Author: WuBlockchain

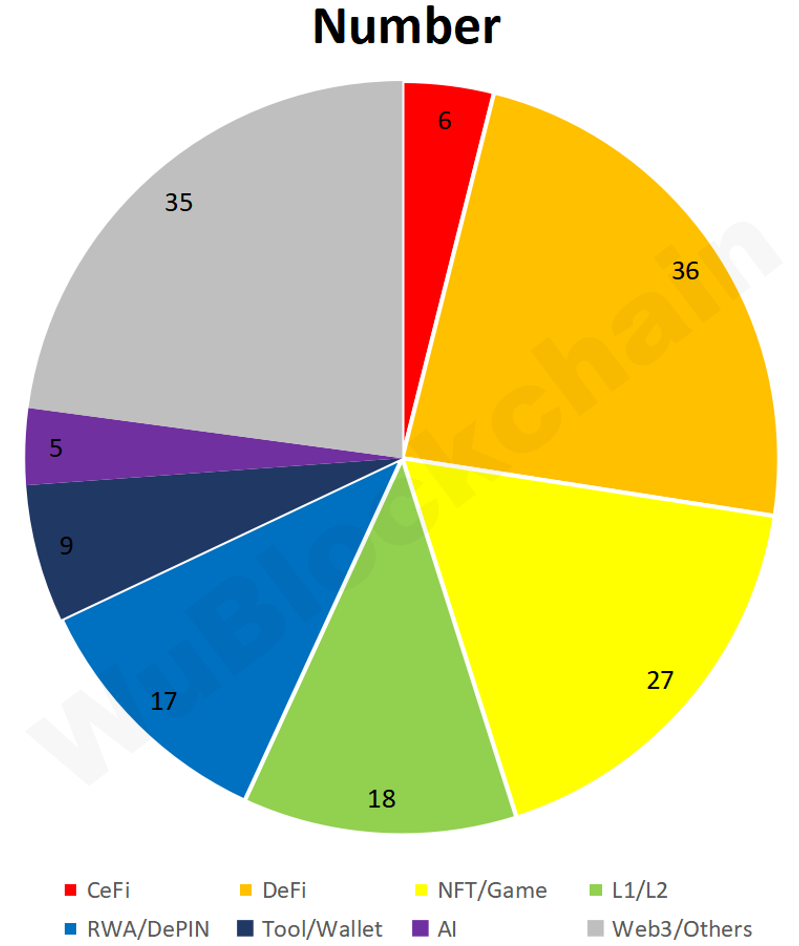

According to RootData statistics, in May, there were 153 publicly disclosed Crypto VC investment projects, a decrease of 8.9% month-on-month (168 projects in April 2024) and an increase of 43% year-on-year (107 projects in May 2023). Note: Since not all fundraisings are announced in the same month, the above statistics may increase in the future. The breakdown by sector is as follows:

CeFi: ~3.9%

DeFi: ~23.5%

NFT/GameFi: ~17.6%

L1/L2: ~11.8%

RWA/DePIN: ~11.1%

Tool/Wallet: ~5.9%

AI: ~3.3%

The total fundraising amount in May was $990 million, a decrease of 3.9% month-on-month ($1.03 billion in April 2024) and an increase of 26.9% year-on-year ($780 million in May 2023). The top 10 fundraising rounds by amount are as follows:

Social protocol Farcaster completed a new $150 million financing round led by Paradigm, with participation from a16z, Haun, USV, Variant, Standard Crypto, and others, with a current valuation of $1 billion.

Bitdeer signed a subscription agreement with Tether, completing a $150 million private placement. This strategic investment will drive the expansion of its data centers and the development of ASIC-based mining equipment. This transaction generated $100 million in total proceeds through stock issuance, with an additional $50 million available if all warrants are exercised.

Bitcoin staking-focused startup Babylon raised $70 million in its latest financing round led by Paradigm. This is the largest investment in the Bitcoin ecosystem recently. Earlier, Binance Labs announced an investment in Babylon. At the end of 2023, it completed an $18 million funding round led by Polychain Capital and Hack VC.

RWA company Securitize announced the completion of a $47 million strategic financing round led by BlackRock. This round also included investments from Hamilton Lane, ParaFi Capital, and Tradeweb Markets.

Decentralized betting protocol Polymarket completed a $45 million Series B financing round led by Founders Fund. Previously, General Catalyst helped the company raise $25 million in its Series A round. Polymarket has raised a total of $70 million in both rounds, with supporters including Ethereum founder Vitalik Buterin.

Humanity Protocol announced the completion of a new $30 million financing round at a valuation of $1 billion. This round was led by Kingsway Capital, with participation from Animoca Brands, Blockchain.com, and Shima Capital. The company plans to launch its test network in the second quarter, with a current waiting list of approximately 500,000 people. Humanity Protocol plans to debut an app that uses mobile phone cameras to scan palm prints for identity verification.

Decentralized derivatives trading platform Arbelos completed a $28 million financing round led by Dragonfly, with participation from FalcolnX, Circle, Paxos, Polygon, and Deribit.

DePIN protocol Peaq raised $20 million through CoinList, with over 14,500 community members contributing more than $36 million, oversubscribing Peaq’s token issuance on CoinList. The new funds will primarily be used to accelerate the development of the Peaq ecosystem.

Crypto startup Lagrange, led by Founders Fund, co-founded by Peter Thiel, announced the completion of a $13.2 million seed round. Lagrange is a startup focused on zero-knowledge crypto technology, with its main product being a zero-knowledge “co-witness” expected to be released later this month.

Cross-chain liquidity aggregator Chainge Finance announced it secured a $13 million investment with participation from GEM Digital and Alpha Token Capital.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish