November VC Monthly Report: Number of Deals Down 28%, Funding Amount Up 219%

Author | WuBlockchain

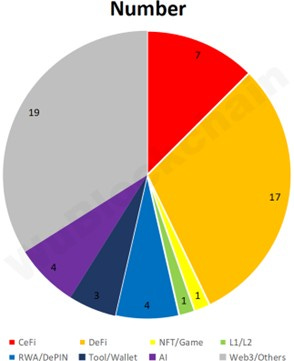

According to RootData statistics, in November 2025 the number of publicly disclosed Crypto VC investment deals totaled 57, a month-over-month decrease of 28% (79 projects in October 2025) and a year-over-year decrease of 41% (96 projects in November 2024). Note: since not all financings are disclosed within the same month, the above figures may increase in the future. The distribution across sectors is as follows:

Among them, CeFi accounts for about 12.5%, DeFi about 30.4%, NFT/GameFi about 1.8%, L1/L2 about 1.8%, RWA/DePIN about 7.1%, Tool/Wallet about 5.4%, and AI about 7.1%.

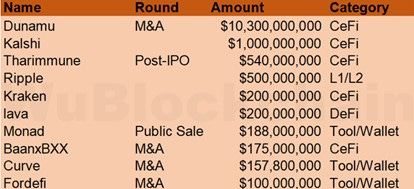

The total financing amount in November 2025 was USD 14.54 billion, of which the acquisition of Upbit alone accounted for USD 10.3 billion. This represents a month-over-month increase of 219% (USD 4.556 billion in October 2025) and a year-over-year increase of 3,131% (USD 450 million in November 2024). The top 10 financings by amount are as follows:

Naver has agreed to acquire Upbit operator Dunamu in an all-stock transaction worth approximately USD 10.3 billion, marking the largest financing event in crypto history. The acquisition values Naver Financial and Dunamu at approximately KRW 4.9 trillion and KRW 15.1 trillion, respectively. Through this share swap, Naver Finance will become its wholly-owned parent company. In the first nine months of this year, Dunamu’s consolidated revenue grew 22% year-over-year to KRW 1.19 trillion, with trading platform operations — including Upbit — contributing about 97.9% of revenue.

Prediction market platform Kalshi has raised USD 1 billion, bringing its valuation to USD 11 billion — more than doubling from a financing round less than two months ago. The round was led by returning investors Sequoia and CapitalG, with participation from Andreessen Horowitz, Paradigm, Anthos Capital, and Neo. Bloomberg reported that Kalshi’s main competitor Polymarket is in talks to raise additional funds at a valuation between USD 12 billion and 15 billion.

DRW Holdings and Liberty City Ventures have signed a subscription agreement to initiate a private placement of approximately USD 540 million through the publicly listed Tharimmune Inc. Tharimmune will hold the native token (Canton) of the Canton public chain for use in financial transaction scenarios. In June this year, DRW and Liberty City participated in Digital Asset’s USD 135 million funding round, which also included Citadel Securities and Goldman Sachs.

Ripple has completed a USD 500 million funding round, raising the company’s valuation to USD 40 billion. The round was led by entities associated with Fortress Investment Group and Citadel Securities, along with Pantera Capital, Galaxy Digital, Brevan Howard, and funds managed by Marshall Wace.

Kraken has received a USD 200 million strategic investment from Citadel Securities, bringing its post-money valuation to USD 20 billion. Previously in September, the exchange raised USD 600 million at a USD 15 billion valuation. The two rounds total USD 800 million. Kraken stated that the capital will support global expansion and payments product development.

BTC lending platform Lava announced that it has secured an additional USD 200 million to build out its suite of BTC financial instruments. The funds come from global capital partners, including both venture and debt financing, with angel investors Anthony Pompliano and Eric Jackson participating in this round.

Monad (MON), publicly sold on Coinbase, raised USD 188 million. The public sale offered 7.5% of the MON supply at a price of 0.025 USDC per token, giving the project a fully diluted valuation (FDV) of USD 2.5 billion. Monad is an ETH-compatible Layer-1 blockchain.

U.S.-listed crypto wallet company Exodus Movement announced the USD 175 million acquisition of W3C Corp (which includes crypto card and payments businesses Baanx and Monavate). The transaction is funded through company cash reserves and BTC-collateralized financing provided by Galaxy Digital. The deal is expected to close in 2026 pending customary approvals.

The U.K.’s largest retail bank, Lloyds Banking Group, has signed a GBP 120 million (approximately USD 157.8 million) acquisition agreement with digital wallet provider Curve. Curve confirmed to investors that it has completed its share purchase agreement, though the sale valuation is far below levels in previous financing rounds, causing strong dissatisfaction among some early shareholders. Curve had raised more than GBP 250 million cumulatively, and its CEO previously warned that without a successful sale, the company might run out of cash this year.

Paxos Trust Company has acquired crypto wallet startup Fordefi Inc. in a deal valued at more than USD 100 million, exceeding the USD 83 million valuation Fordefi received after its most recent funding round last year. Fordefi’s MPC-based wallet is designed for both digital wallet usage and institutional trading use cases.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish