Investigation report:Is There “Insider Trading” in BINANCE and COINBASE's New Listing

This report calculates the price movements of Binance and Coinbase in the week leading up to the listing of the new cryptocurrencies between November 2017 and February 2022, to determine whether the bull news was reflected in the market ahead of time. The two exchanges were chosen because they have the largest volume in the spot market and have a greater influence on the price of the listed cryptocurrencies.

For the new cryptocurrencies, we select the trading pairs announced in the news announcement. Most of the new cryptocurrencies are quoted in stable currency such as USDC, USDT or BUSD, while a small part are quoted in ETH. We selected the hourly opening prices from 0:00 a.m. UTC 7 days before the announcement date to 0:00 a.m. UTC on the announcement date. For example, when Coinbase announced its ETC listing on August 8, 2018, the data we capture is the hourly opening price from August 1 at 0:00 am UTC to August 8 at 0:00 am UTC. As the prices of different cryptocurrencies vary widely, we have standardized all prices by dividing them by the first opening price 7 days ago (i.e. the first price data) for comparison purposes. So the first price is 1, and assuming the final price is 1.5, that represents a 50 percent increase in seven days.

In addition, for cryptocurrencies that have risen too much (more than 1x), we will list them through the table, and search for bull news in the same period one by one, trying to exclude interfering events. It should be explained that our selection of new cryptocurrencies is based on announcements and news, cryptocurrencies outside this range are not collected.

Coinbase

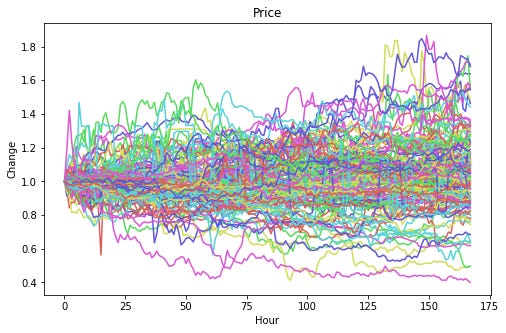

A total of 135 new cryptocurrencies were selected on Coinbase, of which 17 cryptocurrencies were removed because their listing price was the initial launch price and therefore no past 7 days of price data existed. The final result includes 118 cryptocurrencies and is shown in the chart below.

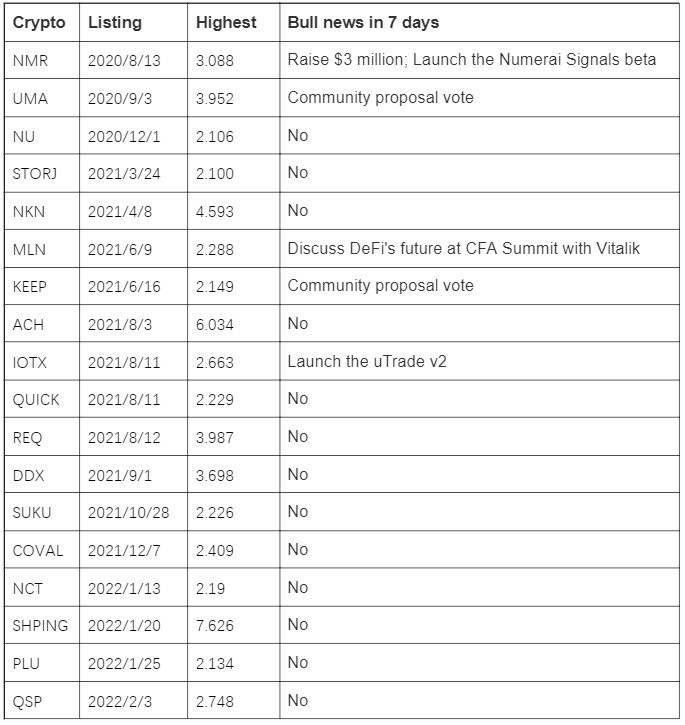

18 of them, or about 15.3%, rose more than 1X. SHPING is the biggest riser, which announced its listing on January 20, 2022, with a maximum increase of 6.6 times within seven days. The following table shows the biggest increase of 18 cryptocurrencies in 7 days (the graph data are all taken from the opening price of the last day, but the table data selects the highest price) and bull news.

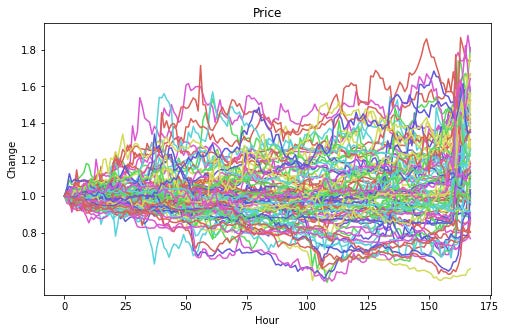

After removing these 18 cryptocurrencies, there are 100 left, and their price movements are shown in the chart below:

Intercepting the last hour of prices, the distribution shows a significant positive skew pattern with a median of 1.226 (up 22.6%) and a mean of 1.243 (up 24.3%). And that’s if we exclude the 18 cryptocurrencies that have more than doubled. If we add all of those, the mean would be 1.476.

Of course, since most of the cryptocurrencies were listing in a bull market, it is possible that the benchmarket may be on an uptrend a week before listing. In order to eliminate this interference factor, we also counted the BTC trend of each period, as a comparison.

It can be obviously found that the increase of BTC was almost normally distributed, with a median of 0.992 (down 0.2%) and a mean of 1.006 (up 0.6%), without a significant positive skew pattern.

Binance

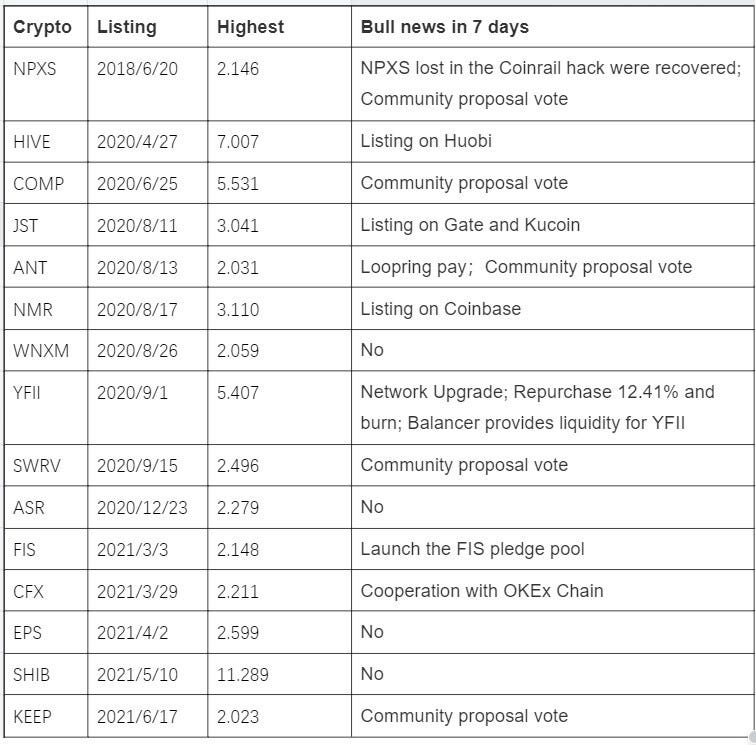

A total of 311 new cryptocurrencies were selected on Binance, of which 144 cryptocurrencies were removed because their listing price was the initial launch price and therefore no past 7 days of price data existed. In the end, 167 cryptocurrencies were retained, of which only 15 were up more than 1x, accounting for about 9%, much less than Coinbase. SHIB has the largest increase of 10.3 times within 7 days, which was listing on May 10, 2021. The following table shows the biggest increase of 15 cryptocurrencies in 7 days (the graph data are all taken from the opening price of the last day, but the table data selects the highest price) and bull news.

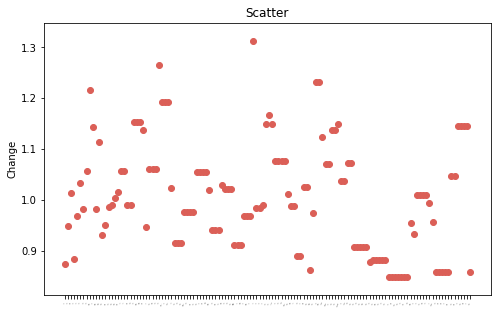

Similarly, we have three charts to show the trend of the new Binance cryptocurrencies in the week before its listing. The first one is the scatter chart, containing 167 cryptocurrencies.

The second chart shows the trend, and after removing the 15 cryptocurrencies mentioned above, 152 are left.

Intercepting the last hour, the distribution is slightly to the right, with a median of 1.051 (up 5.1%) and a mean of 1.056 (up 5.6%). If we take those 15 coins together, the mean is 1.225.

Similarly, we list the statistics of BTC at the same time as a comparison.

The median is 1.003 (up 0.3%) and the mean is 1.009 (up 0.9%), with no significant positive skew. The movement of BTC during the Binance’s is not significantly different from that of Coinbase’s, suggesting that short-term market volatility has little impact on the short-term movement of the new cryptocurrency listing.

Summary

In summary, we compared the trend of new cryptocurrencies on Binance and Coinbase in the week before the listing and came to the following conclusions.

Binance and Coinbase’s new cryptocurrencies outperformed BTC in the pre-listing week, with BTC’s average increase in each time period almost equal to zero, suggesting that the news of the listing was indeed reflected in the price of the cryptocurrency in advance to some extent.

Coinbase’s new cryptocurrencies rose more than Binance’s in the week before listing. Without considering outliers (>1X), Coinbase’s new cryptocurrencies rose 24.3% on average, while Binance’s rose 5.6%.

In terms of outliers, Coinbase had 18 cryptocurrencies that rose more than 1x, accounting for about 15.3%, with a maximum increase of about 6.6x in 7 days; Binance had 15 cryptocurrencies, accounting for about 9%, with a maximum increase of about 10.3x in 7 days.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish