The Algorithmic Arms Race Between CEX and DEX: Hyperliquid's Shield vs. the Spears of Binance and OKX

Original Author: danny (@agintender)

Compiler:WuBlockchain Aki Chen

Original Source Link:

https://x.com/agintender/status/1938445355118649745

Disclaimer: This article is a reposted piece. Readers may refer to the original source for more information. If the original author has any objections to the form of reposting, please contact us and we will make modifications as requested. The repost is intended solely for information sharing and does not constitute any investment advice, nor does it represent the views or positions of Wu Blockchain.

The total assets held on centralized exchanges (CEXs) are a hundred times greater than those on decentralized exchanges (DEXs), and their trading volume is ten times higher. So how does Hyperliquid ensure that it isn't led by the nose by Binance? Is it due to its decentralized architecture? Or its algorithm?

When we talk about "decentralized" exchanges, what exactly do we mean? Which components actually need to be decentralized—assets, matching engine, pricing mechanism, or clearing process?

Introduction: A Contract Storm Unleashes the Clash Between Centralization and Decentralization

In March 2025, the JELLYJELLY contract triggered a market frenzy on Hyperliquid.

Within just a few hours, its price surged by 429%, nearly setting off a wave of liquidations. Had those liquidations occurred, the resulting short positions would have been pushed into the on-chain liquidity pool HLP, leading to unrealized losses in the tens of millions of dollars.

With on-chain positions teetering on the edge and the community in an uproar, Binance made a rare late-night move—listing JELLYJELLY perpetual contracts overnight. It looked like a coordinated blow from centralized exchanges was about to hit.

At the brink of a meltdown, Hyperliquid validators intervened through an emergency vote, forcibly delisting the contract, liquidating positions, and freezing trading. The dramatic intervention left many questioning: can this still be called a "decentralized" exchange?

This incident not only became a hotly debated topic within the crypto community, but also exposed a fundamental question:

On a decentralized trading platform, what truly determines the price? Who ultimately bears the risk? And are algorithms genuinely neutral?

Using the JELLYJELLY event as a starting point, this article will dissect the algorithmic differences among three major platforms in the core mechanisms of perpetual contracts—index price, mark price, and funding rate—and explore the financial philosophies and risk transmission models behind them.

You'll see how different algorithmic designs shape different trading styles, serve different types of market participants, and ultimately determine whether you can walk away unscathed in a market storm.

This is not just a technical autopsy of a contract mechanism—it is a philosophical showdown over how market order is designed.

Overview of Perpetual Futures Trading

Before diving into the core discussion, let's first clarify the three foundational components of perpetual futures trading:

● Index Price: Tracks price movements in the spot market and serves as the "theoretical anchor." On Hyperliquid, this is referred to as the Oracle Price.

● Mark Price: The decisive price used to calculate unrealized profit and loss, liquidation thresholds, and other critical events.

● Funding Rate: An economic mechanism that connects the spot and perpetual markets, guiding the contract price back toward spot through periodic payments.

Detailed Background:https://x.com/agintender/status/1937104613540593742

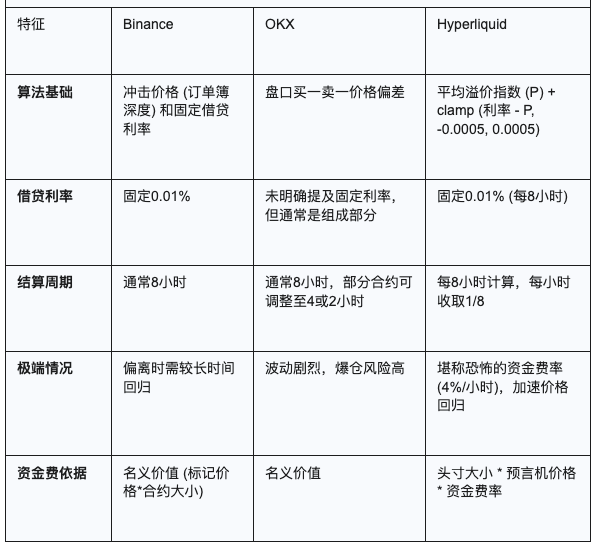

Overview of how the three platforms handle index price, mark price, and funding rate algorithms:

Conclusion:

1. Whoever controls the mark price essentially holds the power of life and death over a perpetual contract. That's why the core of Hyperliquid's "decentralization" lies in ensuring that the mark price is both resistant to manipulation and publicly verifiable.

2. Hyperliquid builds upon Binance's pricing algorithm but introduces key optimizations to ensure that prices quickly revert to fair market value—even under extreme market conditions or when there is attempted manipulation within the Hyperliquid venue itself.

3. To guard against anomalies and price wicks, Hyperliquid has clearly gone to great lengths.

The Devil Truly Lies in the Details

A. Index Price / Oracle Price Comparison

On Hyperliquid, the index price is referred to as the oracle price. It is entirely independent of the platform's own market data and is constructed by validator nodes. To mitigate extreme price volatility, Hyperliquid uses a weighted median algorithm, making the price feed more resistant to manipulation—especially to price wicks. However, this comes with a relatively low update frequency (once every 3 seconds).

Put plainly, the system is designed to filter out outliers and short-term volatility, resulting in a smoother price curve. In this context, "slower" updates are not necessarily a drawback—they serve as a deliberate smoothing mechanism.

One more point: due to the latency in price updates, Hyperliquid has become a playground for a number of clever quant traders who seek to exploit those short time windows.

B. Mark Price: Mechanism Differences and Algorithmic Details

Binance's mark price algorithm is built on two core principles: price smoothing and market depth representation. The formula is based on the median of three key prices: the mid-price between the best bid and ask on the contract market, the last traded price, and the impact price (both bid and ask).

The impact price simulates the execution of large market orders to measure how deeply they would penetrate the order book. This helps reflect the true cost of liquidity and prevents the system from being misled by "fake prices" arising from thin books.

By combining these median values with an Exponential Moving Average (EMA), Binance constructs a mark price that is both stable and resistant to price wicks. This design is particularly suitable for large capital deployment and institutional-grade arbitrage strategies.

In contrast, OKX adopts a more aggressive approach: it uses only the mid-price between the best bid and ask in the order book as the source for its mark price. This algorithm does not take into account trade execution prices or order book depth, making the mark price extremely sensitive to small trades and vulnerable to large orders that sweep through the book, causing sharp price movements.

While this design leads to higher volatility, it also allows prices to revert to spot more quickly. As a result, it is better suited for high-frequency traders, wick hunters, and short-term speculative strategies.

Hyperliquid's mark price mechanism can be seen as a hybrid of Binance and OKX. From a data sourcing perspective, it exhibits decentralized characteristics, as the mark price is calculated and maintained by a network of validator nodes.

These nodes aggregate inputs from three primary sources to determine the mark price:

The 150-second Exponential Moving Average (EMA) of the spread between the Oracle Price and the contract mid-price on Hyperliquid.

The median of Hyperliquid's own best bid, best ask, and last traded price.

A weighted median of mid-prices from perpetual contracts listed on several centralized exchanges (CEXs)—including Binance, OKX, Bybit, MEXC, and Gate—with respective weights of 3, 2, 2, 1, and 1.

If any two of the three mark price inputs fail, the system will substitute them with a 30-second EMA-processed median as a fallback.

On-chain validators are responsible not only for regularly updating the Oracle Price and Mark Price, but also for verifying the integrity of input sources, including timestamp consistency and tolerance for price deviations. This setup forms a certain level of algorithmic democracy on Hyperliquid: neither the platform nor the validators can arbitrarily override the mark price logic, significantly enhancing resistance to manipulation.

Given that the mark price is the sole standard for determining unrealized PnL, liquidation, and forced closures, protecting its integrity is paramount.

At its core, Hyperliquid's decentralization isn't about on-chain matching engines or decentralized accounts—it's about sending a clear message:

"We cannot change the Mark Price to hunt your position."

C. Funding Rate Algorithms and Market Behavior Feedback Mechanisms

As the economic lever that connects perpetual contracts to the spot market, the funding rate plays a critical role in adjusting price discrepancies between the two. It helps guide the market toward self-correction. Across the three platforms, the funding rate mechanisms reflect fundamentally different algorithmic paths and trading philosophies.

Hyperliquid builds its funding rate model on the base structure used by Binance—combining impact price (which accounts for order book depth) and an interest rate model—but introduces a key innovation: a Premium Index, similar to what is seen on Bybit and Bitget. In doing so, Hyperliquid replaces the Oracle Price with a pricing input that is more market-reflective—a practice also adopted by Bybit and Bitget, which use the index price instead.

After all, under the same notional order book depth, the significance of liquidity when price is at 1 USDT is vastly different from when it spikes to 3 USDT or drops to 0.5 USDT. Hyperliquid's adjustment acknowledges this nuance, aiming for a more responsive and representative funding mechanism.

The Premium Index is sampled every 5 seconds and averaged over a rolling one-hour window—resulting in 720 samples per hour. This helps smooth out short-term volatility and wick-induced distortions. The borrowing rate is fixed at 0.01%.

But is this algorithm without flaws or limitations? Not quite. When there is a significant divergence between the contract price and the spot price, the mechanism can take a relatively long time to correct—a behavior similar to what is seen on Binance.

However, unlike Binance, Hyperliquid lacks deep capital pools and arbitrage liquidity, which means prices may not revert quickly on their own. To address this shortcoming, Hyperliquid introduces three distinctive design mechanisms that are unique to its platform.

The first is Hyperliquid's aggressive funding rate, which can spike to 4% per hour under extreme conditions—equivalent to 96% per day. Notably, the rate's frequency and cap do not dynamically adjust based on asset volatility or market behavior. This creates the potential for severe funding costs in volatile markets.

The second feature is that the funding rate is calculated based on the Oracle Price, rather than the Mark Price. This design aims to prevent manipulation: even in scenarios where the on-platform price is artificially distorted and arbitrageurs are absent, the funding mechanism can still gradually drive the contract price back to reality through sustained incentives.

The third feature lies in how funding is collected. While the algorithm computes the rate on an 8-hour basis, it is actually charged incrementally every hour at one-eighth of the total.

For example, if the 8-hour funding rate is 0.1%, then longs will pay shorts 0.0125% per hour.

This "small steps, fast cadence" model accelerates the convergence between contract and spot prices—offsetting the limitations of Binance-style depth-based pricing mechanisms.

In contrast, Binance's funding rate relies on a relatively long settlement interval (typically every 8 hours). The rate is calculated based on impact bid/ask prices, which simulate large market orders against the order book depth, and also factors in a fixed interest rate of 0.01%. This structure is designed to offer smoother and more predictable funding costs, catering to institutional investors and medium-to-long-term strategies.

On the other hand, OKX employs a simpler funding rate model, which is calculated purely based on the spread between best bid and ask prices. While it also uses an 8-hour settlement interval, it does not incorporate order book depth or borrowing costs, making the rate highly volatile. This suits high-frequency and short-term speculative traders, but also introduces a greater risk of liquidation due to more frequent funding swings.

Hyperliquid can be seen as striking a balance between Binance's market structure and OKX's market orientation. It combines a relatively stable algorithmic base—built on order book depth and a premium index—with high-frequency funding settlements and off-chain oracle pricing, supplemented by aggressive funding rates in extreme scenarios. This allows prices on Hyperliquid to rapidly revert to fair market value during periods of high volatility.

These algorithmic differences across the three platforms have led to profound impacts on real-world trading behavior.

One final point worth noting: these three mechanisms collectively give the HLP vault a significant edge, contributing to a positive feedback loop that reinforces its performance. A separate, in-depth piece will explore the strategic importance of the HLP vault within the Hyperliquid ecosystem.

Algorithms Define Destiny: Platform-Specific Strategies and the Financial Philosophies Behind Them

If the perpetual futures market is a silent battlefield, then each platform's pricing algorithm, liquidation logic, and funding mechanism represent its unique doctrine of engagement.

Three platforms. Three philosophies. Three types of traders.

Each reflects a distinct view of financial literacy and market values—emerging from the tension between system design and human behavior.

To reiterate: there is no absolute right or wrong in models and algorithms—only gains and losses, outcomes and trade-offs.

Binance: The Design of an Institutional Rationalist

(Inspired by Quantitative Finance and the Efficient Market Hypothesis)

Binance's overall architecture leans toward institutionalization and moderation, guided by a core philosophy: making the market predictable.

This approach aligns closely with the spirit of quantitative finance and the Efficient Market Hypothesis (EMH)—which assumes that markets are largely rational and can be modeled, measured, and ultimately tamed through statistical systems.

Mechanism in Practice

● Mark Price Smoothing Mechanism:

By incorporating medians, moving averages, and the concept of impact pricing, Binance ensures that its mark price remains stable and resistant to manipulation. This reduces the risk of forced liquidations caused by sudden price spikes and provides predictable liquidation thresholds for large capital, enabling more robust position management.

● Fine-Grained Funding Rate Modeling:

The funding rate is derived from a combination of order book depth simulations (modeling the cost of large market orders) and a fixed borrowing interest rate. This structure aims to offer smooth and predictable funding costs. The relatively long settlement interval (typically every 8 hours) further reduces the impact of short-term funding volatility on medium- and long-term strategies.

● Risk Buffering Mechanism:

Binance maintains a large insurance fund to cover losses from bankrupt positions. When the fund is insufficient, the Auto-Deleveraging (ADL) mechanism is triggered. These layered safeguards act as systemic buffers, preemptively addressing potential failure points that could lead to market-wide contagion. The goal is to minimize socialized losses under extreme conditions.

● Market Behavior Feedback:

This robust modeling philosophy attracts institutional investors and medium-to-long-term traders who seek stable returns and controlled risk exposure. Such participants rely on the clarity and predictability of market rules, leveraging quantitative models and arbitrage strategies to achieve steady capital growth in a relatively stable environment.

Binance's system is fundamentally designed for institutional rationalists—those who believe that markets can be modeled, managed, and predicted through rigorous mathematics and structured systems.

OKX: The Design of a Trading Instinctualist

(Rooted in Behavioral Finance)

OKX's strategic design can be characterized as fast, aggressive, and precise—driven by a philosophy that "the market is a reflection of human nature."

This aligns closely with the logic of behavioral finance, which embraces the idea that markets are not always rational, and that traders are often emotional and reactive.

In this framework, the truly savvy participant isn't the one who builds smoothing models, but the one who pierces through those assumptions, seeking opportunities in volatility and exploiting the psychological dynamics of the crowd.

Mechanism in Practice

● Sensitivity of Mark Price:

When the mark price is primarily derived from the midpoint between best bid and ask, it becomes highly sensitive to small trades and is prone to sharp swings when large orders sweep through the order book. This design accelerates price discovery, but also introduces greater uncertainty in liquidation thresholds.

● Volatility of the Funding Rate:

OKX's funding rate algorithm is relatively simple and lacks comprehensive consideration of order book depth, making the rate highly volatile. Although OKX has attempted to shorten the settlement intervals for some contracts—from 8 hours to 4 hours or even 2 hours—to improve responsiveness, this has only amplified its inherent volatility.

● Liquidation Mechanism:

OKX employs a direct and rapid liquidation process, designed to quickly remove risk-bearing positions from the system.

● Market Behavior Feedback:

This setup naturally attracts high-frequency traders (HFTs), wick hunters, and short-term speculators.

These participants don't fear volatility—they depend on it. For them, profit arises from price dislocations, not from stability. They specialize in detecting fleeting price inefficiencies and exploiting shallow order books for fast arbitrage or speculative gains.

OKX's system is built for trading instinctualists—those who believe that markets are inherently irrational, and who thrive in the chaos of rapid, high-stakes decision-making.

Hyperliquid: The Design of an On-Chain Structuralist

(Rooted in Institutional Structuralism and the "Code is Law" Paradigm)

Hyperliquid aims to build an entirely new financial paradigm—decentralized governance combined with programmable pricing mechanisms. Its core philosophy is that algorithms are not meant to predict the market, but to define its order.

Rather than functioning as a conventional exchange, Hyperliquid operates more like a financial protocol deployed on-chain. Prices are determined through validator consensus, liquidations are backed by the HLP Vault, and all trading data is publicly recorded on-chain.

There is no room for platform-level opacity, and the exchange is explicitly barred from interfering in price formation or position management.

One point worth emphasizing: privacy always comes at a cost.

In essence, it's a trade-off between your identity and your position transparency.

If you choose to conceal your identity, then your asset balances and open positions must remain fully visible. If you prefer to hide your positions, then your identity must be known and verifiable.

Whether centralized or decentralized, there is no inherent superiority—only what fits your needs.

Mechanism in Practice

● Validator-Consensus Pricing:

Both the index price and the mark price are constructed by a decentralized network of validator nodes, aggregating data from multiple CEXs and applying methods such as weighted medians to enhance resistance to manipulation. The pricing logic is enforced via on-chain consensus, making it tamper-proof and further strengthening its integrity.

● HLP Vault as Backstop:

The Hyperliquid Liquidity Pool (HLP Vault) serves as a protocol-level mechanism for both market-making and liquidation support. Its purpose is to democratize institutional-grade strategies and provide shared liquidity for liquidation events—a model where the community collectively bears both risk and reward.

● High-Frequency Funding with Extreme Caps:

The funding rate algorithm combines order book depth and external oracle pricing, and is charged incrementally—⅛ of the 8-hour rate every hour. In extreme scenarios, the funding rate can spike to 4% per hour, accelerating price convergence. This design acts as an algorithmic correction force, while simultaneously giving the HLP Vault a positive feedback loop, reinforcing the growth of the liquidity pool.

● On-Chain Transparency:

All trading data and liquidation processes are publicly recorded on-chain, aiming to eliminate the black-box practices often associated with centralized exchanges.

● Market Behavior Feedback:

Hyperliquid embodies a financial philosophy rooted in institutional structuralism—the belief that even in a chaotic world, a market order can be established if algorithmic rules are transparent and immutable.

It appeals to traders who seek to rebuild trust through verifiable code and distributed governance.

However, the JELLYJELLY incident exposed the inherent tension within this philosophy:

While the logic behind the mark price was designed to be non-modifiable, a governance-level intervention—validator voting—was ultimately triggered to override protocol behavior during a systemic crisis.

This reveals that in extreme conditions, the principle of "code is law" must still confront the practical limits of human discretion.

In summary:

Binance is designed for institutional rationalists—rule-based, predictable, and ideal for steady capital growth.

OKX is built for trading instinctualists—fast, aggressive, and suited for speculators and tactical operators.

Hyperliquid caters to on-chain structuralists—algorithm-driven, built for on-chain arbitrageurs and high-capital, high-leverage strategists.

Conclusion: At the End of Every Algorithm Lies the Human Heart

Price is the surface of trading; algorithm is its structure.

But whether it's Binance's institutional buffering, OKX's behavioral volatility, or Hyperliquid's on-chain consensus, they are all trying to answer the same fundamental question:

How do we trust a market we cannot see?

Some systems choose stability as their anchor, promising that the rules will never change.

Others anchor themselves in volatility, believing that traders will always adapt to risk.

And then there are systems that attempt to encode everything into on-chain contracts—not relying on humans, but on transparent code, distributed nodes, and emotionless formulas.

Yet when the market enters extreme conditions, algorithms step aside—and humans must step in.

The JELLYJELLY crisis reminded us that even the most decentralized systems sometimes require a temporary central bank to absorb risk; that even the most neutral consensus cannot fully eliminate disputes over what is "fair."

In the end, price is not determined solely by algorithms—but by whom we choose to trust.

Perhaps we cannot design a perfect system.

But we can strive to build one that is capable of self-correction in the face of imperfection.

Binance mitigates uncertainty through institutional buffers.

OKX channels market energy through competitive dynamics.

Hyperliquid seeks to forge a new consensus through governance and transparency.

There is no absolute right or wrong—only different choices.

After all, no perfect design exists.

In the financial world of the future, algorithms will continue to expand their territory.

But we must recognize this: every line of code embeds a value judgment behind its logic.

You demand freedom—until you're liquidated, and then you ask for fairness.

You demand fairness—until you're liquidated, and then you ask for transparency.

You demand transparency—but when liquidation comes, you want to control everything.

In the end, what you're chasing isn't price—it's the illusion of order.

And humans must always take responsibility for their own values.

Let us approach the market with humility.

Be like a Fujianese.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish