Author | Wu Blockchain

Recently, stock tokenization has sparked heated discussions in the community, with xStocks, backed by Backed, and Robinhood’s model as prominent examples. In comparison, xStocks’ on-chain stock model offers greater openness and composability, allowing retail users to trade freely on-chain. In contrast, Robinhood, while adhering to compliance requirements, restricts access to users in well-regulated EU exchange jurisdictions and prohibits transfers to non-compliant addresses. This article will explore these two models through multiple datasets.

Backed and xStocks

(1) xStocks Supports 61 Stocks, with 10 Already Generating On-Chain Volume

Despite being launched only days ago, as of July 2, SPY, TSLA, CRCL, MSTR, and NVDA have collectively generated over $1 million in volume on-chain. Additionally, AAPL, GOOGL, QQQ, META, and AMZN have also seen user trading activity. Some meme trading platforms, such as GMGN, have introduced dedicated xStocks trading sections.

(2) xStocks Volume Surges After Support from Bybit and Kraken

Following the announcement of support from Bybit and Kraken, xStocks’ volume surged significantly over two consecutive days. On July 1, the volume reached $6.641 million, with over 6.5k active users and more than 17.8k transactions. Notably, TSLA, SPY, and CRCL each recorded single-day volumes exceeding $1 million.

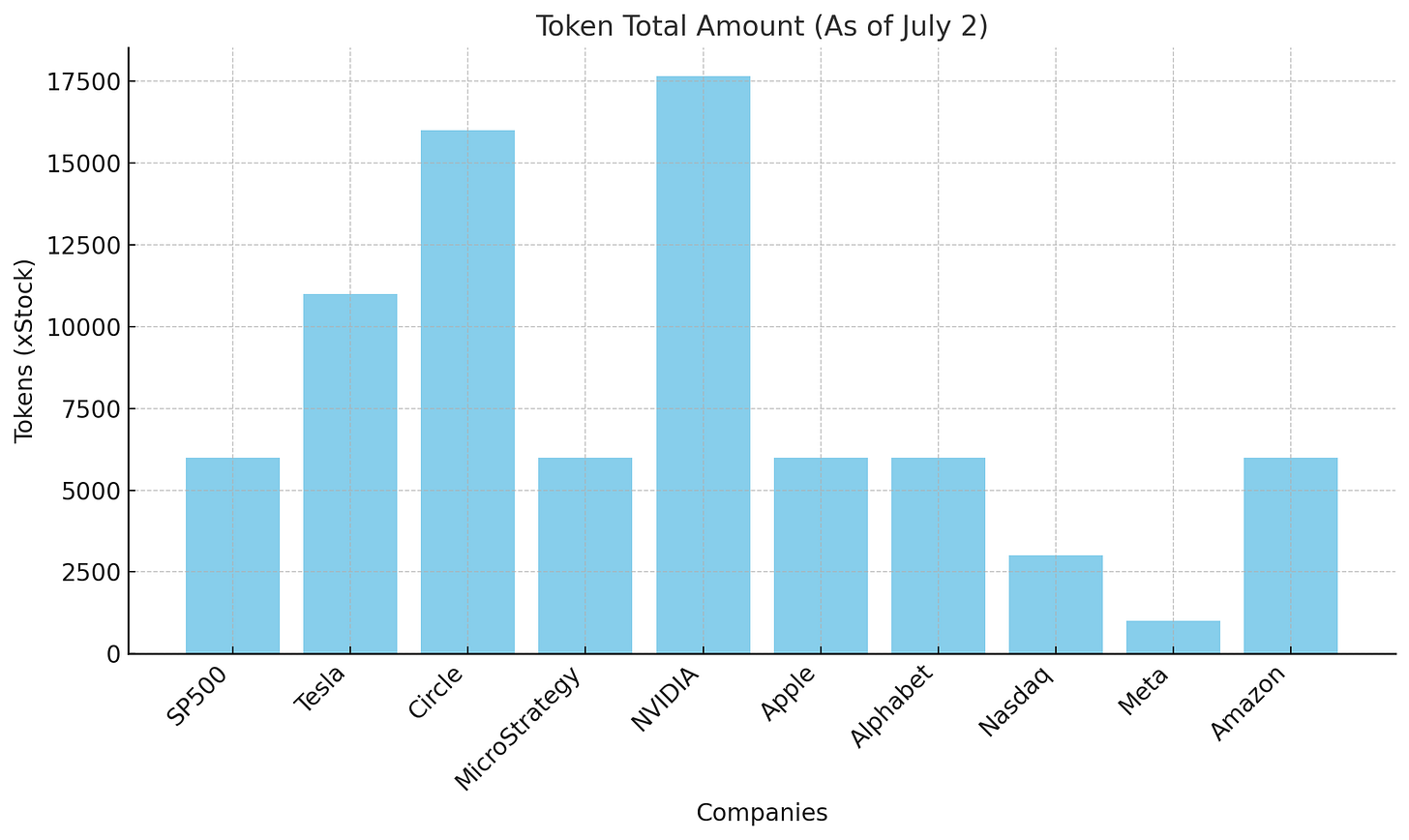

(3) 1 Token Pegged to 1 Share

xStocks adheres to a 1:1 token-to-share model. Professional or compliant investors can apply for a Backed Account to purchase stocks through Backed, which facilitates these primary investors in acquiring stocks via brokers. The purchased stocks are custodied by a third-party institution, and xStocks mints a corresponding number of tokens based on the purchased stock quantity, which are then returned to the primary investors. Primary investors with a Backed Account can issue or redeem stock tokens at any time. Among the 10 xStocks stock tokens currently traded, NVIDIA, Circle, and Tesla have the highest total token supply, each exceeding 10k tokens.

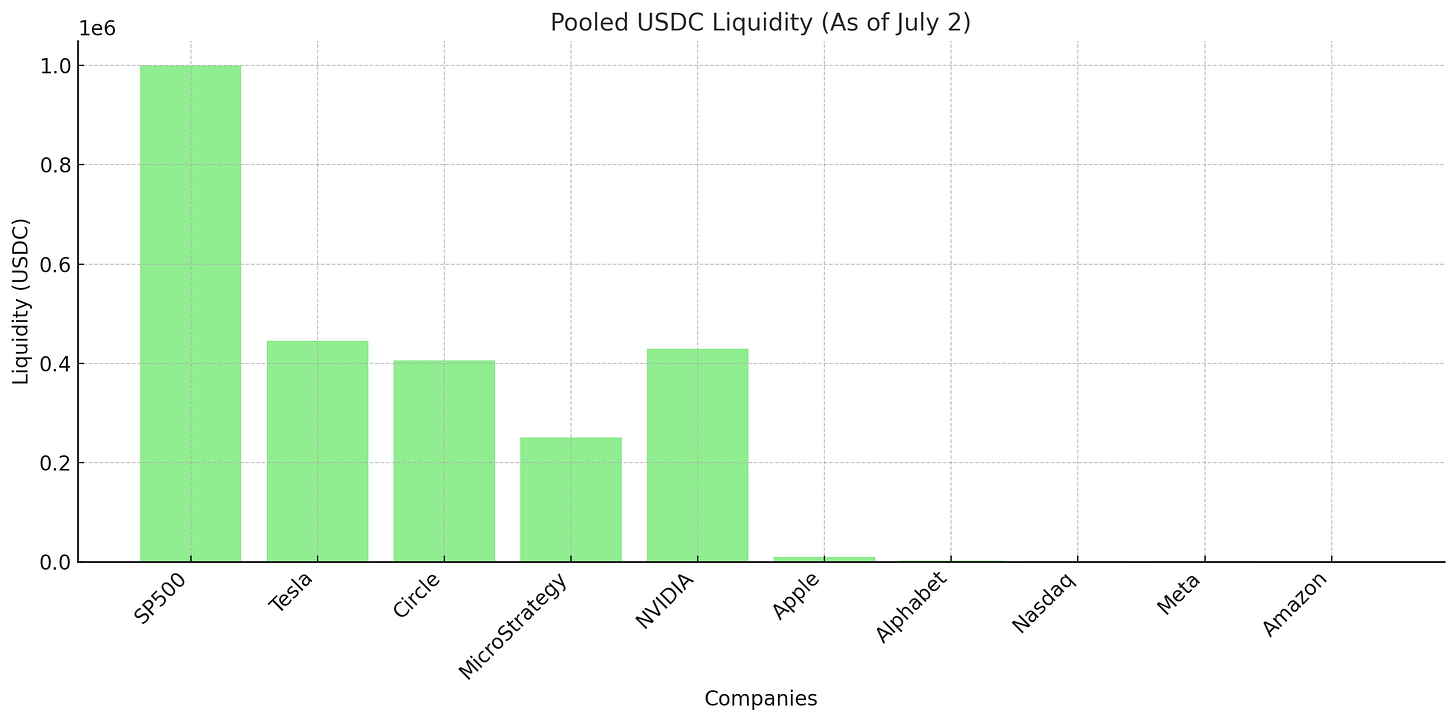

(4) Liquidity Relies on CEX Market Makers

The issuance of stock tokens is centralized in the hands of primary professional investors, but as they issue stock tokens, the question of who provides liquidity arises. The significance of xStocks’ partnerships with CEXs lies not only in providing distribution channels for stock tokens but also in integrating CEXs into the primary issuance process, leveraging their market maker resources to enhance liquidity. Trading activity and pool depth are mutually reinforcing: the more active the trading, the more liquidity is provided. Notably, the S&P 500 (SPY), with the highest volume, has achieved a USDC-based liquidity pool of $1 million on-chain, surpassing the market cap of the issued stock tokens. However, stock tokens with lower volumes face the challenge of limited liquidity provision.

(5) Using Third-Party DeFi Protocol Tokens to Incentivize and Guide Retail Liquidity Provision for Stock Tokens

xStocks stock tokens, issued on Solana, are likely to follow the model of bStocks, also supported by Backed and issued on EVM networks, by collaborating with public blockchains and major DEXs to incentivize and guide liquidity for stock tokens using third-party protocol tokens. Currently, xStocks is actively partnering with DeFi protocols on Solana, with known collaborations including the DEX aggregator Jupiter and the lending protocol Kamino.

Robinhood's Stock Tokenization

(1) Robinhood Deployer Has Deployed 213 Tokens or Is Conducting Stock Token Testing

Robinhood has chosen Arbitrum to issue its stock tokens, deploying 213 stock tokens at a total cost of just $5.35, with an average cost of $0.03 per token. The low transaction fees are a key factor in Robinhood’s decision to use Arbitrum. Moving forward, Robinhood plans to develop its proprietary chain, Robinhood Chain, based on Arbitrum’s technology stack.

(Source: @tomwanhh)

(2) Robinhood Has Minted 2,309 OpenAI (o) Tokens

Robinhood announced that Robinhood EU will launch the world’s first tokenized stocks of non-publicly listed companies, including OpenAI and SpaceX tokens. Positioning crypto as a pre-market for high-potential, non-listed company stocks is undoubtedly the most exciting aspect of Robinhood’s stock tokenization efforts. In the future, crypto users may gain earlier access to stocks of companies preparing to go public compared to traditional stock market investors. Currently, Robinhood has minted 2,309 OpenAI (o) tokens.

(3) Robinhood’s Stock Token Contracts Embed Compliance Requirements

Electric Capital researcher Ren, after decompiling Robinhood’s stock token contracts, found that they operate within a closed system. Each transfer requires verification against an approved wallet registry (KYC/AML), making these tokens likely incompatible with DeFi interactions. However, CeFi platforms with distribution capabilities may benefit. Even EU users purchasing stocks on-chain cannot transfer stock tokens to non-registered addresses, as such transfers are blocked.

(Source: @0xren_cf)

(4) 79 Stock Tokens Have Metadata Set and Are Nearing Launch

In addition to OpenAI, Robinhood-related addresses have set metadata for 79 deployed stock tokens, including Robinhood Markets, Trump Media & Technology Group, GameStop, and ETFs such as Schwab US Dividend Equity ETF and Yieldmax MSTR Option Income Strategy. Some stock tokens with metadata already set have undergone limited minting.

References:

https://dune.com/kucoinventures/xstocks

https://x.com/tomwanhh/status/1940147486280057247

https://x.com/0xren_cf/status/1940077604939129253

https://arbiscan.io/address/0x44c7c4ab4757aa49b50a8082cb1649c51ef7bc43#asset-tokenshttps://arbiscan.io/tx/0xcc3d0318522dc05eb342bc2fe7231f537d574e708f10258daf43e6bc95d0afa8

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish