VC Monthly Report: April Sees Lowest Number of Fundraising Deals in 4 Years, but Highest Funding Amount in Nearly 3 Years; CeFi Sees Explosive Growth for Two Consecutive Months

Author: WuBlockchain

According to statistics from RootData, there were 66 publicly disclosed crypto VC investment deals in April 2025, down 15.4% month-over-month (78 projects in March 2025), and down 62.9% year-over-year (178 projects in April 2024). The number of deals hit the lowest point since February 2021. Note: Since not all fundraising rounds are announced in the same month, the actual number may increase in the future.

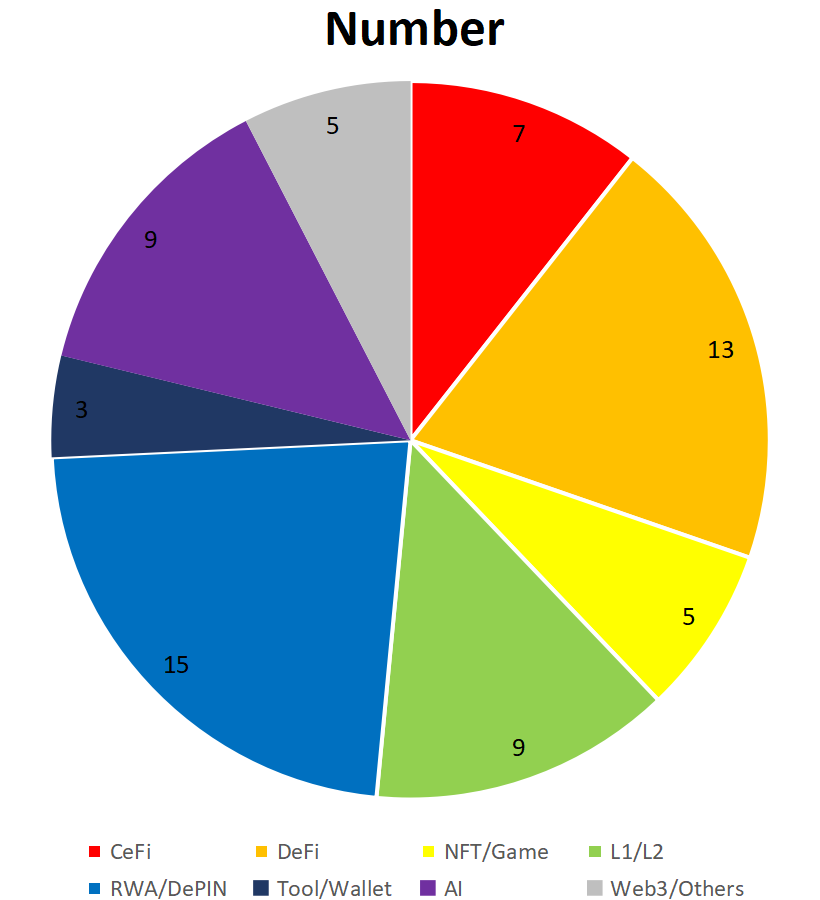

The breakdown of projects by sector is as follows:

CeFi: ~10.6%

DeFi: ~19.7%

NFT/GameFi: ~7.6%

L1/L2: ~13.6%

RWA/DePIN: ~22.7%

Tool/Wallet: ~4.5%

AI: ~13.6%

Total funding in April 2025 amounted to $2.986 billion, up 3.1% from March 2025 ($2.895 billion) and up 170.2% year-over-year (April 2024: $1.105 billion), reaching the highest monthly total since May 2022.

Top 10 funding rounds by amount include:

Ripple has agreed to acquire institutional brokerage firm Hidden Road for $1.25 billion, marking its largest acquisition to date. Founded in 2018, Hidden Road offers clearing, institutional brokerage, and financing services across FX, digital assets, derivatives, swaps, and fixed income. It currently clears over $3 trillion in annual trades across markets with over 300 institutional clients, including hedge funds.

Canadian listed company SOL Strategies announced a convertible note financing of up to $500 million from ATW Partners. The funds will be used to purchase SOL and stake it via the company’s validator nodes. The first $20 million tranche is scheduled for May 1, with staking rewards to be shared between both parties.

Bitdeer raised $179 million through loans and equity financing to expand its Bitcoin ASIC manufacturing operations. It secured up to $200 million in loans from Matrixport, received a $17 million unsecured loan in January, and raised $118.8 million via a stock offering. Funds will go toward expanding ASIC manufacturing and internal chip development, aiming to compete with Bitmain and MicroBT. In 2024, Bitdeer earned approximately $147 million in gross profit from mining and hosting services, investing heavily in SEALMINER chips.

Auradine, a Bitcoin mining hardware manufacturer, completed a $153 million Series C round, including $138 million in equity and $15 million in venture debt. The round was led by StepStone Group, with participation from Maverick Silicon, Premji Invest, and others. Auradine plans to expand its mining hardware production and AI infrastructure business. Clients include Marathon Digital.

Crypto trading and investment firm GSR invested $100 million in a PIPE (Private Investment in Public Equity) into Upexi, Inc., a brand owner focused on consumer product development, manufacturing, and distribution. This follows Upexi’s strategic shift toward a crypto asset-based treasury strategy, including building a Solana-based treasury and staking. Upexi has accumulated 45,733 SOL tokens worth about $6.7 million since the $100 million offering.

a16z general partner Ali Yahya announced a $55 million follow-on investment in LayerZero (ZRO), with a 3-year lockup. a16z previously led LayerZero’s Series A1 and B rounds between 2022 and 2023.

Decentralized AI startup Nous Research completed a $50 million Series A, led by Paradigm, with a $1 billion valuation. Nous uses the Solana blockchain to coordinate global compute power for distributed training of open-source large models and plans to launch a decentralized training system.

Crypto dining app Blackbird raised $50 million in a Series B led by Spark Capital, with participation from Coinbase, a16z crypto, Union Square Ventures, and others. Founder Ben Leventhal raised this round in Q4 2024. Since 2022, Blackbird has raised a total of $85 million.

Meanwhile, a Bitcoin life insurance provider, raised $40 million in Series A, co-led by Framework Ventures and Fulgur Ventures, with participation from Xapo founder Wences Casares. The round values Meanwhile at $190 million. Its first product is a BTC-denominated whole life insurance policy.

Symbiotic, a crypto staking protocol, raised $29 million in Series A, led by Pantera Capital, with participation from Coinbase Ventures and over 100 angel investors from teams like Aave, Polygon, and StarkWare. The round coincides with the launch of Symbiotic's general staking framework aimed at enhancing blockchain security through economic coordination.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish