VC Monthly Report in June: Number of Fundraising Decreased by 41%, Amount Decreased by 31%

Author: WuBlockchain

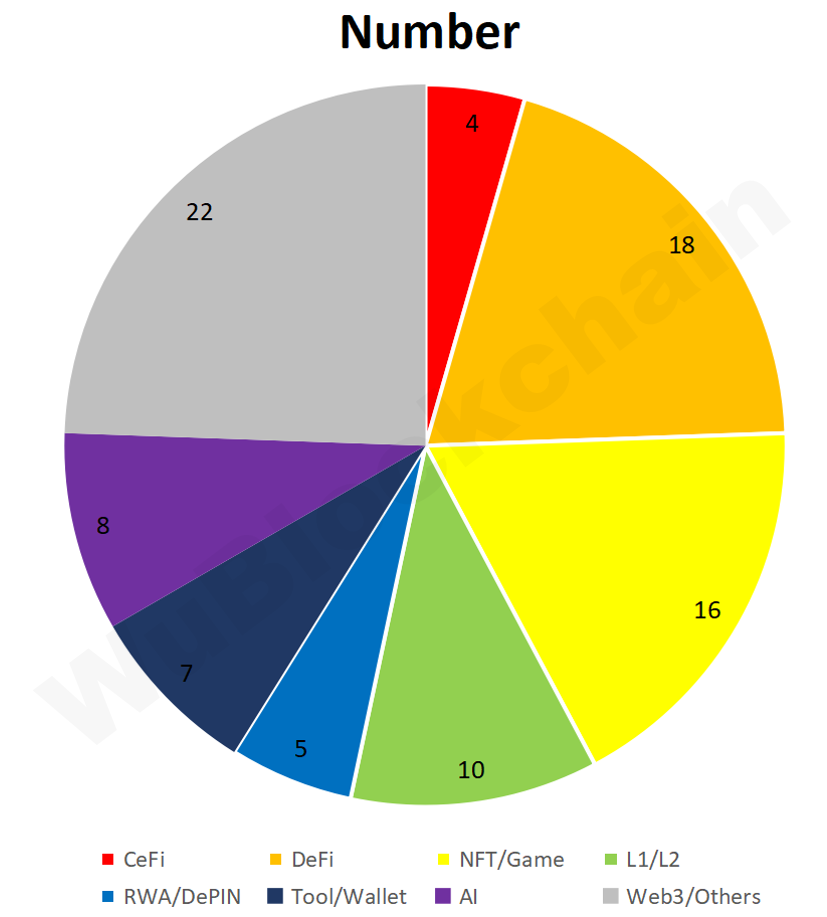

According to RootData statistics, there were 90 publicly disclosed Crypto VC investment projects in June, a decrease of 41% month-on-month (153 projects in May 2024) and an increase of 3% year-on-year (87 projects in June 2023). Note: Since not all fundraisings are announced in the same month, the above statistics may increase in the future. The breakdown by sector is as follows:

● CeFi: ~4%

● DeFi: ~20%

● NFT/GameFi: ~18%

● L1/L2: ~11%

● RWA/DePIN: ~6%

● Tool/Wallet: ~8%

● AI: ~9%

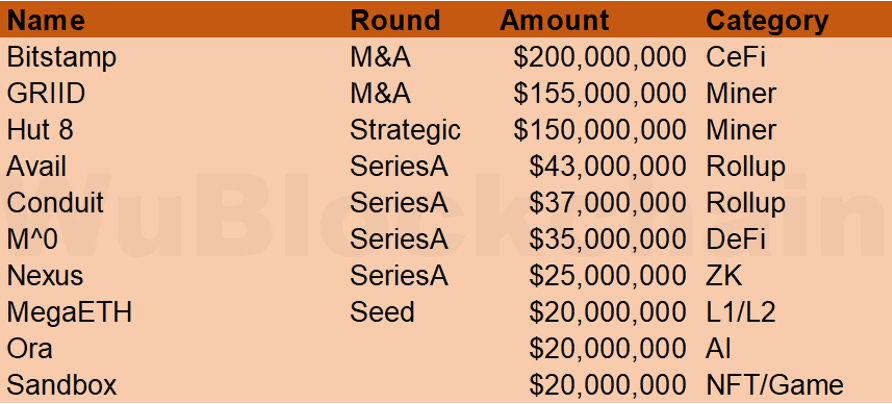

The total fundraising amount in June was $680 million, a decrease of 31% month-on-month ($990 million in May 2024) and an increase of 42% year-on-year ($480 million in June 2023). The top 10 fundraising rounds by amount are as follows:

Robinhood will acquire global cryptocurrency exchange Bitstamp for approximately $200 million in cash. The acquisition is expected to be completed in the first half of 2025, subject to regulatory approvals and other customary closing conditions. Through this acquisition, Robinhood will significantly expand its global operations and introduce institutional business for the first time, covering the EU, UK, US, and Asian markets. Bitstamp currently holds over 50 active global licenses and registrations.

Crypto mining companies Cleanspark and GRIID Infrastructure Inc. announced a definitive merger agreement, with CleanSpark acquiring all issued and outstanding common stock of GRIID through an all-stock transaction. The total enterprise value of the transaction (including payments and assumed debt) is $155 million. Concurrent with the signing of the merger agreement, the two companies also entered into an exclusive hosting agreement for all currently available power, with 20 megawatts allocated to CleanSpark.

Crypto mining company Hut 8 announced it has secured a $150 million strategic investment from Coatue. The two parties will collaborate to build an artificial intelligence infrastructure platform. Coatue agreed to invest $150 million in the company through convertible notes with an annual interest rate of 8.00% (compounded quarterly). The initial term of the notes is five years, with the company having the option to extend up to three one-year terms.

Polygon modular blockchain project Avail announced it has completed a $43 million Series A funding round led by Dragonfly, Founders Fund, and Cyber Fund, with participation from SevenX Ventures, Figment, Nomad Capital, Foresight Ventures, and others. Following this round, Avail’s total funding has reached $75 million. Avail is a modular blockchain project that spun out of Polygon last year, building “rollup-centric infrastructure.”

Rollup deployment platform Conduit announced it has completed a $37 million Series A funding round led by Paradigm and Haun Ventures, with participation from Bankless Ventures, Coinbase Ventures, Robot Ventures, and others.

Stablecoin minting protocol M⁰ completed a $35 million Series A funding round led by Bain Capital, with participation from Galaxy Ventures, Wintermute Ventures, and GSR. M⁰ previously raised $22.5 million in seed funding led by Pantera Capital in early 2023.

Nexus Labs completed a $25 million Series A funding round led by Lightspeed Venture Partners and Pantera Capital, with participation from Dragonfly Capital. Nexus Labs is dedicated to building zero-knowledge privacy tools that support technologies such as AI, cybersecurity, and cloud computing, and plans to use the new funds to expand the team and develop more products.

New blockchain MegaETH, supported by Ethereum co-founder Vitalik, raised $20 million in its seed round led by Dragonfly, with participation from Figment Capital, Robot Ventures, and Big Brain Holdings. Angel investors include Vitalik, Joseph Lubin, Sreeram Kannan, Kartik Talwar, and others. This funding gives MegaETH a fully diluted token valuation of at least $100 million. MegaETH is known as the first fully Ethereum-compatible real-time blockchain, aiming to achieve 100,000 transactions per second (TPS). Its public testnet is expected to go live in the fall, with the mainnet launching by the end of the year.

Blockchain project Ora announced it has completed a $20 million funding round led by Polychain, with participation from HF0 and Hashkey Capital. The project aims to integrate AI into decentralized applications (dapps) through an “on-chain AI oracle.” The funds raised will be used to develop its technology and infrastructure, tokenizing AI models and introducing them into the Ethereum ecosystem.

The Sandbox raised $20 million through convertible debt, reaching a valuation of $1 billion. This funding round was led by Kingsway Capital and Animoca Brands, with participation from LG Tech Ventures and True Global Ventures. The funds will be used to advance The Sandbox’s decentralized virtual world, enhance revenue opportunities for creators, and expand the metaverse version on mobile devices. The Sandbox plans to launch a mobile version in 2025.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish