VC Monthly Report in Sep: the number of funding decreased by 13%, while the amount dropped by 23%

Author: WuBlockchain

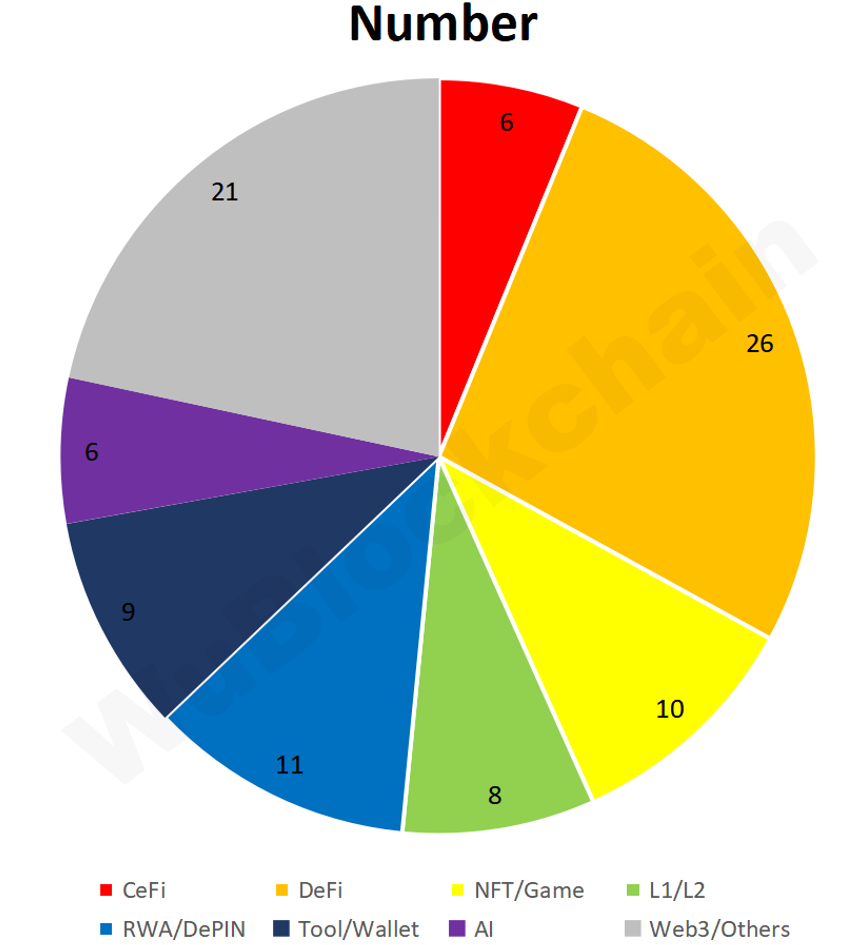

According to RootData statistics, there were 97 publicly disclosed Crypto VC investment projects in September, representing a 13% month-over-month decrease (112 projects in August 2024) but a 4% year-over-year increase (93 projects in September 2023). Note: Since not all fundraising activities are disclosed in the same month, these figures may increase in the future. The breakdown by sector is as follows:

Among them, CeFi accounted for approximately 6%, DeFi for 27%, NFT/GameFi for 10%, L1/L2 for 8%, RWA/DePIN for 11%, Tool/Wallet for 9%, and AI for 6%.

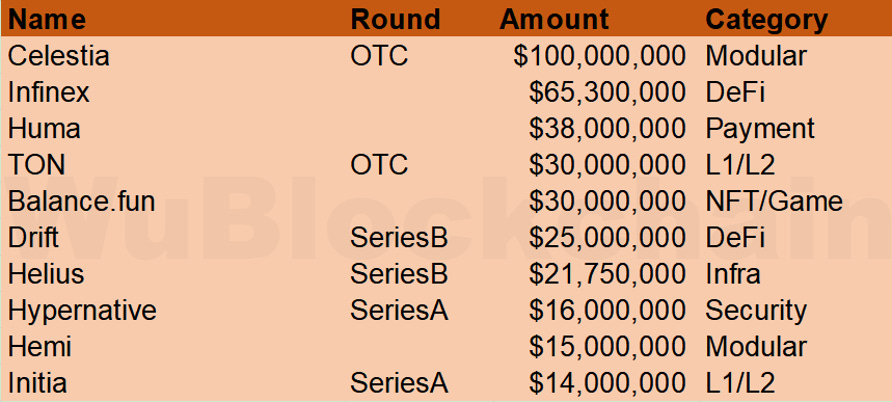

The total fundraising amount in September was $610 million, representing a 23% month-over-month decrease (from $790 million in August 2024) and a 12% year-over-year decrease (from $690 million in September 2023). The top 10 rounds by funding amount are as follows:

Modular blockchain Celestia raised $100 million in funding, led by Bain Capital Crypto. This fundraising was conducted through an OTC token sale, announced during a restricted token release. The community has raised concerns about potential collusion with VCs, speculating that the price may have been artificially inflated for profit-taking.

Infinex raised $65.3 million through the sale of Patron NFTs, with participants including Wintermute, Framework, and Near. Infinex, a decentralized perpetual contract trading platform launched by Synthetix, has not yet opened for trading; users can currently only deposit funds and play card games.

Huma Finance announced it had raised $38 million, including $10 million in equity investment and $28 million in real-world asset (RWA) investments. The round was led by Distributed Global, with participation from Hashkey Capital, Folius Ventures, Stellar Development Foundation, and TIBAS Ventures. Huma plans to use the funds to expand its blockchain-based payment financing (PayFi) platform.

Bitget and Foresight Ventures jointly announced a $30 million strategic investment in TON, which will be executed through OTC purchases of TON.

Gaming platform Balance.fun recently raised $30 million in a round led by a16z and Galaxy Interactive. Formerly known as Epal, a North American companion gaming platform, Balance.fun plans to mint Pioneer Badge NFTs in early October and will launch its governance token EPT in the future.

Solana ecosystem DeFi platform Drift completed a $25 million Series B funding round led by Multicoin Capital, with participation from Blockchain Capital, Primitive Ventures, and Folius Ventures. The platform, which focuses on derivatives trading, is fully based on Solana.

Helius, a development platform in the Solana ecosystem, announced via its CEO Mert Mumtaz that it had raised $21.75 million. The round saw participation from Haun Ventures, Founders Fund, Foundation Capital, 6th Man Ventures, Chapter One, and Spearhead.

Web3 security company Hypernative announced the completion of a $16 million Series A funding round, led by Quantstamp, with participation from Bloccelerate VC, Boldstart Ventures, Borderless Capital, CMT Digital, IBI Tech Fund, and Re7 Capital. This equity round brings the company’s total funding to $27 million.

Hemi completed a $15 million fundraising round, led by Binance. Hemi is a modular blockchain network aiming to integrate Bitcoin and Ethereum for enhanced scalability, security, and interoperability. The funds will be used to accelerate the development of decentralized applications, improve interoperability between Bitcoin and Hemi’s virtual machine (hVM), and speed up blockchain settlement times.

Initia announced the completion of a $14 million Series A funding round, with a fully diluted token valuation of $350 million. The round was led by Tomasz Tunguz’s Theory Ventures, with participation from Delphi Ventures and Hack VC. To date, Initia has raised a total of $22.5 million, including a $7.5 million seed round earlier this year and a pre-seed investment from Binance Labs. The company plans to launch its mainnet and token within the next two months.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish