VC Monthly Report in September: Number of Fundraising Rounds Decreased by 25%, Amount Increased by 5%

Author | WuBlockchain

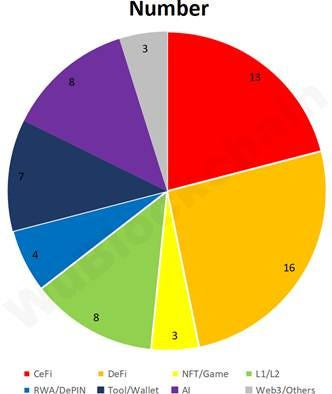

According to RootData statistics, there were 62 publicly disclosed Crypto VC fundraising rounds in September 2025, a decrease of 25.3% month-on-month (83 rounds in August 2025) and a decrease of 37.4% year-on-year (99 rounds in September 2024). Note: As not all fundraising is announced within the same month, the above statistics may increase in the future. The number of projects in various sector tracks is as follows:

Among them, CeFi accounted for about 21%, DeFi accounted for about 25.8%, NFT/GameFi accounted for about 4.8%, L1/L2 accounted for about 12.9%, RWA/DePIN accounted for about 6.5%, Tool/Wallet accounted for about 11.3%, and AI accounted for about 12.9%.

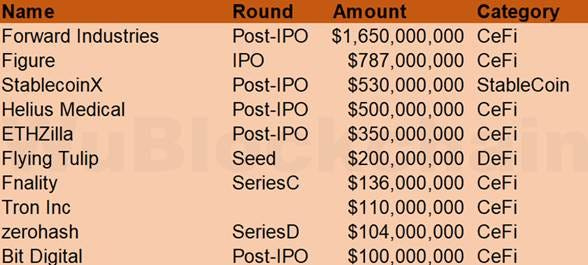

The total fundraising amount in September 2025 was $5.122 billion, an increase of 5.2% month-on-month ($4.869 billion in August 2025) and an increase of 739.7% year-on-year ($610 million in September 2024). The top 10 rounds by amount are listed below:

Forward Industries (Nasdaq: FORD) announced the completion of a $1.65 billion private placement in cash and stablecoins to launch its digital asset treasury strategy based on Solana. This PIPE round was led by Galaxy Digital, Jump Crypto, and Multicoin Capital.

Blockchain financial infrastructure platform Figure Technology officially listed on Nasdaq under the ticker symbol FIGR, becoming the world’s first listed platform with RWA (Real World Assets) as its core business. Wall Street investment banks such as Goldman Sachs and BofA Securities acted as the lead underwriters for this IPO. The IPO originally planned to issue 26 million shares, but was twice increased to 31.5 million shares due to higher-than-expected market demand. It was ultimately priced at $25 per share, raising a total of $787 million, and achieved a market capitalization exceeding $5 billion on its first day of trading.

StablecoinX and TLGY Acquisition have secured an additional $530 million in funding to purchase digital assets, bringing their total committed funding to $890 million ahead of their planned merger and Nasdaq listing. The merged company will be renamed StablecoinX Inc. and is expected to hold over 3 billion ENA.

Helius Medical Technologies (Nasdaq: HSDT) announced the completion of over $500 million in PIPE financing, led by Pantera Capital and Summer Capital, with participation from Animoca Brands, HashKey Capital, and others. The financing was priced at $6.881 per share and included warrants with an exercise price of $10.134. If all warrants are exercised, the total scale could exceed $1.25 billion. The company will use this to launch a SOL treasury strategy, planning to hold SOL as a primary reserve asset and explore on-chain DeFi yield opportunities.

ETHZilla (Nasdaq: ETHZ) announced an additional $350 million in convertible bond financing with a 2% interest rate and a conversion price of $3.05 per share. The funds will be used to deploy ETH in Layer 2 protocols and RWA. ETHZilla currently holds approximately 102,000 ETH (approximately $462 million) and has $559 million in cash and equivalents.

Sonic co-founder Andre Cronje launched a new project, Flying Tulip, and completed a $200 million seed round without a designated lead investor, corresponding to an FDV of $1 billion. Investors included Brevan Howard Digital, DWF Labs, CoinFund, Republic Digital, and others. The project plans to raise up to $800 million more through a public sale of FT tokens. All investors enjoy “on-chain redemption rights,” allowing them to redeem their principal at any time with the assets they invested (e.g., ETH).

Fintech company Fnality announced the completion of a $136 million Series C funding round. Lead investors included WisdomTree, Bank of America, Citi, Temasek, etc., with existing investors such as Goldman Sachs, Nasdaq, Santander, Barclays, and UBS continuing to participate. The funds will be used to expand its settlement system based on central bank digital currencies to cover US dollar and euro markets, pending approval from the Federal Reserve and the European Central Bank. The company also plans to simultaneously enter the cross-border payment and Security Tokenization fields.

Nasdaq-listed TRX treasury company Tron Inc. (TRON) received a new $110 million investment from its largest shareholder to expand its TRX treasury. Its largest shareholder, Bravemorning Limited, exercised warrants worth $110 million to acquire 312,500,100 TRX for the company, increasing the company’s total TRX holdings to a value exceeding $220 million. Following this transaction, Bravemorning’s stake in Tron Inc. reached 86.6%, further consolidating its controlling position.

Crypto infrastructure startup Zerohash announced the completion of a $104 million funding round, reaching a valuation of $1 billion. This round was led by Interactive Brokers, with participation from Morgan Stanley, SoFi, Apollo, and others. Zerohash focuses on providing technical support for three categories of blockchain products for banks and fintech companies: crypto trading, stablecoin services, and Asset Tokenization.

Bit Digital (Nasdaq: BTBT) announced plans to raise $100 million through convertible notes, primarily to increase its holdings of Ethereum (ETH) and potentially for other corporate purposes related to Asset Tokenization. The company has filed a preliminary prospectus with the U.S. Securities and Exchange Commission. Underwriters include Barclays, Cantor, and B. Riley Securities.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish