VC Yearly Report: Cryptocurrency funding totaled $37.7 billion with 1,769 projects

Author: WuBlockchain

According to Messari, there were 1,769 public crypto VC projects in 2022, up 30% from 2021 (1,364 projects in 2021). The industry-level classification is as follows:

In 2022, the number of funds raised in various areas of the crypto market is relatively balanced, with CeFi accounting for 14%, DeFi accounting for 18%, NFT/GameFi accounting for 16%, infrastructure accounting for 17%, and the remaining Web3 projects accounting for 36%.

Total financing in 2022 was $37.7 billion, up 19% from 2021 ($31.6 billion in 2021). Changes in financing amount during each month are as follows:

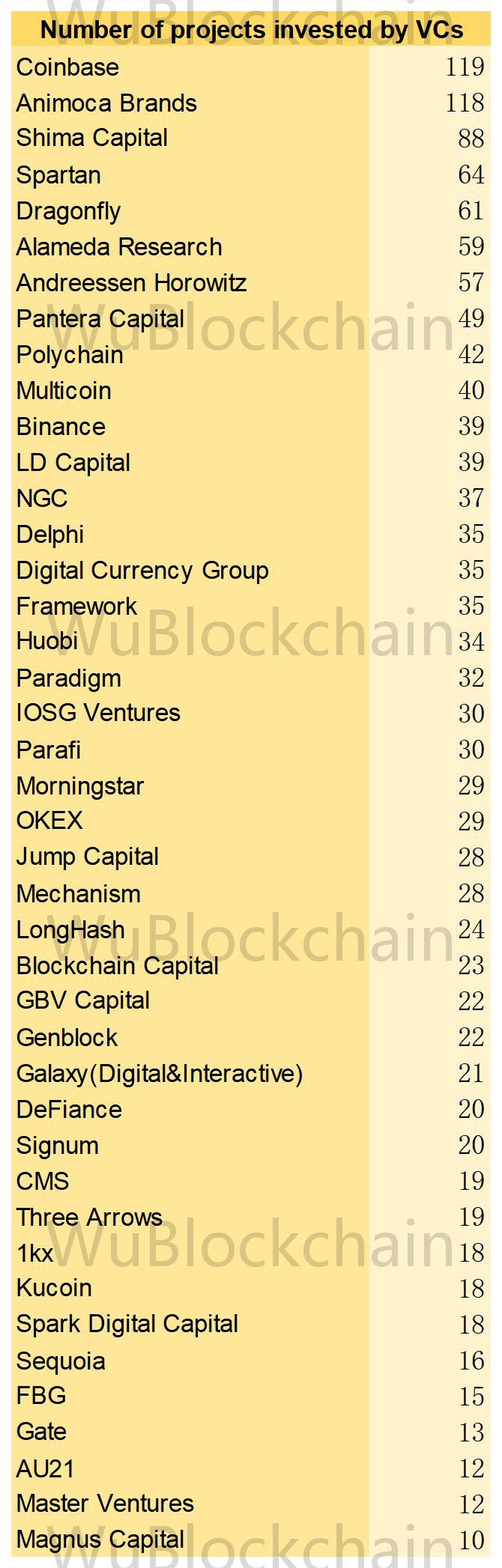

Of all VCs investing in 2022, Coinbase made the most investments with 119; Animoca with 118; followed by SHIMA (88) Spartan (64) Dragonfly (61) Alameda (59) A16z (57).

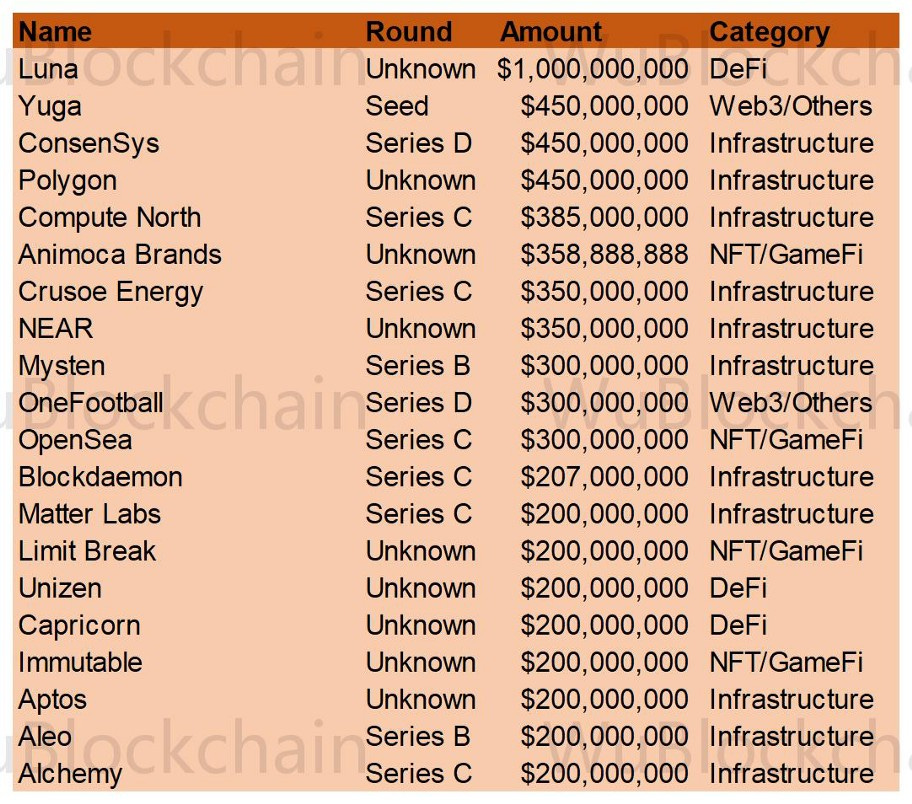

Among them, the top 20 rounds of financing amount (excluding CeFi) are as follows:

Yuga Labs, the startup behind well-known NFT project Bored Ape Yacht Clubs, was founded in 2021. In early 2022, the company also announced the acquisition of two well-known NFT series Cryptopunks with Meebits, developed by Larva Labs. In March, Yuga Labs completed a $450m seed round at a $4bn valuation, led by a16z and Animoca Brands.

ConsenSys is a leading software company focused on the Ethereum ecosystem, and its founder Joseph Lubin is one of the co-founders of Ethereum and also helped set up the non-profit Ethereum Foundation. In addition to providing development and consulting services, ConsenSys continues to develop its own products, with current products in development including the MetaMask wallet, the Infura development suite, the smart contract audit service Diligence, the open-source blockchain protocol Quorum, and more. In March, ConsenSys completed a $450 million Series D funding round at a $7 billion valuation, led by ParaFi Capital, with participation from Temasek, SoftBank Vision Fund II, Microsoft, Anthos Capital, Sound Ventures and others.

Compute North is one of the largest data center providers for mining and has a number of deals with other large mining companies. The company has four large mines in the United States, two in Texas and two in South Dakota and Nebraska. Its partners include Marathon Digital, BitNile Holdings, Bit Digital, Singaporean Mining company Atlas Mining, Chinese mining company The9, and others. Compute North filed for Chapter 11 bankruptcy protection in September.

Animoca Brands, a gaming software venture capital firm, and its subsidiary The Sandbox also recently raised US $93 million each. The fundraising, with participation from Temasek, Boyu Capital and GGV Capital, continues to fund strategic acquisitions, investments and product development. The latest US $100 million funding brings Animoca Brands’ total raised to date to over US $600 million.

Mysten Labs, a blockchain company founded by former executives at social media Meta, was also the development team behind Sui. The funding was led by FTX Ventures, Other investors included other investment funds and partners such as Coinbase Ventures, Jump Crypto, a16z, Circle Ventures, Binance Labs, and O’Leary Ventures. Mysten co-founder and CEO Evan Cheng said the fresh funds will be used to build out its technology, company hiring, and expansion into the Asia-Pacific region.

OneFootball, which aims to become the world’s largest soccer media platform, currently has more than 100 million monthly active users. As previously reported, OneFootball has partnered with Animoca Brands and Dapper Labs to launch NFT marketplace Aera and is set to release HATTTRICKS, the first collection of star card NFTS. The funding was led by Liberty City Ventures, Animoca Brands, Dapper Labs, DAH Beteiligungs GmbH, Quiet Capital, RIT Capital Partners, Senator Investment Group, and Alsara Investment Group participated.

Blockdaemon is a blockchain infrastructure startup. In January, the company announced a $207 million Series C investment at a $3.25 billion valuation, bringing its total raised to nearly $400 million. Existing investors include Goldman Sachs, jpmorgan Chase, SoftBank Vision Fund and Tiger Global.

Matter Labs, the team behind the Layer 2 solution zkSync, was led by Blockchain Capital and Dragonfly, with participation from LightSpeed Venture Partners, Variant and a16z.

Limit Break, the parent company of NFT project DigiDaigaku, launched the new model Free to Own (F2O), was created based on the free minting of Genesis NFTS. The round was led by Josh Buckley, Paradigm and Standard Crypto, with participation from FTX, Coinbase, Positive Sum, Shervinator and Anthos Capital, among others. The new funds will be used to develop Web 3 Mmos.

Unizen, a cross-DEX and CEX trading aggregator built on BNB Chain, has secured a $200m “commitment” from alternative investment group Global Emerging Markets. The funds will be used to grow the team, market and accelerate the development of its aggregation system, which is designed to find the optimal trading path across different centralized and decentralized trading platforms.

Capricorn protocol, the issuer of the CUSD stablecoin, has received an investment from Malaysia-listed MQ Technology at a US $200 million valuation. The investment will be used to further establish its presence in Southeast Asia and optimize its stablecoin services for users and businesses.

Aleo is a Layer 1 privacy public chain, which can be regarded as a modular zero-knowledge privacy application platform. It is committed to protecting user data on the network through decentralized systems and zero-knowledge encryption to achieve perfect privacy protection. At the same time, as a Layer 1 blockchain, Aleo also has a strong scalable architecture with good programmability. The financing was led by Kora Management LP and SoftBank Vision Fund, with participation from Tiger Global, Sea Capital, Samsung and others.

Alchemy, a blockchain infrastructure company, has released its plans to update its popular Internet feeds to Web3 in a recently published white paper, the information distribution protocol Really Simple Syndication (RSS). The fundraising was led by venture capital firm Lightspeed and US global private equity firm Silver Lake.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish