VC Monthly Report, the amount of funding saw a slight recovery, while the number continued to reach new lows, with a significant increase in the proportion of DeFi

Author: WuBlockchain

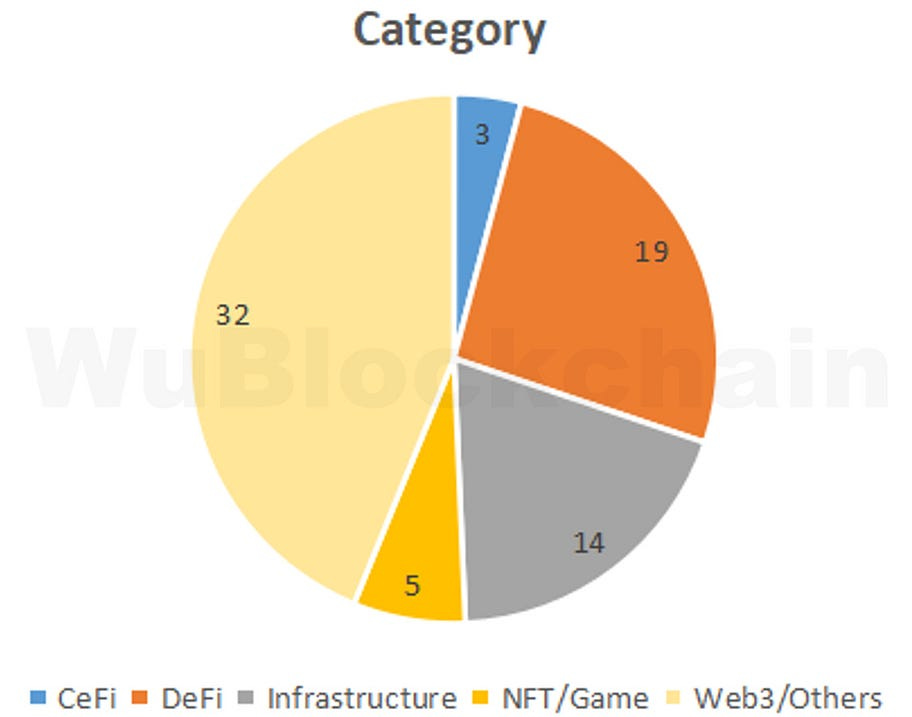

According to statistics from RootData, there were a total of 73 publicly announced investment projects in the cryptocurrency VC space in August, representing a 6% decrease compared to July 2023 (which had 78 projects) and a 45% decrease compared to August 2022 (which had 132 projects). Note: Since not all funding announcements are made in the same month, these statistics may increase in the future. The industry-level breakdown is as follows:

In the cryptocurrency market for August, among various categories, the funding share for infrastructure projects accounted for approximately 19%, which represents a significant decrease of 32% compared to the previous month. DeFi’s share, on the other hand, was about 26%, marking a substantial increase of 12% compared to the previous month. Additionally, CeFi accounted for approximately 4%, and NFT/GameFi accounted for approximately 7%.

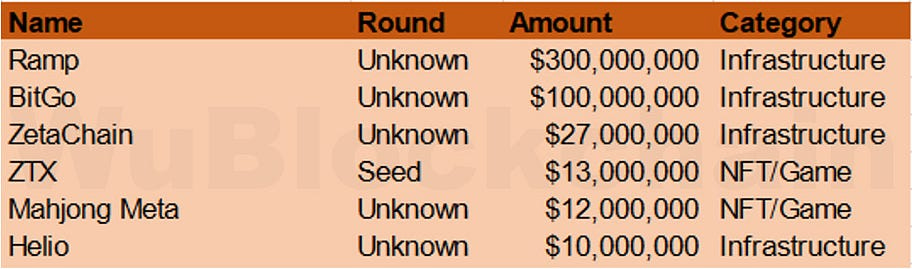

The total funding amount in August was $660 million, marking a 20% increase compared to July 2023 (which had $550 million), but a 57% decrease compared to August 2022 (which had $1.54 billion). Here are some funding rounds exceeding $10 million:

Payment company Ramp announced a $300 million funding round, valuing the company at $5.8 billion. Thrive Capital and Sands Capital led the investment, with participation from General Catalyst, Founders Fund, and others. The new capital will be used to accelerate product development and expand hiring in the second half of the year. Ramp is a non-custodial, full-stack payment infrastructure that allows users to purchase cryptocurrencies without leaving DApps or wallets.

Cryptocurrency custody firm BitGo raised $100 million at a valuation of $1.75 billion. This funding will be used for strategic acquisitions, with at least two transactions currently in progress. BitGo is currently the custodian for FTX creditors and serves clients such as financial services company Swan Bitcoin, blockchain developer Mysten Labs, and apparel giant Nike.

Cross-chain infrastructure project ZetaChain raised $27 million, with investors including Blockchain.com, Human Capital, VY Capital, and others. ZetaChain is an L1 public blockchain that connects different blockchains through its OmniChain functionality, enabling cross-chain capabilities.

ZTX announced a $13 million seed round, led by Jump Crypto, with participation from Collab+Currency, Parataxis, MZ Web3 Fund, Everest Ventures Group, and others. ZTX is a collaborative project between South Korean metaverse platform Zepeto and Jump Crypto.

Ethereum mainnet-based Web3 mahjong game Mahjong Meta completed a $12 million funding round, with joint leadership from Dragonfly and Folius Ventures.

Helio Protocol secured a $10 million investment from Binance Labs. Helio is the issuer of the stablecoin HAY, currently built on the BNB Chain. This new funding is expected to help the platform expand to other networks, including Ethereum, Arbitrum, and zkSync. Helio Protocol combines over-collateralized lending, decentralized stablecoin borrowing, multi-chain StaaS (Staking as a Service), and LSD through its Synclub product on the BNB Chain.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish