VC Monthly Report:$4.219 billion in May, down 38.2% from April 2022 and up 97.8% from May 2021

According to Dove Metrics, there were 169 open investment projects of crypto VC this month, including 170 rounds, down 24.2% from the previous month (224 rounds in April 2022), and 28.8% from the previous year (132 rounds in May 2021). The secondary industry breakdown is as follows. The secondary industry classification is as follows:

Among them, infrastructure industry has the most projects, accounting for 21%, followed by DeFi, CeFi and NFT industry, and DAO industry has the least projects.

Total funding for the month was $4.219 billion, down 38.2% from April 2022 ($6.829 billion) and up 97.8% from May 2021 ($2.233 billion). The top 10 financing rounds are as follows:

A brief introduction to less well-known decentralization projects:

Xendit, an Indonesian unicorn founded in 2016, is a fintech company focused on converged payment platform.

Headquartered in Denmark, Naetion is committed to building the world’s largest on-chain career platform.

Talos, currently valued at $1.25 billion, is emerging as the latest unicorn, aiming to provide institutional investors with optimal trading solutions. Its products help clients view prices from trading platforms and market makers in a one-stop shop, and issue trading orders and even complex algorithms.

Flowcarbon is a carbon credit-enabled platform on the Celo chain that Tokenizes institutional carbon credits for collateralized lending or payment sales, or to redeem underlying real-world credits.

Price performance in May

Finally, we have a brief count of the price performance of all projects (issued tokens) that have had a public funding record since July 2020 for this month. The total number of rounds is 821, containing 684 tokens.

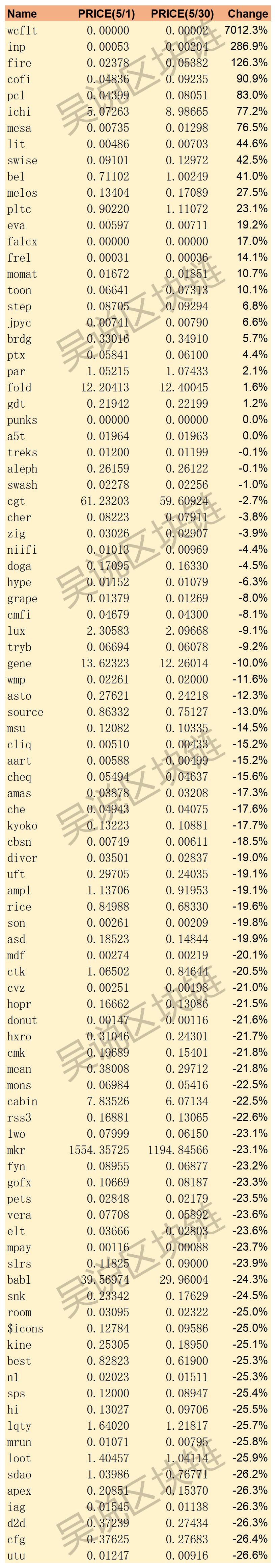

Among them, the top 100 tokens in terms of price increase in May.

A total of 614 VCs have invested in these projects, of which 41 have invested in more than 3, which are listed as follows in number (the second column represents the total amount of investment projects since 2020.7) :

Tokens in the bottom 100 in terms of price increase in May.

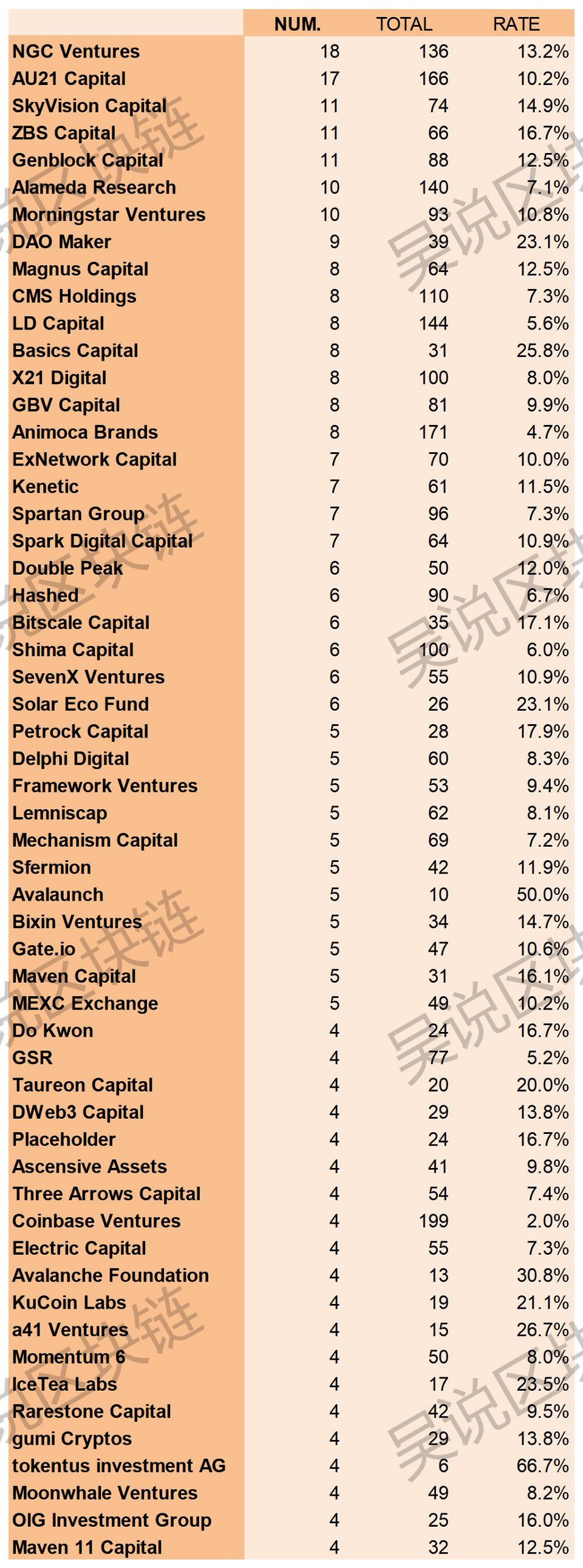

A total of 692 VCs have invested in these projects, of which 56 have more than 3, which are listed as follows in number (the second column represents the total amount of investment projects since 2020.7) :

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish