VC Monthly Report:Funding Overview in June

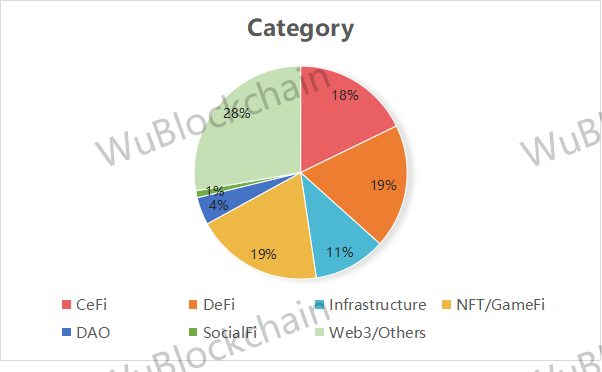

According to Dove Metrics, there were 191 open investment projects of crypto VC this month, down 15% from the previous month (225 rounds in May 2022), and 42.5% from the previous year (134 rounds in June 2021). The secondary industry classification is as follows:

The number of rounds raised this month was relatively even across all sectors, with CeFi, DeFi and NFT/GameFi each accounting for about 20% of the total. CeFi raised the most because of the number of institutions that raised debt to avoid liquidation, such as BlockFi, which raised $250m from FTX, and Voyager Digital, which raised $200m from Alameda.

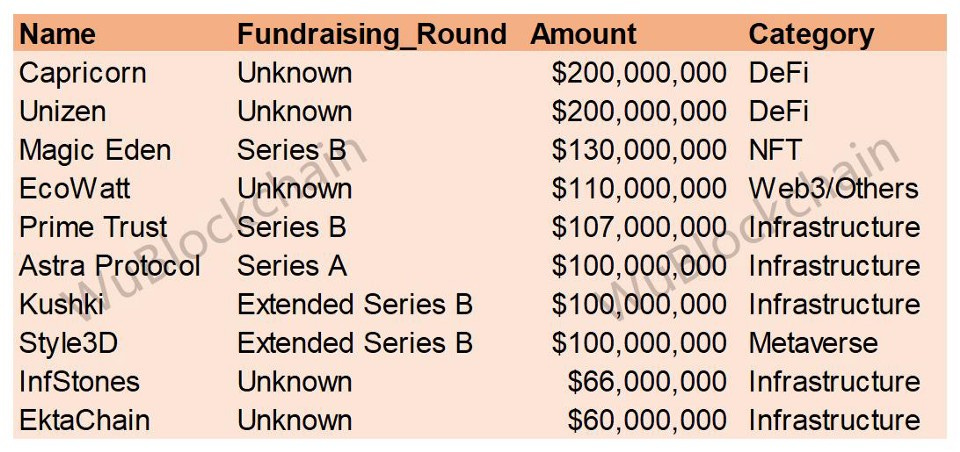

Total funding for the month was $3.67 billion, down 18% from May 2022 ($4.45 billion) and up 60% from June 2021 ($2.3 billion). The top 10 financing rounds(excludeCeFi) are as follows:

Capricorn is a stablecoin lending agreement backed by multiple assets. The stablecoin CUSD issued by Capricorn will be used to provide users with financial services focused on payments and corporate lending.

Unizen is a trading infrastructure built on multi-chain liquidity that allows users to stake various assets for trading on multiple chains, currently backed by Binance Liquidity, and aggregated for decentralized liquidity through the SifChain module. The $200 million is not a direct investment, but will be based on performance to ensure that the use of funds is fully optimized.

Magic Eden is the largest NFT trading platform on Solana, with over 430,000 monthly active users.

EcoWatt is an enterprise blockchain solution for verifying carbon certificates on the blockchain and making their community and corporate partners carbon neutral as a service.

Astra Protocol is a decentralized security and legal assurance protocol that creates a decentralized legal network in partnership with some of the world’s leading business consulting firms, auditing firms and law firms. It provides anti-money laundering (AML) and KYC functionality that ensures funds arrive safely at compliant wallet addresses.

Kushki, based in Ecuador, provides payment infrastructure that helps Latin American businesses process digital payments globally.

InfStones is a PaaS provider for enterprises and developers that enables users to rapidly deploy nodes and create APIs focused on improving the efficiency and speed of developing and deploying decentralized applications such as Staking, DeFi, NFT, GameFi and others on multiple protocols.

Ekta’s businesses include NFT markets, cryptocurrency trading platforms, blockchain-based games and real estate investment, among others. Its Layer 1 blockchain EktaChain was launched in August 2021 and focuses on tokenizing real assets.

Price performance in June

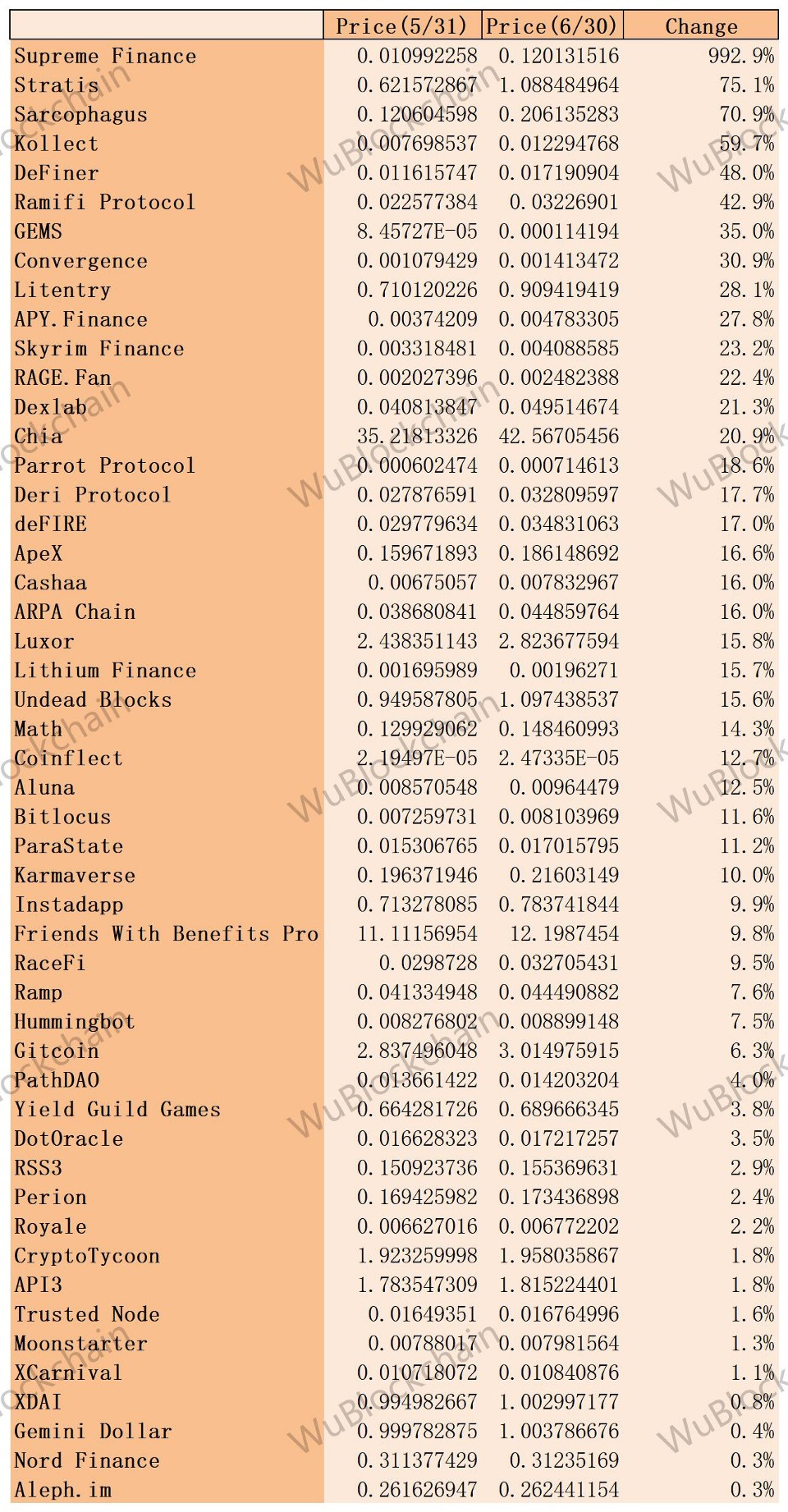

Finally, we have a brief count of the price performance of all projects (issued tokens) that have had a public funding record since July 2020 for this month. The total number of rounds is 2811, containing 615 tokens.

Among them, the top 50 tokens in terms of price increase in June.

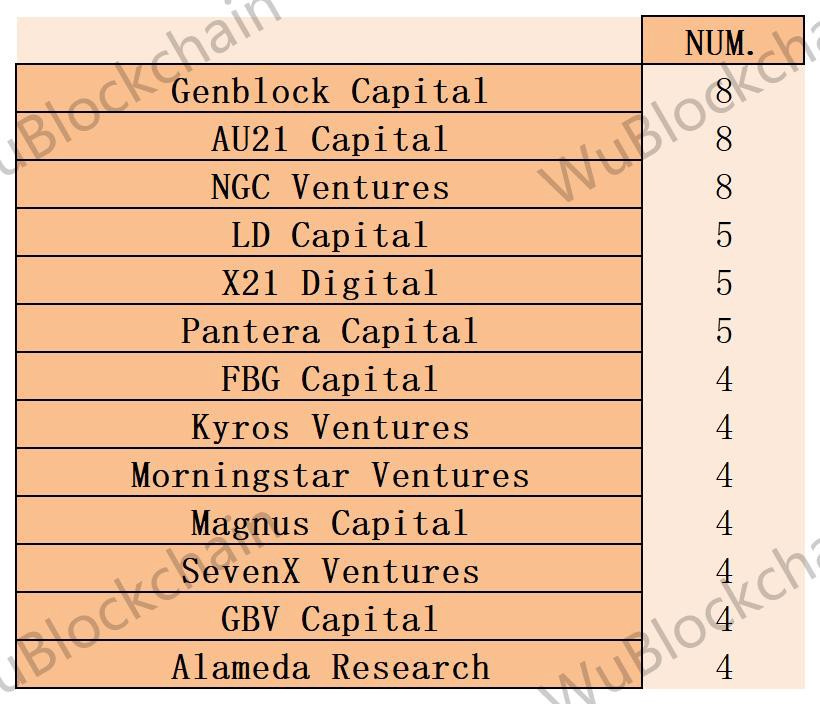

Among the above-mentioned projects, there are 13 VCs with more than 3 investments, listed by number as follows.

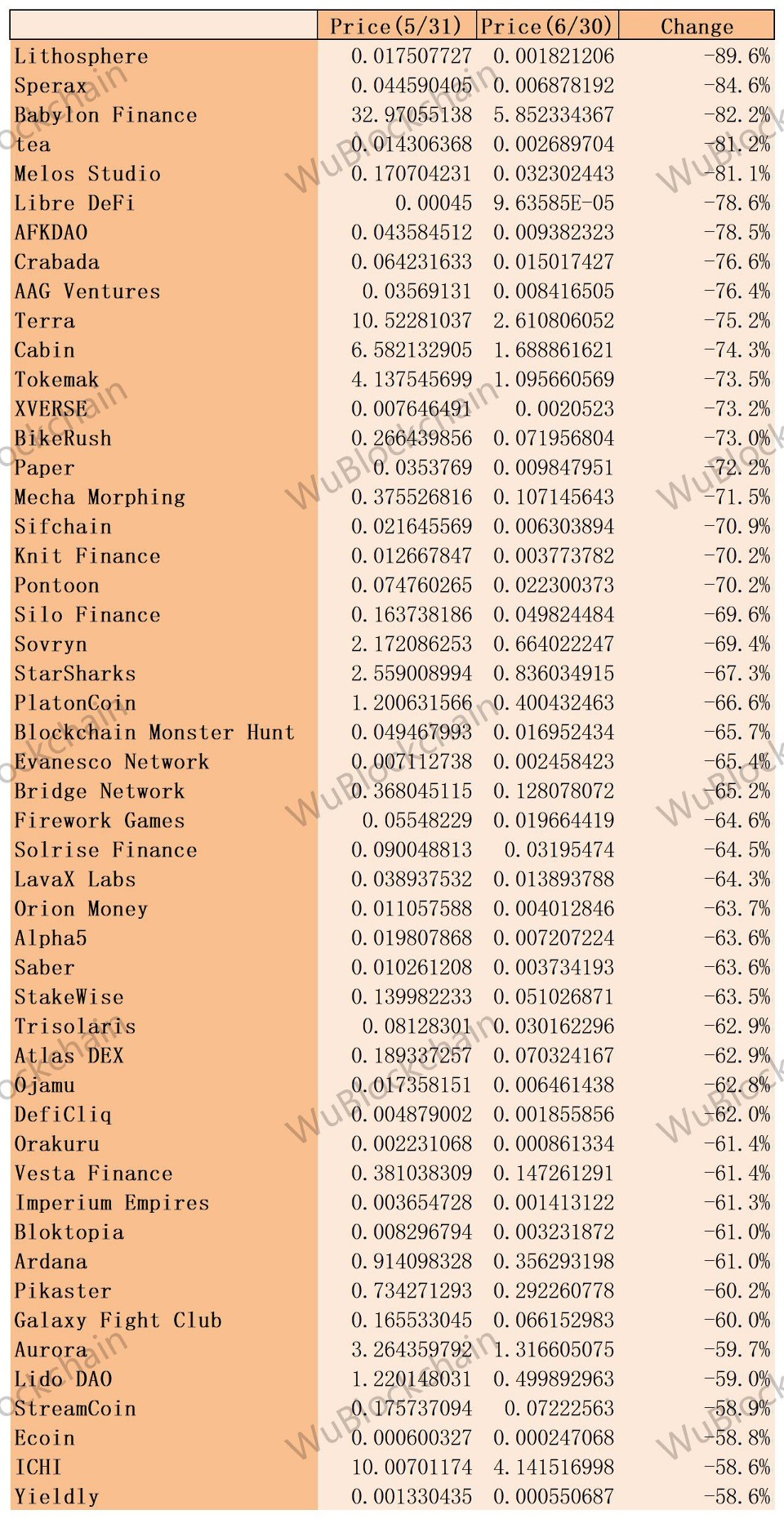

Tokens in the bottom 50 for June:

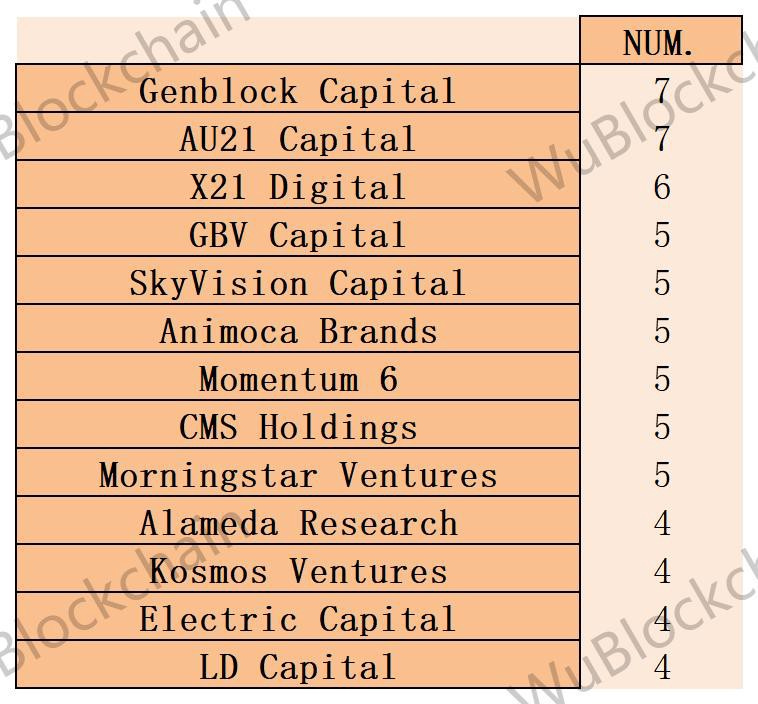

Among the above-mentioned projects, there are 13 VCs with more than 3 investments, listed by number as follows.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish