The On-Chain Bretton Woods System: Stablecoins, U.S. Treasuries, and a New Architecture for the 21st-Century Dollar

Author:宏观对冲付鹏

Original Link:

https://mp.weixin.qq.com/s/BANJpg2ELQB_WhNPxl1wKA

In the new wave of digital finance, stablecoins are not disruptors of the old system but rather “digital relays of the Bretton Woods system” — carrying the credit of the U.S. dollar, anchored to U.S. Treasury assets, and reshaping the global settlement order.

I. Historical Retrospective: Three Structural Leaps of Dollar Hegemony

After 2020, a new phase began — digitizing, fragmenting, and programming the dollar’s credit foundation. Stablecoins are the key connective tissue of this reconstruction.

II. The Nature of Stablecoins: An On-Chain USD–Treasury Anchor Mechanism

Stablecoins — particularly USD-pegged ones like USDC, FDUSD, and PYUSD — are issued based on a mechanism of “on-chain dollar certificates backed by cash or Treasuries,” effectively forming a simplified “Bretton-like system”:

This shows that the stablecoin system has essentially rebuilt a “digital Bretton Woods framework” — with the anchor shifting from gold to Treasuries, and settlement shifting from sovereign systems to blockchain consensus.

III. The Role of U.S. Treasuries: A New “Digital Reserve Gold” Behind Stablecoins

In the reserve structures of mainstream stablecoins, short-term U.S. Treasuries (1–3 month T-Bills) dominate:

● USDC: Over 90% of reserves are in short-term Treasuries and cash

● FDUSD: 100% in cash and T-Bills

● Tether: Increasing its Treasury allocation while reducing commercial paper exposure

▶ Why have Treasuries become the “hard currency” of on-chain finance?

● Extremely liquid — suitable for large on-chain redemptions

● Yield-generating — issuers can earn spreads

● Backed by U.S. sovereign credit — enhancing market confidence

● Regulatory-friendly — qualify as compliant reserve assets

From this perspective, stablecoins are “new Bretton tokens” backed not by gold but by T-Bills — embedding U.S. fiscal credit into the token economy.

IV. Stablecoins = Dollar Sovereignty Extension, Not Erosion

While stablecoins are issued by private entities and may appear to weaken central bank control, in practice:

● Every USDC must be backed 1:1 by Treasuries or cash

● Every on-chain transaction is denominated in U.S. dollars

● Every instance of global stablecoin circulation expands the dollar’s usage radius

This enables the U.S. to “airdrop” dollars into global wallets without SWIFT or military projection — a new paradigm of outsourced monetary sovereignty.

Thus, we argue:

Stablecoins are the “unofficial contractors” of U.S. monetary hegemony — not replacing the dollar, but pushing it on-chain, global, and into unbanked regions.

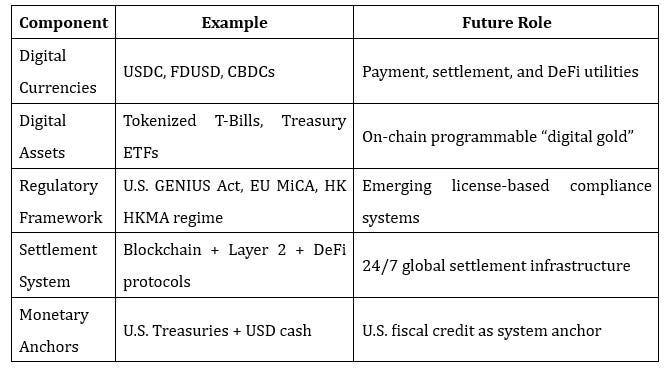

V. Bretton 3.0 Emerging: Digital Dollars + On-Chain Treasuries + Programmable Finance

This new architecture points to a future global financial model:

This implies: The next Bretton Woods will be negotiated not in conference rooms, but in smart contracts, asset pools, and API interfaces.

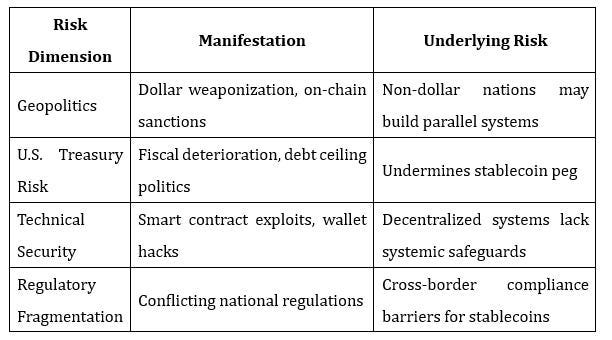

VI. Risks and Uncertainties: How Far Can This System Go?

VII. Conclusion: Stablecoins Are Not the End, but a Midfield Supply Station in Dollar Governance

Although often viewed as private innovations, stablecoins are quietly becoming a strategic bridge in the U.S. digital currency agenda:

● Bridging old finance (Treasuries) and new finance (DeFi)

● Extending U.S. financial sovereignty to smart contract layers

● Preserving dollar dominance in the digital age

Just as the original Bretton Woods established dollar credit through gold backing, today’s stablecoins aim to reengineer monetary governance through “on-chain T-Bills + dollar-denominated settlement consensus.”

Stablecoins are not a revolution — they are a reconstruction of Treasuries, a reconfiguration of the dollar, and an extension of sovereign power.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish