Is the lackluster performance of Hong Kong's virtual asset spot ETFs due to "insufficient innovation" or "bad timing"?

By Jason Jiang, Researcher at OKG

This article was published in May this year, so some information is outdated. This article mainly discusses the shortcomings of Hong Kong ETFs.

Source: https://www.techflowpost.com/article/detail_17888.html

Since April 30, six virtual asset spot ETFs have been listed for trading in Hong Kong for half a month. How has the market performed? Has the much-anticipated physical redemption and the earlier launch of Ethereum spot ETFs ahead of the U.S. brought new growth to the Hong Kong market? What future stories are worth expecting? With these questions, OKG reviewed the development of Hong Kong's virtual asset ETF market over the past half month based on data.

Market Performance of Hong Kong Virtual Asset ETFs in the Past Half Month

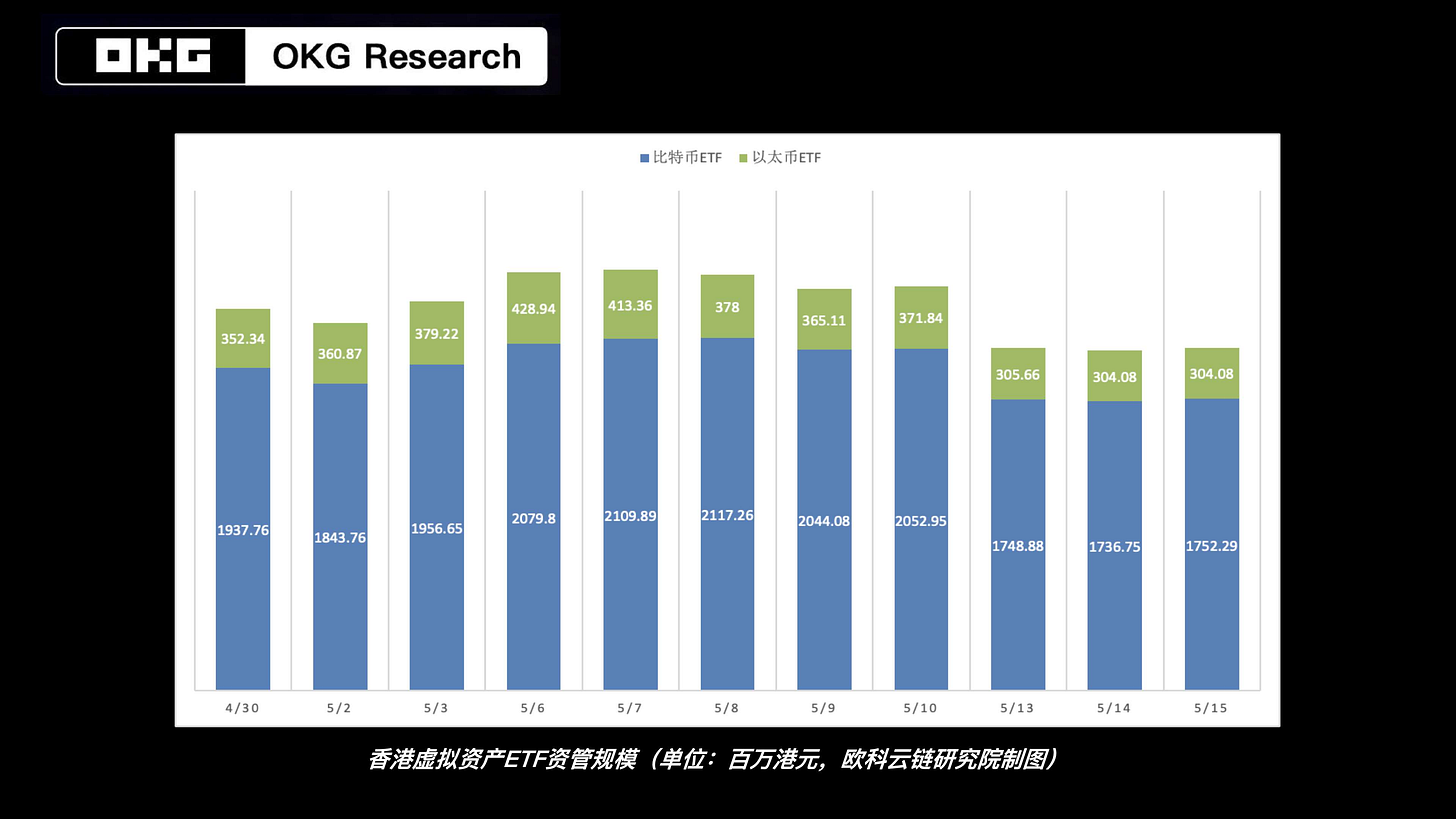

On April 30, the initial issuance scale of Hong Kong's three Bitcoin spot ETFs reached $248 million, far exceeding the approximately $125 million initial scale of the U.S. Bitcoin spot ETFs on January 10 (excluding Grayscale). However, the subsequent market performance was less optimistic than expected. According to incomplete statistics from OKG, as of May 15, 2024, the total assets under management (AUM) of Hong Kong's six virtual asset spot ETFs exceeded HKD 2 billion (approximately USD 264 million), with ChinaAMC Bitcoin ETF AUM reaching HKD 816 million, nearly 40% of the total, while the current scale of other spot ETFs is less than HKD 500 million. Although this pales in comparison to the U.S. Bitcoin spot ETF scale (approximately $51.4 billion), considering the ETF market size comparison between Hong Kong ($50 billion) and the U.S. ($8.5 trillion), the $264 million virtual asset spot ETFs have a significant impact on Hong Kong's local financial market.

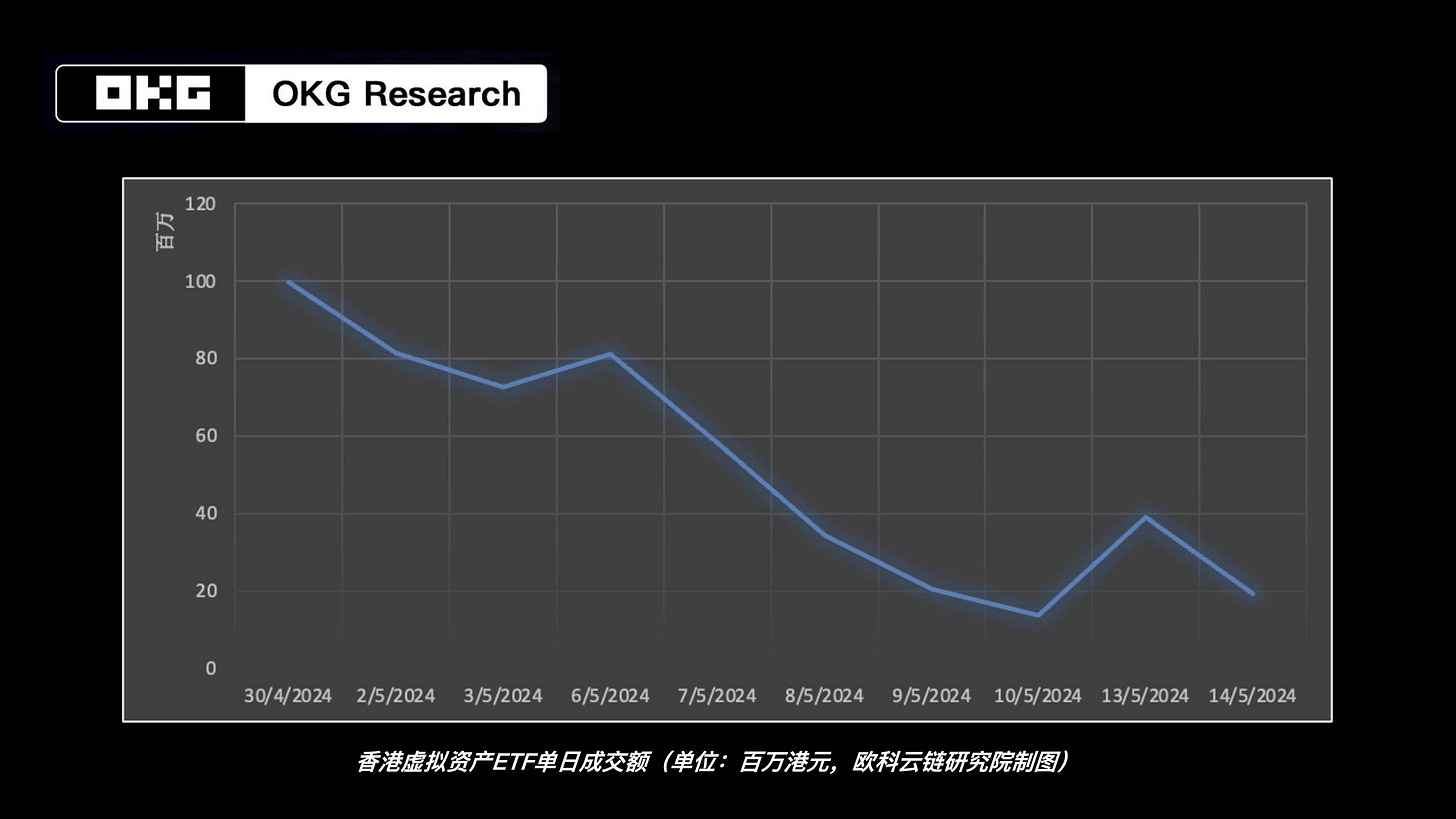

In terms of trading, the total trading volume of Hong Kong's virtual asset spot ETFs exceeded HKD 520 million in the past half month, but the daily trading volume has shown a fluctuating downward trend recently, falling below HKD 40 million for several consecutive days (as of May 14).

However, trading volume does not reflect the direct impact of spot ETFs on the crypto market; only funds that truly flow into the market can affect market trends. The fund inflow of Hong Kong ETF products is also not optimistic: the three Bitcoin spot ETFs have experienced net outflows for four consecutive days, and the Ethereum spot ETF has also seen net outflows for several days. In fact, the global demand for virtual asset spot ETFs seems to be weakening now. Since the halving, U.S. Bitcoin ETFs have also generally seen fund outflows: in the past month, U.S. Bitcoin ETFs had net outflows on 14 trading days, with a total outflow of $783 million.

Why Didn't the Ethereum ETF Bring "Surprises"?

Compared to the U.S., the main advantage of Hong Kong's Bitcoin spot ETFs lies in supporting physical redemption. Although the specific shares of physical and cash subscriptions have not yet been disclosed, according to previously revealed information, the shares of physical subscriptions in the initial issuance scale may exceed 50%, but this does not seem to have brought continuous growth to Hong Kong's spot ETF market.

In theory, physical redemption is more attractive to native crypto investors, with Bitcoin miners being the expected main group interested in Hong Kong's Bitcoin spot ETFs. However, from on-chain data, miners seem to prefer "continuing to observe" rather than investing Bitcoin through physical subscriptions in the ETF market under the current situation. The miner wallet balance shows that miner shipments have fallen to the lowest point in six months. Additionally, Hong Kong does not have an advantage in terms of fees, so it is unlikely that the miner community will change their minds in the short term to inject growth into the Hong Kong ETF market.

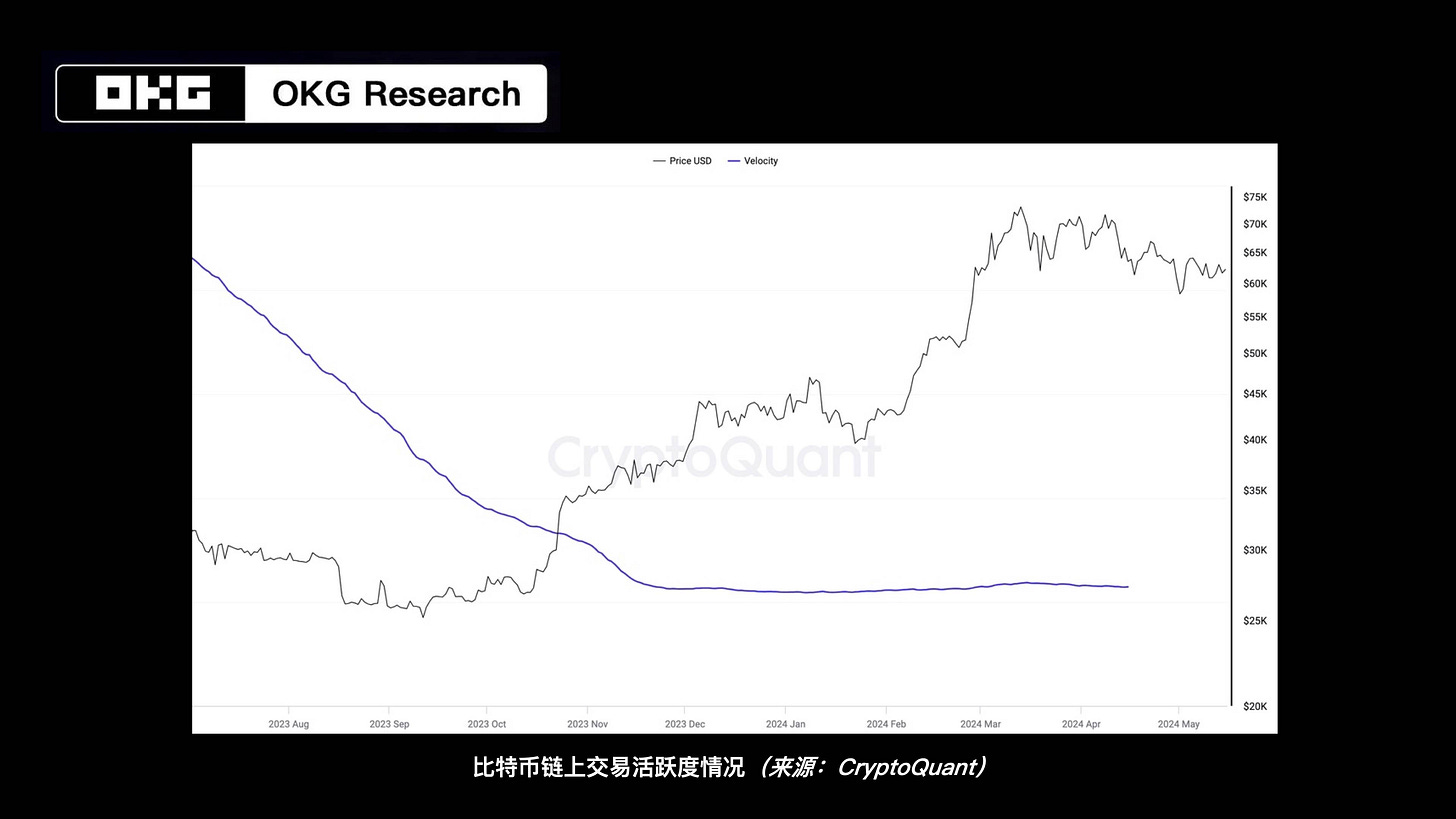

Furthermore, observing recent overall on-chain data changes in the Bitcoin market, we find that Bitcoin trading volume and market liquidity are declining. This is partly due to the impact of U.S. macro expectations, causing Wall Street investment elites to be reluctant to release their liquidity at this stage, and partly due to the recent weak performance of the Bitcoin ecosystem, leading to insufficient enthusiasm among Bitcoin holders to participate in trading within the current price range, thus reducing demand for ETF products.

(Note: Velocity is an indicator measuring the circulation speed of units in the network. The higher the value, the faster the Bitcoin circulates on-chain, and the higher the trading activity.)

The much-anticipated Ethereum spot ETF has also not brought surprises in the short term. In the current Hong Kong virtual asset spot ETF market, Ethereum spot ETF shares account for only 15.11%, with an AUM of approximately HKD 327 million—lower than the initial issuance scale. This is partly due to Ethereum's recent weak performance. The Cancun upgrade did not bring a collective explosion of L2 projects, and although Gas fees once dropped to historical lows, it did not improve on-chain activity. On the contrary, due to the Cancun upgrade's adjustments to transaction fee structures, Ethereum has been in an inflationary state for more than a month, affecting market expectations for Ethereum to some extent.

Additionally, the fact that Hong Kong's Ethereum spot ETF does not support staking may be a factor affecting its appeal to more investors. We believe that whether or not staking is supported may be key to determining the scale of the Ethereum spot ETF product. Currently, the staking yield of Ethereum is approximately 3.7%. From both a narrative and economic perspective, the additional income brought by staking is likely an important factor in attracting investors, especially traditional financial investors, and distinguishing between Bitcoin and Ethereum. Existing Ethereum holders may be reluctant to participate due to the ETF's inability to stake, as subscribing to the ETF means giving up staking income. New investors, unless they are particularly optimistic about the Ethereum ecosystem, are likely to prefer Bitcoin ETFs over Ethereum ETFs.

What Should We Expect from the Hong Kong Virtual Asset ETF Market in the Future?

There are more aspects worth looking forward to in the future of Hong Kong's virtual asset spot ETF market:

First, considering that Hong Kong has approved the application for an Ethereum spot ETF based on the PoS mechanism, it is possible to accept more mainstream public chain tokens, such as Solana, which also supports the PoS mechanism, to enter the mainstream financial market through issuing ETFs. This will greatly increase Hong Kong's attractiveness to various Web3 projects and enhance the future imagination of Hong Kong's virtual asset ETFs.

Moreover, virtual asset spot ETFs are essentially similar to token securitization, turning relatively niche virtual assets into securities assets more acceptable to the mainstream market through a series of compliance processes. Once Bitcoin and other virtual assets complete their "identity conversion," financial institutions can use ETF products to launch more derivative products such as leverage, lending, and asset management, realizing financial innovation that previously could not be achieved using physical Bitcoin assets directly, and meeting the needs of various investors to allocate virtual assets.

Currently, Guotai Junan International has launched structured products based on virtual asset spot ETFs in Hong Kong, ChinaAMC and Harvest Global Investments are also advancing the collateralization of ETF products. We believe that virtual asset spot ETFs, as frictionless trading tools, will inspire more financial innovation. Various structured products and derivatives based on spot ETFs will also bring more possibilities to the Hong Kong market, accelerating the connection between Hong Kong's financial system and the virtual asset market.

More importantly, as OKG mentioned in interviews with media such as the South China Morning Post, the significance of Hong Kong issuing virtual asset spot ETFs does not lie in bringing significant market changes in the short term but in marking that Hong Kong's financial institutions will accelerate their embrace of virtual assets. We may soon see more financial institutions in Hong Kong participate in the Bitcoin and Ethereum spot ETF market, or accelerate the layout of virtual asset businesses in other ways, providing virtual asset products and services to a broader range of users.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish