop high and never get up is still the mechanism — the higher the price and the more people are in the market. The higher the price and the more people in the field, the more people and money needed to enter the field to support it.

If you can always do like once Solana on the shoe price of about 1100U (or other prices), and about 4u of GST (or other prices), such a stable output of stable entry stable consumption, may be able to maintain this ponzi bottoming economic model has been maintained.

But there is no if, Shenzhen Bro’s entry, retail investors passively involved in the active enjoyment of the brutal pleasure, greatly overdrawn the development of the game model speed, the project side efforts, but when they found that they could not control the situation, also joined the “one day flow of $100 million income of $6 million” orgy, after all, pang as Tencent, the With a market of 1.4 billion people, the peak period is just like this.

The current StepN is caught in the same death spiral as Axie: shoe prices fluctuate down, GST fluctuates down, although whenever you enter the field can be calculated to be about 35 days back to capital (if the price of GST does not continue to fall), but the actual field at this time has been difficult to return to capital, has really been transformed into a Web3 fitness annual card: there has been a return to capital earnings temptation, but only incentive for health. No loss of capital? Can only give up the idea from the beginning.

There is not the slightest doubt that the project originally hoped that through limited skin burning gems, burning shoes, scroll Mint, open new Realm and other ways (do not care what they are, in any case, are in-game consumption means and means of renewal), can be one at a time and the death spiral tug of war, to bring it back to a state of basic balance, so that StepN has the opportunity to become like “Fantasy West” 20 years without crashing game. After all, you can’t easily make a money printer, surely you want him to be a 20-year money printer …… or at least 2 years?

It is difficult to say in the end because of which problem of the technical team, resulting in a substantial halt to the update, or because the game data due to poor business or the project side of the fight Shenzhen Lao failure and data growth out of control, it is more difficult to distinguish which cause the crash — I think into a failure to provide a stable return expectations and last for a longer period of time stage can already be considered a collapse. At the same time, the number of entrants is now showing a significant decline, with a peak of 15,000+ entrants on Solana, close to 1w on BSC, and close to 1w on BSC, now the number of entrants is down to 6,000+ on Solana and less than 1,000 on BSC.

For a game that does bottom out with a ponzi model, this enters a very unhealthy phase with visible growth shrinking, temporarily stepping into the same spiral as Axie.

There is no doubt that if they want to be an evergreen, they are failing at least temporarily, although there are still more than 5,000 people in the new day as well.

Afterwards, we will continue to watch the development of this still good team, after all, no matter how much we angrily blame Axie and StepN’s team, they are the only project parties who created the first and second generation of the fiery Gamefi.

The standard of other imitation discs is even less worth mentioning compared to these two.

Maybe StepN will still slide low for a while and give Jerry and Yawn, two guys who do have the theoretical and operational caliber, a window of time to get their project back on track for a possible multi-million user base.

In recent days, the project has posted that they recognize that “it is their responsibility to stabilize the economic model and prices” .

Gains and Losses

From the whole process, the project side has gone through several processes: “smooth and slow growth — controlled outbreak — out of control outbreak — downward spiral “These stages, the outbreak of data can be said to be expected.

Unexpected factors are mainly two: the first is as a strong market force and the project side to compete with the game shoes and GST volume and price control of “Shenzhen Bro”; second, is the end of April early May announced the May limited “Panda skin” after the sudden emergence of The former led to an accelerated explosion of data and a sudden increase in the number of users.

The former led to the accelerated explosion of data and the shortening and overdraft of the game’s life, while the latter made it impossible for the project owner to take out a lot of “weapons” that could have been used to fight for control and quickly respond to the development of the project, and could only modify the Mint parameters and do AMAs to adjust market expectations and regulate the game.

If we talk about fundamentally maintaining the model of sports health, a more practical suggestion is: part of the commission from the sale of shoes is directly used to destroy tokens, which is equivalent to buying shoes is also a way to consume, making the sale itself, mainly new players / new accounts into the field itself becomes a kind of activity similar to buying point cards.

But in fact, in the previous period, the more important operation is to try to make the shoe price back to the slow upward channel, or launch a new Realm at the right pace, the former effort is the goal, is to make the model can go back to the number of entrants after a surge in the constant decline of the tepid state before, but look at the data, BSC and Solnala on Realm are unlikely to go back, the most likely or But from the point of view of maintaining confidence, to be able to maintain the basic balance of the previous two Realm, basically do not fall too quickly, because a project if the confidence of the players plummeted, may be its growth potential is no longer.

And in the technical team such a lifeline staff part, strongly early use of Web3 decentralized work structure, after all, Web3 is not necessarily within the framework of the company, but also not suitable for the company framework.

As a very thoughtful team in operation and a fast-hot game project party, StepN team encountered what should be considered a normal grade of market test, whether it is Shenzhen Lao or technical team problems — if the game is made and really becomes evergreen, this grade of problems will appear from time to time, and only the team constantly improve to deal with one by one.

So instead of offering them more advice, the team should be advised to see that there is still very much to improve itself, all the way to the highs of April and May, it is too easy for a young team to get carried away. And whether they intend to continue to adjust the continuation and make it bigger on the StepN project, or send another project, the most important thing is actually the value of the team’s integrity and the value of the outside world’s confidence.

Perhaps this is the time to test the pattern, as it is often said in the blockchain Chinese world.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish