Quick Analysis: Why did FTX sell to Binance? What other obstacles are there? What are the implications for the future?

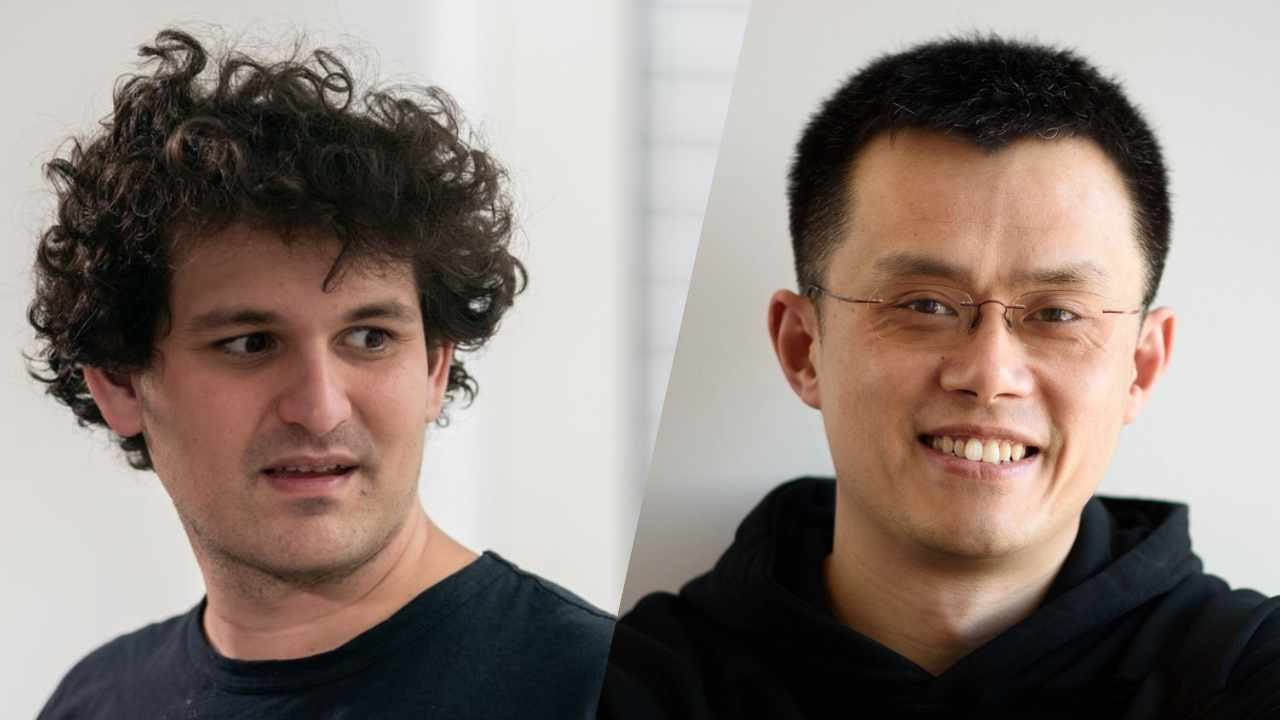

picture from bitcoin.com

On the afternoon of November 8 (UTC+8), the related hot wallets of FTX suddenly appeared strange, and almost no coins were transferred out in the past several hours. At the same time, the hot wallet of FTX US continues to transfer coins. Some people say: Is FTX about to issue an announcement (stop withdrawal)? But an historical announcement happened.

Binance founder CZ:

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire http://FTX.com and help cover the liquidity crunch. We will be conducting a full DD in the coming days. There is a lot to cover and will take some time. This is a highly dynamic situation, and we are assessing the situation in real time. Binance has the discretion to pull out from the deal at any time. We expect FTT to be highly volatile in the coming days as things develop.

SBF, founder of FTX, said:

e have come to an agreement on a strategic transaction with Binance for FTX.com (pending DD etc.). Our teams are working on clearing out the withdrawal backlog as is. This will clear out liquidity crunches; all assets will be covered 1:1. This is one of the main reasons we’ve asked Binance to come in. It may take a bit to settle etc. -- we apologize for that. FTX.us is not included.

At present, FTX is the second largest crypto ecosystem in the industry after Binance (even surpassing Binance in many places), but suddenly because of a report on Alameda + Binance’s announcement of selling FTT caused liquidity difficulties. The decision to sell the company to Binance greatly shocked the global industry and will become one of the most important and influential events in the history of cryptocurrency.

Arthur, founder of DeFiance Capital, stated that Given how little time it took to close this deal. It's likely Binance acquire FTX for nominal/negligible amount and assume all the liabilities. if I am previous round investor of FTX, I will probably start engaging litigation lawyer now.

What prompted FTX to make such an astonishing decision? There may only be one answer: FTX could not meet the user's withdrawal needs, FTX misappropriated the user's assets (such as short-term debt and long-term investment), and may even have caused it to fail to pay in large proportions. When the demand for coins withdrawal cannot be met, the misappropriation of assets or even the deficit is relatively confirmed. SBF's parents are professors at Stanford Law School, and he should be aware of the potential legal liability and the enormous impact on his personal reputation. SBF must not want to be the next SuZhu or Do Kwon.

Compared with 3AC Babel Celsius AEX, etc., FTX is actually not very different. The first moment of encountering a liquidity crisis is the need for external rescue. Therefore, there are also many rumors in the market that "Wall Street" is the backer/background of FTX. This is also incomprehensible to the people. With the background and resources of SBF and his team, is it impossible to find the white knight? We can only guess that the time is too tight (too late for complex negotiations), the hole is too large (traditional institutions may not be willing to invest), and SBF's own decision-making (maximizing comprehensive interests, mutual understanding of business), there may be part of the reason.

Of course, there are still many unknowns as to whether the acquisition will ultimately succeed. The first is whether the DD of Binance is successful, such as whether more problems will be found; the second is whether FTX will find other white knights while gaining time and confidence; the third is the US regulatory authorities and Whether regulatory authorities in other countries will take action, although both Binance and FTX theoretically have no US users, they are also under investigation by various US agencies. CoinDesk also pointed out that such acquisitions could violate antitrust laws.

If according to normal progress, Binance successfully acquires FTX, and SBF still holds FTX US and Alameda, what will be the impact? (Although it's too early to talk about it at the moment)

First of all, for Binance, the most powerful competitor is temporarily eliminated; OKX Huobi Bybit KuCoin, etc. will also benefit, and the global exchange is once again occupied by the Chinese(out of China). Competition will also continue to be fought among the Chinese; Secondly, there is great uncertainty in the future of SBF. Without FTX, we are not sure whether the Solana ecosystem he supports, as well as the current FTX US and Alameda can still show their strength in the industry. In the end, Binance’s bailout actually covered up the problems of FTX, and we may not see much progress in seeing better transparency, 100% reserves, etc.

Great post. Keep up the good work