VC Jan Report, the number of fundraising projects increased by 12%, while the amount decreased by 29%

Author: WuBlockchain

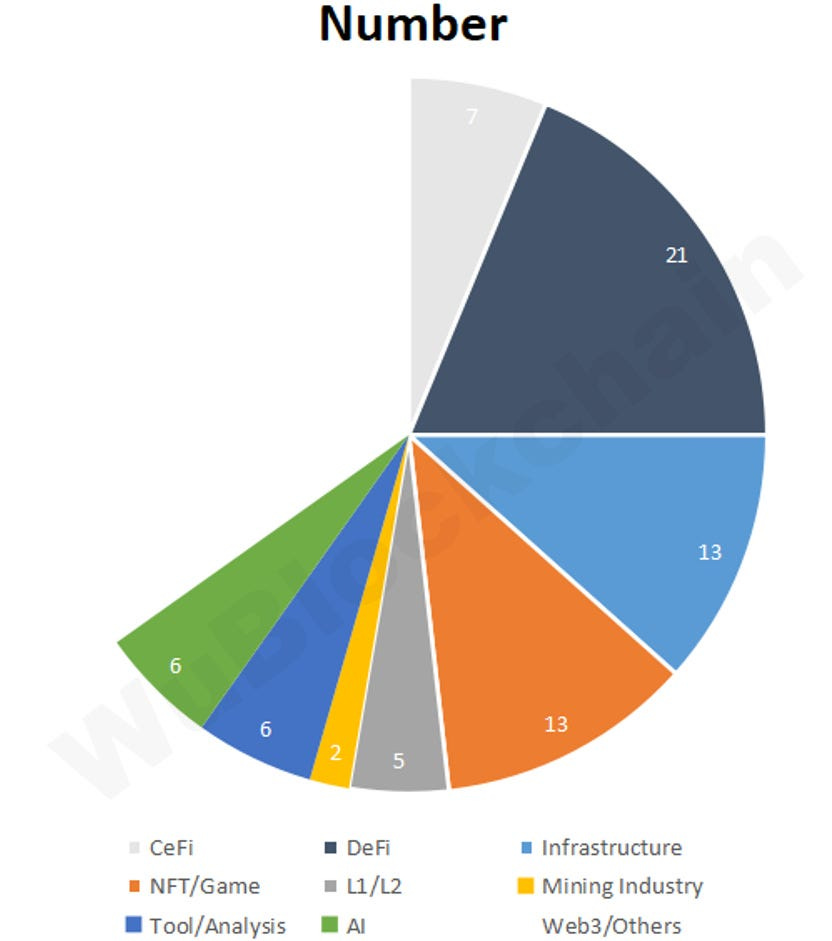

According to RootData’s statistics, there were a total of 113 publicly disclosed investment projects in the crypto venture capital space in January, representing a month-on-month increase of 10.8% (from 102 projects in December 2023) and a year-on-year increase of 1.8% (from 111 projects in January 2023). Note: Since not all fundraisings are disclosed in the same month, the above statistics may increase in the future. The industry-level classification is as follows:

Among the various industries in the crypto market in January, the financing proportion of infrastructure projects was approximately 12%, DeFi approximately 19%, CeFi approximately 6%, NFT/GameFi approximately 12%, and L1/L2 approximately 4%.

The total fundraising amount in January was $650 million, representing a month-on-month decrease of 28.6% (from $910 million in December 2023) and a year-on-year increase of 3.2% (from $630 million in January 2023). The top 10 rounds by amount are as follows:

HashKey Group has completed its Series A funding round, raising nearly 100 million dollars with a pre-money valuation exceeding 1.2 billion dollars. Its core businesses also include HashKey Capital, a global asset manager investing exclusively in blockchain technology and digital assets; HashKey Cloud, a blockchain node validation service provider; HashKey Tokenisation, tokenisation services provider; and HashKey NFT, Web3 PFP incubation and community operation service provider, among others.

Cryptocurrency mining company Core Scientific announced the final results of its $55 million equity offering (ERO), which was oversubscribed. The restructuring of Core Scientific shares will be proportionally allocated based on the $55 million limit and the quantity of Core Scientific shares subscribed by each participant. Due to the successful fundraising, Core Scientific managed to avoid bankruptcy in January.

French cryptocurrency market maker Flowdesk completed a $50 million Series B funding round led by Cathay Innovation, with participation from Cathay Ledger Fund, Ripple, and Bpifrance (French sovereign investment bank). The post-money valuation reached $250 million, and the company plans to expand global operations, obtain market regulatory approvals, with a focus on growth in Singapore and the United States, and establish a new office in London.

Cryptocurrency bank Sygnum announced that it secured over $40 million in funding in the mid-term round of strategic financing led by Milan asset management company Azimut Holding, valuing the company at $900 million.

Cross-chain DEX project Portal completed a $34 million seed round of financing with participation from Coinbase Ventures, Arrington Capital, OKX Ventures, and Gate Ventures. Portal is a Bitcoin-based cross-chain atomic swaps protocol with its main products being a decentralized trading platform and wallet. The funding structure for this round includes a combination of Simple Agreement for Future Equity (SAFE) and convertible notes.

IBC protocol infrastructure provider Polymer Labs completed a $23 million Series A funding round, led by Blockchain Capital, Maven 11, and Distributed Global, with participation from Coinbase Ventures, among others. Co-founder Kim stated that the project’s Ethereum interoperability infrastructure is in development, with plans to launch a testnet in March.

Ingonyama completed a $21 million seed round of financing, led by IOSG Ventures, Walden Catalyst Ventures, and Geometry. Ingonyama is an innovative protocol focused on accelerating and popularizing zero-knowledge proof technology.

Ethereum historical data protocol Axiom announced the completion of a $20 million Series A funding round, led by Paradigm and Standard Crypto. The funds will be used for team development and platform development. Axiom is a novel protocol that uses zero-knowledge proofs (ZK proofs) to access historical data on the Ethereum network.

Ethereum staking platform Kiln completed a $17 million financing round led by 1kx, with participation from IOSG, Crypto.com, and Wintermute Ventures, among others. The funds raised will be used for global expansion, including the opening of the Asia-Pacific headquarters in Singapore in the first quarter.

3A game platform SkyArk Chronicles completed a $15 million financing round, led by Binance Labs, with participation from VividThree, GuildFi, Jambo, BreederDAO, LayerZero CEO Bryan Pellegrino, Tangent Ventures co-founder Wangarian, and Story Protocol CEO S.Y. Lee, among others.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish