Solana's Staking Volume Surpasses ETH:Does This Mean Its Security Exceeds Ethereum's?

By @0x_Todd

Intro

A post about the staking volume of Solana (SOL) and Ethereum (ETH) has sparked widespread discussion in the crypto community recently.

The post points out, “Solana’s staking volume has surpassed ETH. Does this mean the security of the Solana chain has surpassed that of Ethereum?” The question has sparked a lot of discussion and misunderstanding, with many even believing it to be true.

However, the truth is not so simple. This article will reveal the truth by the following points.

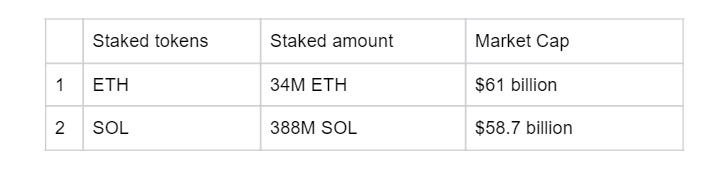

Comparison of Staking Data

(Data source: Beaconcha & Solana Beach).

Similarity in attack thresholds and practical difficulty

Both Solana and Ethereum use the Proof of Stake (PoS) mechanism, and theoretically, their attack thresholds are roughly the same, around 33%.

Specifically:

● 33% can prevent block generation.

● 51% can create the longest chain, leading to a chain fork.

● 67% is enough to execute a double-spending attack.

However, in terms of practical difficulty, attacking ETH is significantly harder than attacking Solana.

PS: Of course, assuming the success rate of attacking SOL is 0.001%, the difficulty of attacking ETH might be 0.0001%. While there is a significant difference, it’s important to note that both remain extremely low-probability events.

The reasons for the difference are

(1) Node centralization

(2) The maturity of staking infrastructure

1. The Impact of Node Centralization

In a blockchain’s PoS mechanism, the distribution of nodes is one of the key factors determining security.

Let’s assume a scenario: a skilled hacker exploits a 0-day vulnerability and successfully breaches the data centers of Amazon and major cloud service providers.

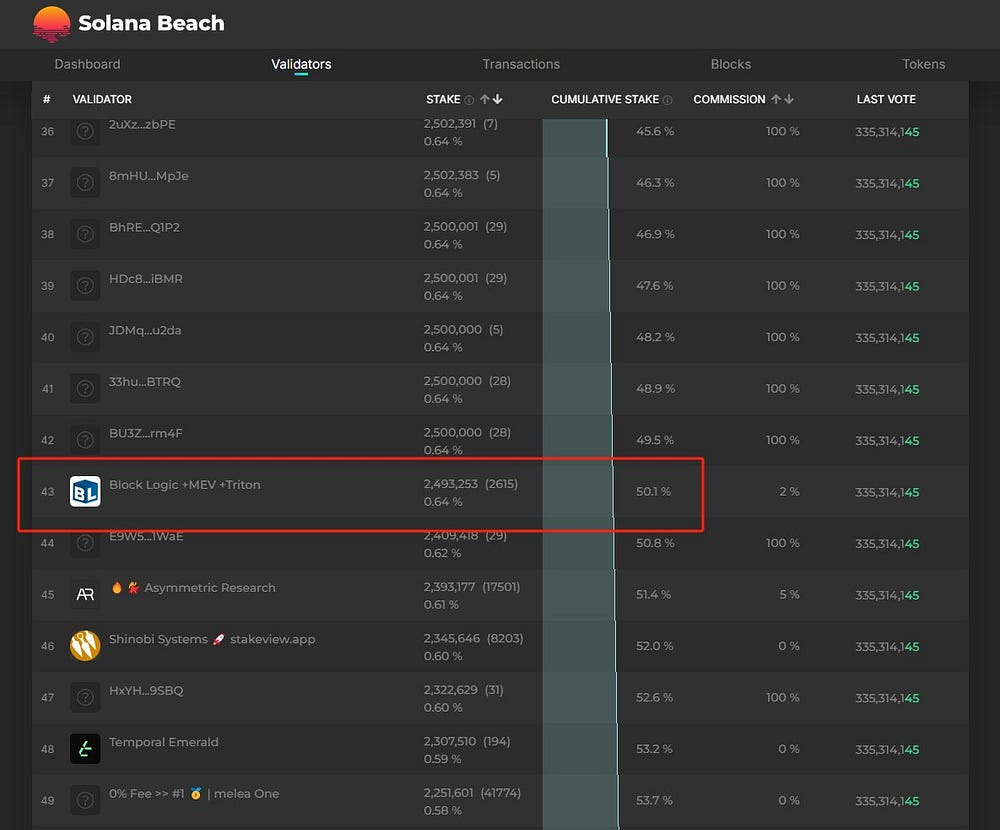

Then, controlling over 50% of the Solana network’s nodes would require taking control of the first 43 nodes. While this situation is unlikely, it still remains a theoretical possibility.

In contrast, Ethereum’s network nodes appear to be more decentralized.

Each Ethereum node can stake a maximum of 32 ETH, so to control over 51% of Ethereum’s nodes, an attacker would need to control 1.187 million nodes. For an attacker, this is nearly an impossible task.

Of course, this wouldn’t be fair to Sol, because essentially, ETH is also operated by numerous node operators, and a single entity might own thousands of nodes.

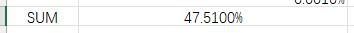

So, based on the operators listed on Rated…

You’ll find that all the ETH node operators listed together only account for 47.5%, not even close to the 50% threshold. It is still an impossible task.

The reason is that ETH, as an ancient blockchain, has truly experienced PoS attacks from the early days. It has made extensive preparations to prevent this potential risk, such as encouraging retail investors to participate in staking.

Ethereum’s 32 ETH staking threshold is not high, whereas Solana has high server requirements, with monthly costs 5–10 times higher than ETH, and this is just the entry-level. Therefore, for retail investors to break even, they would need to stake at least 10K SOL, and the yield would still be lower than Jito’s.

2. Differences in Infrastructure Maturity

In addition to node distribution, the maturity of infrastructure is also a key factor affecting network security.

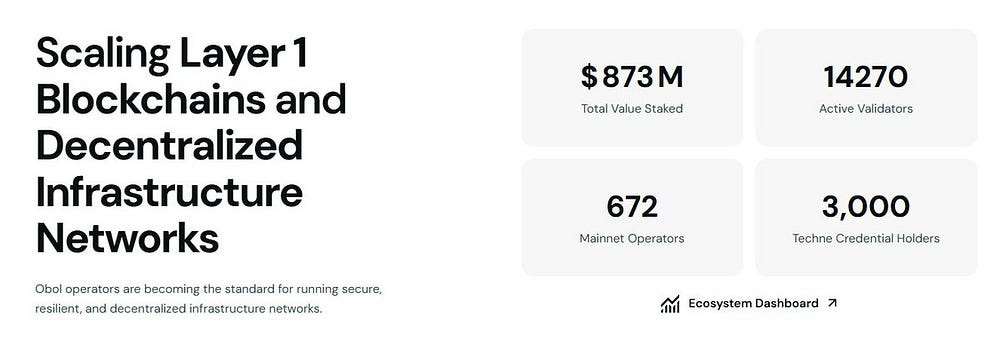

Ethereum’s staking infrastructure is relatively mature, with multiple projects like Lido and Obol providing strong support for its staking ecosystem.

For example, Lido requires node operators to reduce the use of Amazon data centers and use more niche data centers.It also encourages using fewer mainstream clients and supporting more niche clients. Additionally, Lido has allocated 4% of ETH specifically for DVT infrastructure, such as Obol and SSV.

In the case of Obol, it uses Distributed Validator Technology (DVT), allowing multiple nodes to jointly manage one staking node rather than a single entity, providing enhanced security.

For example, if 4 people jointly manage a node, you can set it to a 3/4 configuration, so that if one node goes offline, the other nodes can immediately take over.

If you set it to 10, you can configure it to 7/10, allowing up to three nodes to go offline.

Note: In ETH and most PoS chains, going offline is also considered a form of “malicious behavior.” If 33% of the nodes go offline, the chain will collapse.

Moreover, what makes Obol unique is that it implements the cluster through a single client, so your private key (fragments) are not uploaded to the blockchain, enhancing security. This is achieved through DKG (we can discuss DKG in more detail later).

Currently, infrastructure projects like Obol, which are specifically designed for ETH staking, are not available for Solana. As a result, Solana’s staking infrastructure is relatively weaker.

Conclusion

Of course, this article is not about praising one and criticizing the other. Both are highly secure blockchains. While Solana’s staking volume is on par with Ethereum’s, in terms of actual security, Ethereum has made significant optimizations in PoS mechanism design and infrastructure, ensuring decentralization and resistance to attacks due to differences in node centralization and infrastructure.

Both chains have their strengths and weaknesses in security, but for now, Ethereum still holds a certain advantage in chain security.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish