Opinion: Web3 Development in HK: The Next Step is RWA, Avoiding Being "Licensed to Be Killed"

Author :

● Wang Yang, Vice-President (University Extension) of The Hong Kong University of Science and Technology, and Chief Scientist of the Hong Kong Web3.0 Association

● Zhu Haokang, PhD candidate in FinTech at The Hong Kong Polytechnic University, and founding member of the Hong Kong Web3.0 Association’s RWA and Stablecoin Working Group

Source:

http://www.takungpao.com/opinion/233119/2023/1011/901267.html

On June 1, 2023, the official implementation of Hong Kong’s Virtual Asset Regulation marked an important milestone in the development of Web3.0 in Hong Kong. This significant event underscored the profound impact of Web3.0 on fintech development, as articulated by Chief Executive of the Hong Kong Special Administrative Region, John Lee, during the establishment ceremony of the “Hong Kong Web3.0 Association” on April 11, 2023. It also demonstrated the open attitude and determination of the SAR government. Simultaneously, the Hong Kong Securities and Futures Commission opened applications for virtual asset trading platform licenses, allowing compliant operators to provide virtual asset services to professional and retail investors. This policy further propelled the development of the virtual asset industry and paved the way for the broader expansion of virtual assets and Web3.0 in Hong Kong. Despite the tightening global regulatory environment for virtual assets, the SAR government has remained steadfast in its commitment and support for the development of the virtual asset industry in Hong Kong, further confirming its determination for the growth of the virtual asset space and Web3.0.

Building a Compliant, Rational, and Friendly Web3 Ecosystem

However, Hong Kong’s focus on virtual assets and Web3 development has been primarily centered around compliance and licensing, with less emphasis on constructing a vibrant ecosystem to enable licensed institutions to develop viable business plans. While this regulatory approach aims to maintain order in the virtual market, it has posed a significant burden for Hong Kong’s virtual asset companies. The term “Licensed to Be Killed” is aptly used here, as licensed exchanges like OSL have experienced substantial annual losses since obtaining their licenses. Hong Kong urgently needs a more expansive vision to create the world’s first compliant, rational, and friendly Web3 ecosystem, one that genuinely leads the global development of Web3.

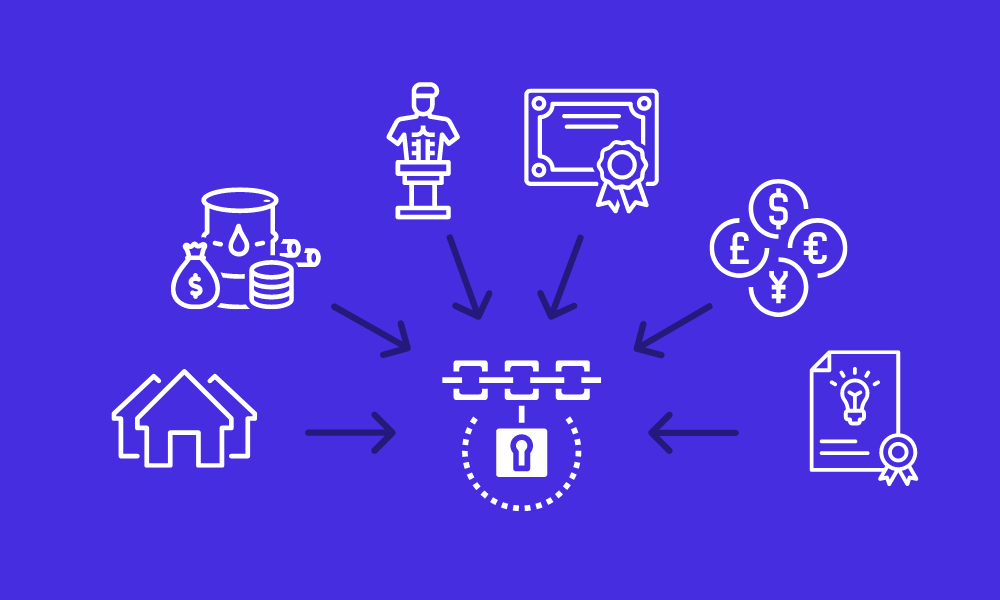

We firmly believe that the next step for Hong Kong in Web3.0 development should focus on the deep integration of virtual and real-world assets. Leveraging blockchain technology with the Hong Kong Dollar-backed stablecoin as the foundation, we can build a powerful Web3 ecosystem based on this stablecoin. Our emphasis should be on the digitization and tokenization of real-world assets (RWAs), including bonds, private loans, trade finance, real estate, carbon credit certificates, and precious metals, among others. These actions will significantly facilitate the integration of the virtual economy with physical assets. Notably, the tokenization of RWAs not only represents the greatest potential for Web3 development in Hong Kong but also embodies a global trend for Web3.

In a conducive regulatory environment, RWAs can offer legitimate participants a genuinely prosperous opportunity, rather than becoming casualties labeled “Licensed to Be Killed.” This transformation will undoubtedly place Hong Kong at the forefront of global Web3 development.

The tokenization of RWAs, i.e., converting tangible or intangible assets into digital tokens, represents a revolutionary shift in the field of digital assets and has the potential to redefine market dynamics. The introduction of blockchain technology has brought groundbreaking optimizations to RWAs compared to traditional securitization. RWA tokenization offers transparency, security, and increased liquidity through partial ownership. This approach addresses the inefficiencies of traditional financial systems, removes limitations, allows assets to be digitized and made unique, shortens the gap between traditional and emerging finance, meets individualized financial needs, and lowers investment thresholds. This stimulates greater participation by small and medium-sized investors in financial activities, thereby creating significant value and revenue. Simultaneously, RWAs infuse liquidity and diversity into the real economy by expanding the range of assets and increasing fund sizes.

Furthermore, the Hong Kong Dollar-backed RWA offers an added layer of security, enabling traditional finance and the real economy to enjoy the benefits of blockchain technology in terms of liquidity, transparency, innovation, and simultaneously safeguarding the funds of investors and participants. In September 2022, Boston Consulting Group (BCG) predicted that the tokenization of real-world assets would reach $16 trillion by 2030. Correspondingly, Citibank released a comprehensive 162-page research report in March 2023, analyzing the path to achieving a billion users and reaching a market value of trillions of dollars for digital assets within Web3. Citibank forecasted that by 2030, assets worth $4 trillion to $5 trillion would be tokenized, and blockchain-based trade finance transactions would reach $1 trillion.

Reasonable Regulation Promotes the Healthy Development of RWAs

The healthy development of the RWA ecosystem requires reasonable regulation. However, building a compliant, rational, and friendly RWA tokenization environment is not straightforward and demands collaborative efforts from both the government and the industry. To this end, we propose adopting the “RWA 2+4” framework that Zhu Haokang has advocated for in earlier discussions. This methodology centers around two types of tokens (security tokens and utility tokens) and four core elements (legal foundation, financial architecture, technical tools, and data-driven processes). This approach aims to identify opportunities amidst challenges and promote the healthy development of RWAs.

Firstly, security tokens represent ownership or profit rights of assets or businesses, with their value usually directly related to the performance of the underlying assets or businesses. Those who purchase these tokens generally expect to earn returns through asset appreciation or profit distribution. Conversely, utility tokens grant rights to use specific services or resources while allowing data generated during token processes to be recorded on the blockchain. Understanding the characteristics and differences between these two types of tokens is crucial for accurately evaluating and investing in RWAs.

Next, we need to focus on four core elements: legal regulations, financial frameworks, technical support, and data applications.

Legal regulations form the foundation of RWAs, determining which assets can be tokenized and the regulations that need to be followed during the tokenization process. Hong Kong, as a globally significant financial hub, boasts a well-developed legal framework for securities, which provides a unique advantage for promoting the issuance of compliant security tokens (Security Token Offering, STO). Hong Kong’s securities laws comprehensively regulate various types of securities assets such as stocks, bonds, and more. Financial assets that RWAs aim to tokenize, including stocks, debt securities, and funds, have clear legal definitions in the Hong Kong market. Furthermore, the Securities and Futures Commission of Hong Kong has established robust standards for reviewing securities issuance and listing. RWAs intending to conduct STOs need to link their underlying assets, such as corporate equities and debts, to meet the commission’s requirements for information disclosure and approval to ensure asset quality. Hong Kong has also implemented strict investor suitability management to prevent ordinary investors from purchasing complex and high-risk RWA products.

Finance serves as the framework for RWAs, defining the specific structure for asset tokenization, including asset evaluation, audit verification, issuance and trading of tokens, and related risk management. Hong Kong has rich experience and a leading scale in debt and equity financing. Investment banks and auditing firms in Hong Kong can provide professional valuation and auditing services for the underlying assets of RWAs, determining asset quality and clear ownership to facilitate token issuance. Moreover, Hong Kong’s compliant licensed virtual asset trading platforms ensure the transparency of RWA token issuance and trading.

Technology acts as the tools for RWAs, providing the technological means for tokenization and trading. This includes blockchain technology, smart contract technology, oracles, cross-chain solutions, and related security and privacy protection technologies. Since the release of the Hong Kong Virtual Asset Development Policy Statement on October 31, 2022, top blockchain technology companies from around the world have actively established themselves in Hong Kong.

On September 19, 2023, during the “2023 Shanghai Blockchain International Week — 9th Blockchain Global Summit,” Peter Yan, CEO of Hong Kong Cyberport Management Company Limited, revealed that there are now more than 190 Web3.0-related enterprises based in Cyberport. This includes important foundational blockchain infrastructure companies such as digital identity and privacy computing infrastructure company zCloak and professional digital asset custody solutions company Safeheron.

Establishing a Public Chain that Adheres to Hong Kong Standards

Data serves as the driving force for RWAs, providing vital information about assets and markets to support investment decisions and market analysis. RWA tokenization, as a novel form of investment, not only offers investors a broader range of investment options but also generates a wealth of data and valuable information for the market, such as transaction data and user behavior data. This data constitutes a powerful driving force that significantly enhances the ability of asset operators and investors to understand market dynamics, forecast market trends, and manage investment risks. The application of this data will also drive the organic integration of artificial intelligence and Web3, further propelling technological innovation in Hong Kong.

To promote the development of RWA tokenization in Hong Kong, we must first construct a compliant and robust infrastructure, with blockchain technology at its core. This infrastructure provides a decentralized, secure, and transparent platform that facilitates global asset movement and can automatically execute complex financial transactions and protocols. However, given the considerable complexity involved in moving RWAs to the blockchain, we need to establish a strong, secure, and Hong Kong standard-compliant Know Your Customer (KYC) mechanism. Organizations like the Hong Kong Web3.0 Association have already proposed the establishment of a new public blockchain for RWAs in Hong Kong, complete with an embedded KYC mechanism. Although building a new public chain demands substantial technical investments and extensive community development, it is a crucial step in driving the development of RWAs and an essential phase in advancing fintech innovation in Hong Kong.

Of course, creating a new public chain is not a one-time effort. It requires significant technical investment, including designing efficient consensus mechanisms, constructing robust network architecture, and developing user-friendly clients, among other components. Moreover, it necessitates extensive community building and management to attract and retain developers, users, and investors. We believe that as long as Hong Kong is determined to lead in RWAs, these challenges can be overcome swiftly.

Additionally, the issuance of a stablecoin is another essential infrastructure that cannot be overlooked in RWA tokenization. Its healthy establishment is critical for the future development of RWAs. We must ensure its effective deployment in Hong Kong to pave the way for further RWA development. As a hub for global Web3.0 development and an international financial center, Hong Kong has a vital role in issuing the Hong Kong Dollar-backed stablecoin quickly. With the flourishing development of RWAs, the demand for stablecoins is expected to grow rapidly.

In our previous article, “Proposing the Issuance of a Hong Kong Dollar-Backed Stablecoin with Foreign Exchange Reserves,” we recommended that Hong Kong issue a unified Hong Kong Dollar-backed stablecoin (HKDG). However, when we observed Singapore’s management system for the stablecoin market, specifically the “Response to Public Consultation on the Proposed Regulatory Approach for Stablecoin-Related Activities in Singapore,” we became concerned about the possibility of Hong Kong adopting a similar stablecoin policy, which could have a severe negative impact on the future development of RWAs in Hong Kong. Singapore’s stablecoin policy lacks comprehensive planning for the issuance entities and the types of currency to which the stablecoins are pegged. This is likely to lead to fragmentation and confusion in stablecoin issuance schemes, resulting in fierce competition between stablecoins, increasing financial risks, hindering the development of mature stablecoins, and potentially marginalizing stablecoins as niche products. This approach cannot meet the extensive demand for stablecoins in the future of RWAs.

Therefore, we strongly urge Hong Kong to introduce a unified stablecoin, guided by a global plan and issued by licensed entities, which can include government institutions, banks, insurance companies, and financial organizations. This approach should also be accompanied by appropriate profit-sharing schemes. Only through this means can we avoid market fragmentation, reduce financial risks, satisfy the vast demand for stablecoins, establish Hong Kong’s stablecoin as a mature and widely used financial product, lay the groundwork for the healthy development of the RWA ecosystem in Hong Kong, and further solidify Hong Kong’s leading position in the global fintech field.

In reality, we don’t have much time. The tokenization of RWAs has garnered widespread attention and been broadly applied in various industries. As part of decentralized finance (DeFi) protocols, MakerDAO was one of the early institutions to incorporate RWAs into their strategic plans. As early as 2020, MakerDAO passed a proposal to include RWAs, such as tokenized real estate, as collateral. This decision significantly expanded the issuance scale of DAI (MakerDAO’s stablecoin). Although DeFi’s overall situation hasn’t been ideal over the past year, MakerDAO’s involvement in RWAs has continued to grow. As of May this year, the total value of MakerDAO’s RWA portfolio reached 2.34 billion DAI. Projected annual income from RWAs could reach as high as 71 million USD, making it a crucial source of income for MakerDAO. Additionally, the Propy platform in the United States is a typical application of real estate RWAs. The platform utilizes blockchain technology to put real estate on-chain as non-fungible tokens (NFTs) and supports purchases with cryptocurrencies. It also leverages artificial intelligence (AI) technology to enhance transaction efficiency. On July 6, this year, Propy announced that the value of its platform token, PRO, had risen from $0.268 to $0.571, a more than 200% increase. This event strongly underscores the immense potential and value of RWAs in real-world applications.

Clarifying Regulatory Policies for RWA Token Issuance

Hong Kong, as a global trading hub and a world trade center, has unparalleled advantages in terms of geographic location and economic status. Hong Kong has the ability to lead the global RWA market, and, therefore, it should seize the opportunity to swiftly construct an RWA business ecosystem with Hong Kong as its foundation. Firstly, we need to clarify the regulatory policies for RWA securitization and security token issuance (STO). It is essential to define the scope of assets to which security tokens can be pegged and the requirements for disclosure of information, all while safeguarding the rights of investors. Establish RWA token issuance trading platforms on Hong Kong stock exchanges and increase their liquidity.

We should encourage financial institutions like banks, insurance companies, and funds to make full use of their expertise to participate in RWA businesses. At the same time, Hong Kong should strengthen its collaboration in the field of RWA tokenization with regions like Singapore, the European Union, and others to expand the market jointly. Through education and training, we can nurture the professional talents needed for RWA tokenization businesses. Building an open, standardized, and vibrant RWA tokenization business ecosystem will significantly enhance Hong Kong’s digital economy and fintech capabilities, laying a solid foundation for Hong Kong’s future.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish