Reveal the secrets of 3AC' 1 billion big creditor Voyager

Foreword: Voyager, 3AC’s sudden revelation of a $1 billion creditor, is a mystery. Its assets are huge, reaching $6.2 billion as of last year, largely from customer deposits. Voyager added 115, 000 customers in the first quarter but lost $61.44 million, according to the data. The vast majority of loans offered by Voyager are unsecured, but it believes that: based on its due diligence, it can confirm that the borrowers are quality financial institutions with sufficient funds to meet its obligations as they become due. BRIAN BROOKS, a director of Voyager, is the former Auditor General of the OCC and the former CEO of Binance US.

Voyager, through its U.S. operating subsidiaries, operates as a crypto asset broker that provides eligible retail and institutional customers with access to its digital platform to buy and sell crypto assets in one account across multiple centralized marketplaces. Voyager offers customers order execution, market data, wallet, and custody services through its proprietary digital platform. Voyager also launched the Voyager Loyalty Program for customers that hold a certain number of VGX tokens to unlock various tiers that offer token utility rewards, including VGX staking rewards, earnings reward boost, crypto back rewards, as well as refer-a-friend cash back rewards.

For the quarter ended March 31, 2022, total revenue was $102.7 million, up 70% year-over-year, but down 38% quarter-over-quarter. The net loss for the quarter was $61.44 million and adjusted EBITDA was $-53.5 million.

The company’s main business is to provide customers with services to purchase, sell or execute crypto asset orders, so the main operating income is transaction fee income. Voyager saw a decrease in transaction fee revenue in the first quarter due to the downturn in the crypto market. Transaction revenue was only $33.39 million in the first quarter, down 38% year-over-year. The company claims to follow through with strengthening and expanding its wallet payments business and has acquired Coinify to provides crypto payment solutions for both consumers and merchants around the globe.

The company’s second largest business is to earn fees from crypto assets lending activities with institutional borrowers. These lending agreements generally are on an unsecured and secured basis, either for a fixed term of less than one year or can be repaid on a demand basis. Interest income in the first quarter was $31.03 million, up 3.6 times from a year earlier, and the business is gradually replacing transaction. As you can see from the financial statements, the collateral is only about one-tenth of the total loan.

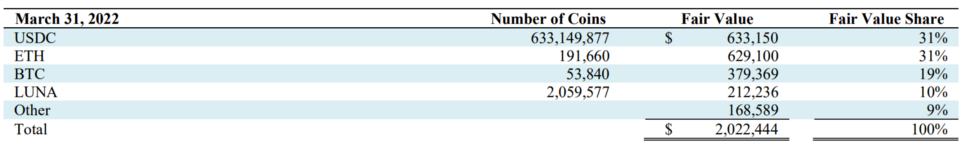

As of the first quarter, Voyager had the following accounts receivable in cryptocurrencies.

USDC, ETH, and BTC are the main ones, with a total value of $2 billion. The following 7 companies are the main applicants for loans, and the fee is based on the percentage of crypto assets lent and denominated in the related crypto asset.

According to the previous official announcement, the loans include 15,250 BTC and 350 million USDC from 3AC, with a total value of about $1 billion (estimated at the market price at the end of March), which represents half of the total. Although we have no way of knowing the exact identities of the seven companies, based on the amounts owed and the disclosed registered addresses of the companies (A in the British Virgin Islands and B in Singapore), it seems likely that both companies A and B are 3AC.

3AC’s official website also indicates the terms and conditions. These Terms and Conditions shall be governed by and construed in accordance with BVI law. The BVI courts shall have non-exclusive jurisdiction over all claims or disputes arising in relation to, out of or in connection with, the Site, its use and these Terms and Conditions.

In addition, as of March 31, 2022, Voyager holds 25,000,000 BTC, 270 million ADA, 170 million VGX, and a host of other cryptocurrencies with a total value of $3.43 billion. So Voyager has $5.68 billion in crypto assets held and receivable, which is almost all of its assets. Voyager had $6.22 billion in assets and $5.9 billion in liabilities, including $5.68 billion in crypto assets held by customers, according to last year’s annual report. It added 115,000 customer accounts in the first quarter, mostly in North America, and hired four-time Super Bowl champion Rob Gronkowski as an ambassador.

We can think of Voyager as a bank that takes in depositors’ crypto assets and provides basic operations such as transfers and transactions, while also lending deposits to other institutions to earn interest. Analyzing from this perspective, we can measure the level of risk by two indicators, one is the reserve ratio and the other is the bad debt ratio.

Voyager has a reserve ratio of 60.4% (34.3/56.8), which is a pretty safe number for a bank to run on. But companies like Voyager have less tolerance for risk than banks, so it makes sense to keep more reserves.

As for bad debts, it is safe to have a bad debt rate of 5% or less for general corporate and bank’s short-term loans (within one year), while Voyager’s short-term loans (3AC needs to be repaid by June 27 this year) have a bad debt rate of 50%, which is very dangerous.

Because of its business model, Voyager faces significant regulatory scrutiny in the U.S. Its quarterly disclosure states that between March 29, 2022 and April 13, 2022, the company received suspension and closure orders from state securities departments in Indiana, Kentucky, New Jersey, Oklahoma and South Carolina, as well as similar orders or notices from the states of Alabama, Texas, Vermont and Washington. Texas, Vermont, and Washington. These orders typically claim that the company engages in unregistered securities or investment activities through rewards programs that allow customers to receive rewards from their eligible crypto asset balances.

Ironically, in each financial report Voyager emphasizes that based on its due diligence, the Company believes that the borrowers are high quality financial institutions with sufficient funds to meet their obligations as they become due. The Company’s due diligence process for its lending activities may include a review of the borrower’s financial condition, the borrower’s level of liquidity among applicable assets, a review of the borrower’s management, a review of certain internal control procedures of the borrower, a review of market information, and monitoring of the Company’s risk exposure thresholds. The Company’s Risk Management Committee meets regularly to evaluate and monitor the credit risk of each counterparty.

In December 2021, BRIAN BROOKS, who served as Coinbase’s Chief Legal Officer, OCC’s Auditor General, and Binance US’s CEO, joined Voyager’s Board of Directors.

In response, Voyager officially announced on the 22nd that the 24-hour withdrawal limit has been changed from $25,000 to $10,000, and a maximum of 20 withdrawals will be allowed.

At the same time, an agreement was signed a non-binding term sheet with Alameda Research to secure a revolving line of credit providing Voyager with access to further capital. The term sheet with Alameda Research provides for revolving term credit facilities each having a term expiring December 31, 2024, and having an annual interest rate of 5% payable on maturity. The first credit facility is a cash/USDC-based credit facility with an aggregate principal amount of US$200 million. The second revolving credit facility is for 15,000 in Bitcoin (BTC). The credit facilities will only be used by Voyager if needed to safeguard customer assets. The move could solve the short-term liquidity crisis, but if 3AC never pays its debts, Voyager’s sword of Damocles will be up in the air.

SBF-controlled Alameda became a shareholder as early as 2021. The Company is issuing a total of 7,723,996 common shares to Alameda Research at a price of US$9.71 per common shares. In October 2021 Voyager issued and sold 7,723,996 shares of the Company’s common stock to Alameda Research Ltd. at a price of $9.71 for an aggregate purchase price of $75 million. The transaction was completed on November 22, 2021.

2022, First Quarter, MD&A: https://www.investorx.ca/doc/2205160432437296

2021, Financial Report: https://www.investorx.ca/doc/2202141905159335

3AC’s notice of default: https://www.prnewswire.com/news-releases/voyager-digital-provides-market-update-301572971.html

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish