Polkadot Treasury Mid-Year Financial Report Analysis: Network Revenue Only $250,000, Expenditures Exceed $80 Million

Author: defioasis

Polkadot is an open-source blockchain platform founded by Ethereum co-founder Gavin Wood and supported by the Web3 Foundation. It is designed to enable seamless data and asset transfers between different blockchains through its architecture of parachains and a relay chain. Polkadot launched its mainnet in 2020, and its native token, DOT, is used to pay transaction fees, participate in network governance, and play a role in network security and consensus mechanisms. DOT reached a market cap peak of over $56 billion in November 2021 and remains one of the top twenty tokens by market cap in the crypto industry. However, Polkadot's ecosystem development and network activity have significantly lagged behind its market cap.

Polkadot recently announced its financial status for the first half of 2024, and this article will provide an analysis of the report.

Asset Status

Polkadot's assets can be categorized into four main types:

1. Cash and Cash Equivalents: 29,336,487 DOT ($187,753,510)

2. Non-liquid Custodial Supply: 1,001,533 DOT ($6,409,811)

3. Designated Assets: 7,347,953 DOT ($47,026,898)

4. Receivable Loans (loans to be repaid upon maturity): 584,480 DOT ($3,740,672)

(1) Cash and Cash Equivalents: 29,336,487 DOT ($187,753,510)

This category actually includes three types of assets: DOT, USDC, and USDT. These are Polkadot's liquid funds, spread across the relay chain, AssetHub, and Hydration. The relay chain holds 23,071,098 DOT ($147,655,027), accounting for 78.6%; DOT-AssetHub holds 5,000,309 DOT ($32,001,978), accounting for 17%. This means that over 95% of cash and cash equivalents are held as DOT assets, with stablecoins accounting for less than 5%, totaling $8,096,505 (USDT + USDC). This could introduce financial uncertainty risks due to price volatility and liquidity levels. When dealing with ecosystem external partnerships lacking depth, the expenditure of DOT could become a selling pressure. Notably, following the Ref 457 referendum in the first quarter of this year, a portion of the Treasury's liquid funds in DOT will be slowly converted into stablecoins in small amounts and at high frequency annually.

[Note: AssetHub is a module on the Polkadot network used for managing and operating various assets. It features multi-asset support, asset issuance and management, cross-chain operability, security (multi-signature, permission management, and auditing functions), support for DEX, compatibility with smart contracts, and community participation. Hydration is a mechanism on the Polkadot network for maintaining health and vitality, including upgrades and bug fixes, performance optimization, and ecosystem support.]

(2) Non-liquid Custodial Supply: 1,001,533 DOT ($6,409,811)

The non-liquid custodial supply primarily refers to the 1 million DOT that Polkadot provided as single-sided liquidity to its on-chain DeFi protocol, Hydration Omnipool. However, the funds are still controlled by the Polkadot protocol and its decentralized governance system, OpenGov. This allocation was officially made on June 10 of this year.

It is noteworthy that Polkadot allocated a total of 2 million DOT to Hydration. Apart from the aforementioned 1 million DOT still owned by the protocol for single-sided liquidity in Omnipool, an additional 1 million DOT was given as liquidity mining rewards to users as part of the Hydration Campaign. Following this liquidity injection, Hydration's TVL surpassed $50 million, although the increase in trading volume has been quite limited.

(3) Designated Assets: 7,347,953 DOT ($47,026,898)

Designated assets refer to the assets allocated by the Polkadot Treasury for specific purposes but not yet fully spent. These primarily include:

① 3,555,680 DOT ($22,765,352) for bounties;

② According to Ref 457, continuously converting 2,303,808 DOT ($14,744,371) from the Treasury's liquidity into USDT through Hydration (one transaction every 20 blocks, each for 100 USDT);

③ 1,000,000 DOT ($6,500,000) for a token swap with MyTH Swap for 20 million MYTH tokens;

④ Collective Fellowship salaries totaling 1,824,466 USDT (equivalent to 285,073 DOT);

⑤ Polkadot technical scholarships totaling 1,301,709 USDT (equivalent to 203,392 DOT).

The salaries and scholarship plans are paid in the USDT stablecoin.

(4) Receivable Loans (loans to be repaid upon maturity): 584,480 DOT ($3,740,672)

Polkadot has provided short-term loans with a one-year term to ecosystem applications, mainly including:

① A 500,000 DOT loan to Bifrost, with a total repayment (principal and interest) of 534,480 DOT ($3,420,672);

② A 50,000 DOT ($320,000) loan to Pendulum.

Bifrost is an Omnichain LST protocol with a TVL of $77 million, where DOT assets account for 75.19%, reaching $58 million. After receiving a 500,000 DOT loan, Bifrost staked and minted vDOT. vDOT gains base yield through staking, distributed by adjusting the vDOT exchange rate. Over the past 90 days, the average annual base yield of vDOT was 17.13%, with an additional 0.21% yield from DeFi dapps, making the expected annual yield 17.34%. Interestingly, the one-year loan interest for Bifrost is approximately 6.9%. It is noteworthy that the yield provided by vDOT LST is almost twice the network's inflation rate, and given the low network activity, the sustainability of this yield is questionable.

Pendulum has built the cross-chain bridge Spacewalk, connecting the Polkadot and Stellar networks (audited by Certik). The 50,000 DOT loan Pendulum received was staked on Bifrost, then used vDOT as collateral for stablecoins in the Stellar ecosystem. The vDOT collateral has a one-year lock-up period and will be fully repaid after one year without interest.

Overall, the total value of Polkadot Treasury assets is 38,270,453 DOT, worth $244,930,891. Among these, the three categories of non-liquid custodial supply, designated assets, and receivable loans are all non-liquid assets, accounting for approximately 23.34% of the total assets. Liquid assets, or cash and cash equivalents, amount to 29,336,487 DOT, valued at $187,753,510. Among these, stablecoin assets are $8,096,505 in USDC and USDT, accounting for about 4.3%. Thus, liquid stablecoin assets make up 3.3% of Polkadot Treasury's total assets.

Sources of Income

Polkadot Treasury's income mainly comes from Polkadot network fees, DOT token inflation, and other sources.

(1) Polkadot Network Fees Income: 39,444 DOT (approximately $250,000)

20% of Polkadot network fees are allocated to block producers to incentivize them to maintain the security and efficiency of the network. The remaining 80% goes to the Polkadot Treasury, which uses these funds to support future development, community activities, network upgrades, and various projects and proposals. Tips, which are optional transaction fees added by users, serve as an incentive for block producers to prioritize their transactions and are directly allocated to block producers.

In contrast to the second half of 2023, the income for the first half of 2024 was only 39,444 DOT, a decrease of 87.4%, reflecting the low activity on the Polkadot network. In the latter half of last year, Polkadot Treasury income reached 313,443 DOT, largely driven by short-term speculation on inscriptions, indicating the network still lacks sustainable growth potential.

(2) DOT Token Inflation Income: 5,221,990 DOT (approximately $33.19 million). After accounting for token burns, the net inflation income was 2,715,306 DOT (approximately $17.26 million).

DOT is an inflationary token with an inflation rate set at 10% per year. The newly generated DOT from inflation is allocated to DOT token stakers (validators and nominators) and the Treasury based on the ideal staking rate. Polkadot's ideal staking rate is 60%, meaning if 60% of DOT is staked, all inflation would go to validators and nominators. Any deviation from the ideal staking rate of 60%, whether positive or negative, results in the proportionate deviation being allocated to the Treasury.

Data from the Staking Explorer shows that the current staking rate on the Polkadot network is 58.18%, which is below the ideal staking rate, allowing the Treasury to benefit from the inflation allocation. The DOT token inflation rate is approximately 8.8%.

(3) Other Income, Including Slashes, Dust, OpenGov Returns: 132,253 DOT (approximately $840,000)

Other income consists largely of unpredictable revenue sources. Slashes income refers to the DOT transferred to the Treasury when validators or their nominators lose a portion of their staked DOT due to misbehavior in the network. Dust income refers to small amounts of funds sent to the Treasury address. OpenGov Returns income includes the return of unused governance funds and the recovery of funds, among other sources.

Expenditures

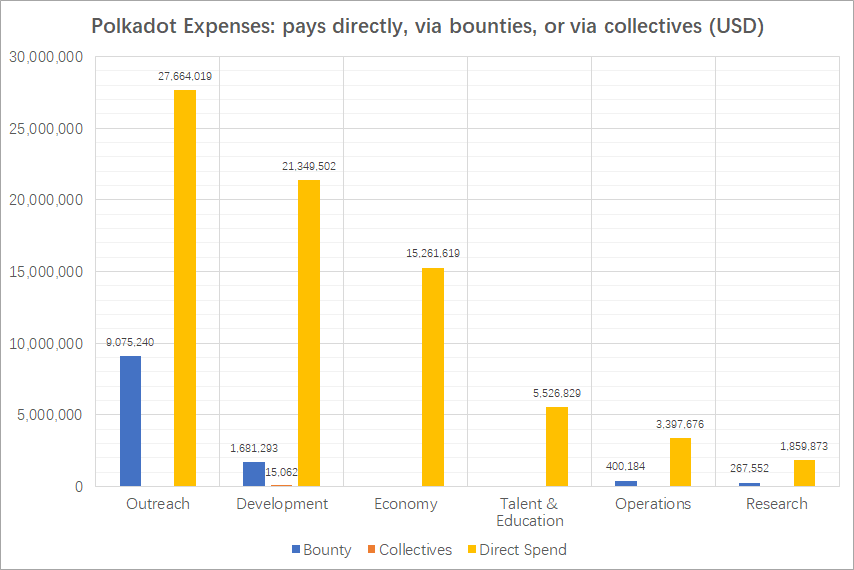

In the first half of 2024, Polkadot's total expenditures reached 11,327,316 DOT ($86,586,711). In DOT terms, this represents a 124% increase compared to the second half of 2023, and in USD terms, the expenditure grew by 225%.

Polkadot's expenditures can be categorized into six main types:

(1) Outreach (Marketing, BD, and Community Development): 4,941,691 DOT ($36,739,259)

(2) Development: 2,956,611 DOT ($23,133,719)

(3) Economic Activities (Loans, Liquidity Incentives, Active Asset Swaps): 2,000,497 DOT ($15,261,619)

(4) Talent and Education (Education, Hackathons, Recruitment, and Talent Incubation): 704,270 DOT ($5,526,829)

(5) Operations (Network RPC and Archive Nodes, Browsers and Indexers, Legal Fees): 451,280 DOT ($3,797,860)

(6) Research (Protocol Research, Reports and Analysis, UX&DX, Scam Prevention, and Audits): 272,967 DOT ($2,127,425)

Apart from talent and education as well as operating costs, which have decreased, all other expenditure categories have seen significant increases. Notably, economic activities expenditure is a new cost category this year.

Polkadot's expenditures can be divided into three main categories based on the accounting method:

(1) Direct Spend: 9,819,122 DOT ($75,059,519)

(2) Bounty: 1,493,132 DOT ($11,424,269)

(3) Collectives: 15,062 DOT ($102,923)

(1) Outreach: 4,941,691 DOT ($36,739,259)

Outreach was the largest expenditure in the first half of 2024, accounting for 43.6% of total costs, a significant increase of 269% compared to the second half of the previous year. Outreach expenses can be subdivided into five categories: advertising, events, business development (BD), media, and community building.

① Outreach Expenses - Advertising: 2,908,449 DOT ($20,895,477), representing 58.9% of outreach expenses and 25.7% of total expenditures.

Advertising can be further subdivided into sponsorships, influencers, digital advertising, physical advertising, platform integration, and general(unmarked).

● Sponsorships Expenditure: 1,463,622 DOT ($10,085,879)

○ Sports Sponsorship with Inter Miami: Signed a sports sponsorship agreement in April worth 1 million DOT ($6.8 million). According to a previous report by CryptoSlate, the sponsorship will span the 2024 and 2025 seasons and will feature the blockchain project's branding on Inter Miami's training kits.

○ Sponsorship of Racer Conor Daly: Sponsored Conor Daly with $1.9 million. Conor Daly primarily participated in the IndyCar series this year and achieved a tenth-place finish in the Indianapolis 500.

○ Partnership with Esports Team HEROIC: Entered a $1.3 million partnership with HEROIC, a Norwegian esports organization founded in 2016, with main teams in CS and PUBG.

● Influencers Expenditure: 648,391 DOT ($4,881,943)

○ Promotion of Polkadot with Media EVOX ($2.2 million)

■ From February to May this year, Polkadot and EVOX signed six advertising collaborations. The largest of these occurred on May 21, costing 127,711 DOT ($919,618).

EVOX does not appear to be a crypto-native media outlet and prefers to use YouTube for video marketing. Many of the YouTube influencers they collaborate with have very low follower counts on Twitter.

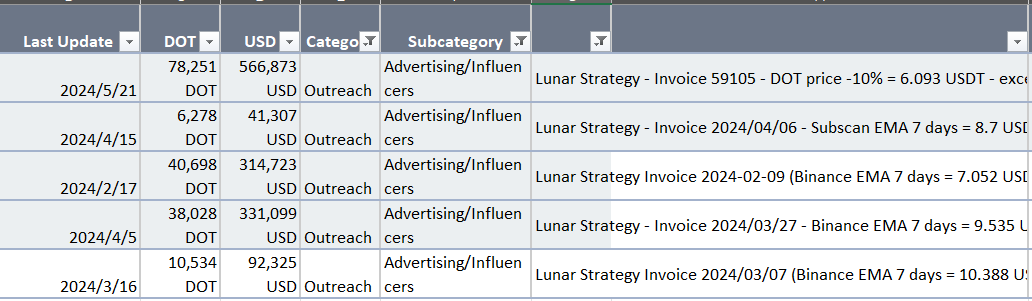

○ Partnership with marketing firm Lunar Strategy ($1.3 million)

■ Between February and May this year, Polkadot and Lunar Strategy signed 5 advertising cooperation agreements, with the largest one on May 21st costing 78,251 DOT ($566,873).

■ According to the Polkadot case study displayed on the Lunar Strategy official website, there were over 180 collaborations in 45 days, achieving 266.5 views through KOLs.

According to a document signed by Lunar Strategy and Polkadot on February 9, Lunar Strategy provided a list of KOLs including: Crypto Banter (414.1k followers), Crypto Lark (1.2m), Michaël van de Poppe (721.9k), Satoshi Stacker (200.8k), Layah (672.3k), Boxmining (259.1k), That Martini Guy (575.2k), Ash Crypto (1.1m), and Wendy O (383.1k). The total payment was $287,000 ($267,000 + $20,000 reserved), with an average payment of $31,900 per KOL. The average cost per reached follower was approximately $0.052. [Corresponding to the expenditure item on February 17 in the Polkadot document]

○ and Chainwire ($490,000) and Unchained ($460,000)

● Digital advertising expenditure: 538,706 DOT ($4,075,102)

○ Placed through CoinMarketCap ($1,000,000) and EVOX ($900,000)

After signing a discounted contract with Polkadot, CMC charged $980,000 for a 6-month digital advertising campaign. The original price for a single month was $225,000, which included the following costs: community live events at $100,000 (covering 1-2 videos/clips shared on Telegram, Instagram, TikTok, and YouTube); social media package at $100,000 (including 1 tweet, 2 TG posts pinned for 24 hours, 5 newsletters, 1 Instagram post, 1 dedicated newsletter, 1 sponsored in-depth article, and 1 CMC community live session); and management fees at $25,000.

② Outreach Expenses - Events: 960,326 DOT ($7,927,676), accounting for 19.4% of outreach expenses and 8.5% of total expenditures.

Event expenditures can be further subdivided into conferences attendance and side events, conference hosting, and meetups:

● Conferences Attendance and Side Events: 566,171 DOT ($4,468,793)

○ Polkadot Decoded China: $560,000

○ 3 {bash} parties: $540,000

○ Token2049 side events: $420,000

● Conference Hosting: 326,507 DOT ($2,949,957)

○ Polkadot Decoded and Sub0: $2,900,000

● Meetups: 67,648 DOT ($508,927)

③ Outreach Expenses - Business Development: 503,647 DOT ($3,853,701), accounting for 10.2% of outreach expenses and 4.4% of total expenditures.

● Collaboration with The Tie ($1,000,000): Polkadot gained speaking opportunities at institutional conferences.

● Integration with insurance provider Avata ($550,000)

● Recruiting future partners through Missing Link ($540,000)

④ Outreach Expenses - Media: 442,766 DOT ($3,188,360), accounting for 9% of outreach expenses and 3.9% of total expenditures.

The largest media expenditures include supporting the media project Kusamarian, which focuses on content creation and dissemination to enhance the visibility and influence of Kusama and Polkadot ($530,000), and the "Behind the Code" documentary series ($530,000).

Among the more well-known media, the few representatives of the Polkadot Chinese community, PolkaWorld, received 31,474 DOT ($272,566) for one year of future operating funds; Crypto media Cointelegraph received 43,946 DOT ($323,571) for a year-long Polkadot brand awareness campaign; and Polkadot Insider, focused on Polkadot information, received 26,195 DOT ($199,823) for 52 weeks of operating funds.

⑤ Outreach Expenses - Community Building: 126,503 DOT ($874,044)

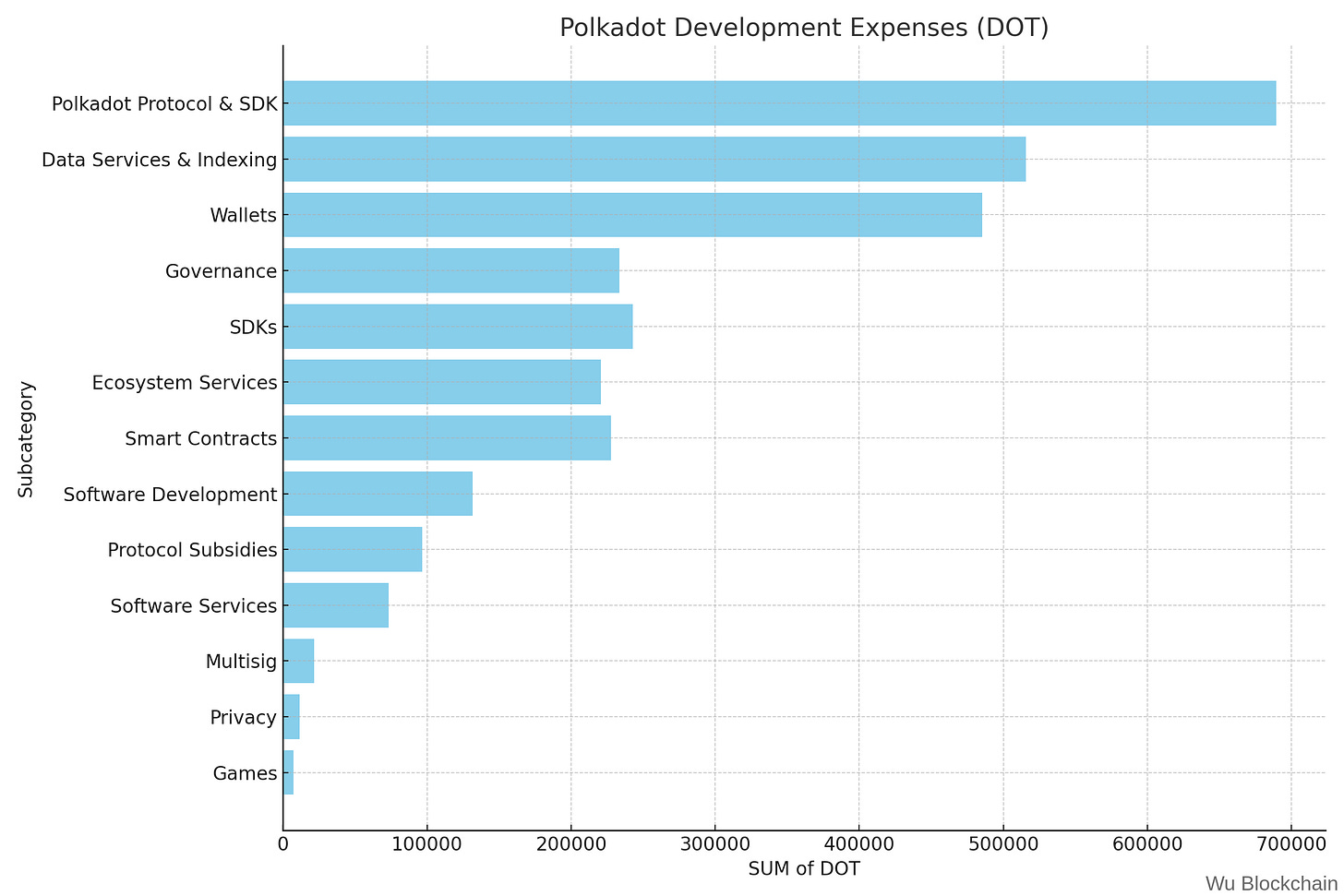

(2) Development: 2,956,611 DOT ($23,133,719)

Development costs are the second largest expenditure after outreach, increasing by 27.8% compared to the second half of last year.

① Development - Polkadot Protocol and SDK: 689,361 DOT ($5,092,912), accounting for 23.3% of development expenditures and 6.1% of total expenditures.

● New host implementations like Gosammer ($2,800,000)

● Interoperability standards such as NFT XCM ($730,000)

● Rust runtime verification ($540,000)

● XCQ ($310,000)

② Development - Data Services and Indexing: 515,521 DOT ($4,048,918), accounting for 17.4% of development expenditures and 4.6% of total expenditures.

● New integration with Dune ($2,500,000)

● New integration with Token Terminal ($1,400,000)

③ Development - Wallet: 485,460 DOT ($3,849,432), accounting for 16.4% of development expenditures and 4.3% of total expenditures.

● SubWallet ($880,000)

● Talisman ($1,400,000)

● Nova ($1,200,000)

④ Development - Investment in Governance Functions: 233,592 DOT ($2,315,443), accounting for 7.9% of development expenditures and 2.1% of total expenditures.

● Zeitgeist's Futarchy proposal ($1,000,000)

● Project Glove ($810,000)

⑤ Development - SDKs: 242,877 DOT ($1,716,209), accounting for 8.2% of development expenditures and 2.1% of total expenditures.

● ORML/Chopsticks/Subway ($720,000)

● Apillon ($650,000)

● PAPI ($180,000)

⑥ Other development expenditures exceeding $1,000,000 include ecosystem services, smart contracts, and software development.

(3) Economic Activities: 2,000,497 DOT ($15,261,619)

The expenditures for economic activities are straightforward, with Hydration and Stellaswap each receiving 1,000,000 DOT for liquidity incentives to be distributed over a year.

(4) Talent and Education: 704,270 DOT ($5,526,829)

① Talent and Education - Training and Hackathon expenditures: 637,612 DOT ($5,047,604), accounting for 90.5% of talent and education expenditures and 5.6% of total expenditures.

● Polkadot Blockchain Academy ($3,100,000)

● Other hackathon series expenses (ranging from $60,000 to $600,000)

(5) Operations: 451,280 DOT ($3,797,860)

① Operations - Governance: 262,950 DOT ($2,489,771), accounting for 58.3% of operations expenditures and 2.3% of total expenditures.

● Polkassembly ($1,800,000)

● OpenGov funding for a foundation in the Cayman Islands as a legal wrapper ($640,000)

② Operations - Data Services and Indexing: 45,235 DOT ($331,440)

● Indexing service Subsquid ($330,000)

● Subscan block explorer ($760,000)

③ Operations - RPC and Node: 49,226 DOT ($320,856)

(6) Research: 272,967 DOT ($2,127,425)

Research expenditures are the smallest cost category and mainly include:

● Data storage system chain ($690,000)

● Hiring a Chief Information Security Officer ($370,000)

● Increasing OG Tracker to investigate Treasury ($210,000)

Overall, there are 9 categories with expenditures exceeding 500,000 DOT, accounting for 63.2% of total expenditures. Among these, the outreach-advertising expenses, which focus on marketing, constitute 3 of these categories.

According to Google Trends, the price of DOT is significantly correlated with social media search interest. However, after experiencing a strong rally along with the broader market in early March, both the price and online interest have rapidly declined. Despite Polkadot's high marketing and advertising expenditures in the first half of this year, network and social activities remain sluggish. This is particularly evident after signing a major contract with Messi's Miami team in April.

Cash Flows

Currently, Polkadot is operating at a deficit. In the first half of 2024, the revenue was 2,887,002 DOT, while the expenditures amounted to 11,327,316 DOT, resulting in a net loss of 8,440,314 DOT for the half-year. The Polkadot Treasury holds 29,336,487 DOT in cash and cash equivalents. With the current monthly loss rate of 1,406,719 DOT, the liquidity of the Polkadot Treasury will be exhausted in 20.85 months.

More critically, from a USD standpoint, stablecoins account for less than 5% of the Polkadot Treasury's liquid cash, totaling $8,096,505 in USDT and USDC (equivalent to 1,265,080 DOT). At the current loss rate, this would not even last a month. While the Polkadot Treasury has some funds on paper, its actual liquidity and payment capability face significant short-term challenges, especially during market volatility.

Reference:

https://forum.polkadot.network/t/2024-h1-polkadot-treasury-report/8862

https://x.com/Polkadot/status/1800199814237364499

https://cryptoslate.com/polkadot-eyes-8-8-million-sponsorship-deal-with-lionel-messis-inter-miami/

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish