Weekly Project Updates: Blockchain Startup Tempo Raises $500 Million, OpenSea to Launch SEA Token in Q1 of 2026, Perp DEX Open Interest Plunges by Over 60%, etc

1. Stripe — backed Blockchain Startup Tempo Completes $500 Million Series A Funding link

Tempo, a blockchain startup backed by Stripe, has closed a $500 million Series A funding round, valuing it at approximately $5 billion. The round was led by Thrive Capital (Joshua Kushner) and Greenoaks, with participation from Sequoia, Ribbit Capital, SV Angel, and others. Co-developed by Stripe and Paradigm, Tempo focuses on stablecoin payment infrastructure. Its partners include OpenAI, Shopify, and Visa, and it aims to build U.S. dollar stablecoins into a new underlying network for global payments.

Dankrad Feist, a core Ethereum developer, has left the Ethereum Foundation to join Tempo, a Layer 1 blockchain project focused on stablecoin infrastructure. Tempo is committed to natively integrating stablecoin issuance and settlement functions into its underlying network.

2. Ondo Finance Writes to SEC, Requests Halt to Nasdaq Tokenized Securities Plan link

Ondo Finance has sent a letter to the U.S. Securities and Exchange Commission (SEC) requesting a delay or rejection of Nasdaq’s proposal for tokenized securities trading. It stated that the proposal relies on undisclosed settlement details, which may give large institutions an unfair advantage. Ondo pointed out that regulators and investors cannot fairly evaluate the plan without understanding the blockchain settlement mechanism of the Depository Trust & Clearing Corporation (DTC). Nasdaq’s proposal is currently under SEC review, with a ruling expected as early as November.

3. Eric Trump Plans to Launch Real — Estate Tokenization Project via World Liberty Financial link

In an interview with CoinDesk TV, Eric Trump stated that he is collaborating with World Liberty Financial to advance a real estate tokenization initiative. The initiative involves a building currently under development and may be implemented through the institution’s stablecoin, USD1. He revealed that the project could allow the public to make small investments starting as low as $1,000, enabling them to obtain partial ownership and additional benefits such as hotel-related perks — eliminating the need for financing through traditional banks.

4. Perp DEX’s Open Interest Plunges from $26 Billion to Under $14 Billion After October 11 Crash link

After the 1011 flash crash, the open interest of Perp DEX plummeted from $26 billion to less than $14 billion; the fees captured by lending protocols on that day exceeded $20 million, setting a new all-time single-day record; the weekly trading volume of DEX surpassed $177 billion last week, hitting an all-time high; the total borrowings of cross-chain lending protocols fell below $50 billion for the first time since August; and the stETH APY soared to over 7% at one point.

5. OpenSea Plans to Launch SEA Token in Q1 2026 link

OpenSea CEO Devin Finzer posted that the company plans to launch the SEA token in the first quarter of 2026. Fifty percent of SEA’s total supply will be allocated to the community, with initial claims accounting for half; users participating in OpenSea’s reward programs and OG users will be given priority consideration. The launch of SEA will provide users with more usage methods, including a staking function, allowing users to stake SEA behind their favorite tokens and collectibles. Additionally, 50% of SEA’s revenue will be used to purchase SEA upon its release, aiming to ensure the token’s value and the healthy development of the ecosystem.

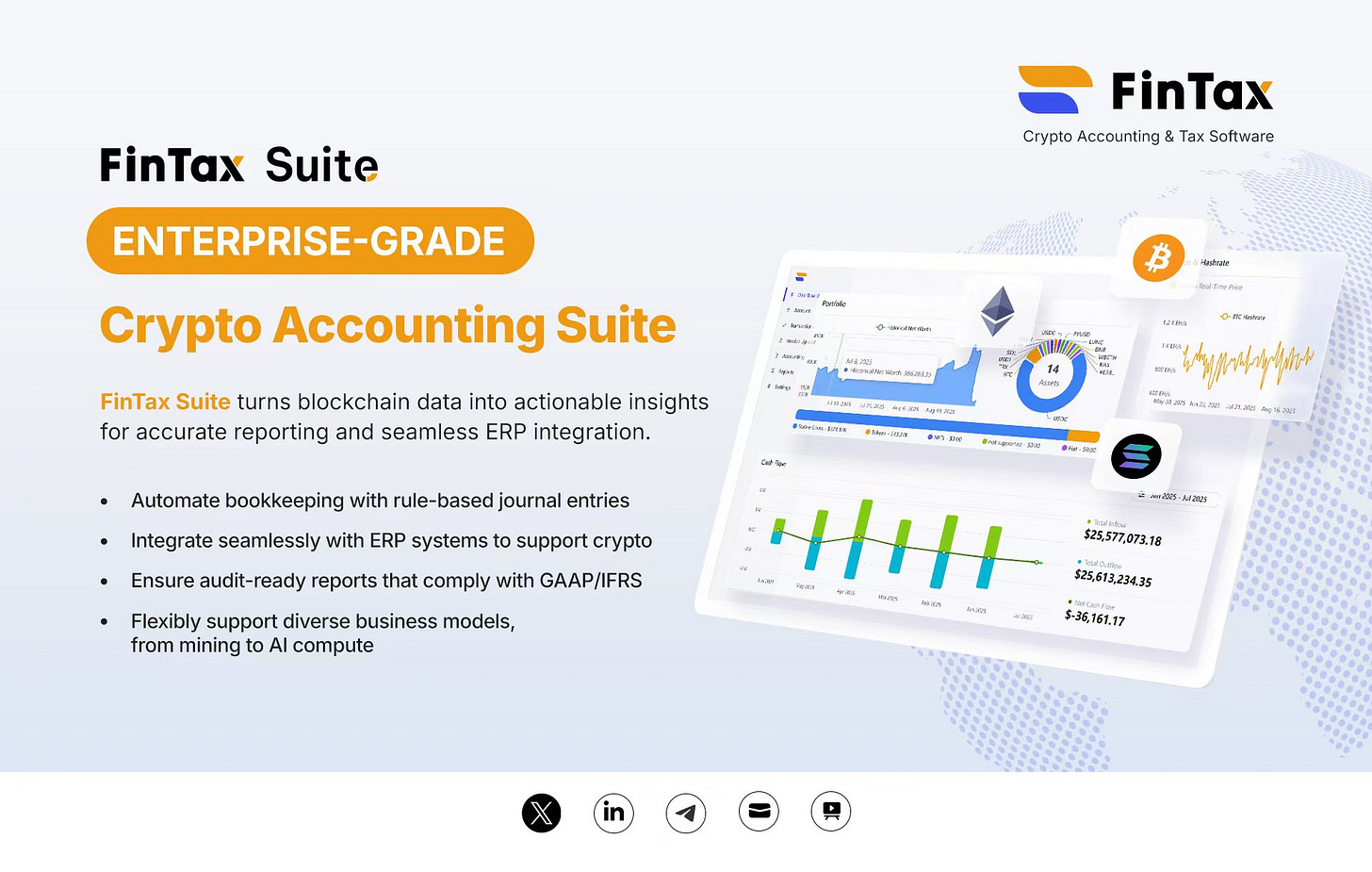

Sponsored by FinTax

6. Ripple Labs to Lead $1 Billion Funding for XRP Digital Asset Treasury link

Ripple Labs is leading a financing initiative of at least $1 billion, which intends to raise funds through a SPAC (Special Purpose Acquisition Company). The funds will be used to establish a new digital asset treasury for accumulating XRP. Ripple will also contribute a portion of its own XRP to this treasury.

7. Lighter CEO Discloses Spot Listing Time and Airdrop Details in AMA link

Lighter CEO @vnovakovski stated in an AMA that the spot market will launch in late October or early November. The first batch of trading pairs will include major cryptocurrencies such as BTC and ETH, with fees lower than those of competitors. Lighter will position itself as a Layer 2-like ecosystem, supporting integration with major DeFi protocols such as AAVE. Fifty percent of the total airdrop will be allocated, with 25%-30% distributed in the first and second seasons combined; this portion will be issued to point holders during the TGE phase. The second-season points program will run until just before TGE. The official stated that points of rule-breakers will be cleared, but no retrospective recovery will be conducted.

8. Believe Announces Upgrade of LAUNCHCOIN Token to BELIEVE link

Believe, one of Solana’s largest launchpads, has announced the upgrade of its LAUNCHCOIN token to BELIEVE. Holders can exchange LAUNCHCOIN for BELIEVE at a 1:1 ratio through the official website over the next 4 weeks; any unupgraded LAUNCHCOIN supply will be burned after the deadline. Notably, the total supply of BELIEVE has increased by 25% compared to LAUNCHCOIN, set at 1.33 billion. Of this increased supply, 17% will be used to incentivize contributors, 5% allocated to early investors, and 3% dedicated to foundation initiatives. Ben Pasternak, founder of Believe, stated that the team did not receive any token supply when launching Pasternak/Launch Coin; all new supply except the foundation’s share will have a lock-up period starting from now; and revenue will be used for on-chain repurchases of BELIEVE.

9. Jupiter to Launch Governance Vote on Whether to Burn 121 Million Repurchased JUP Tokens link

Jupiter will make major adjustments to its ecosystem structure: the DAO will shift to a “high-impact governance” model, reducing the number of proposals and disbanding existing working groups, while the $JUP unstaking period will be shortened from 30 days to 7 days. Meanwhile, the community will launch an independent vote to decide whether to burn the 121 million $JUP held by Litterbox Trust (accounting for approximately 3.8% of the circulating supply), and will determine the future revenue management plan in subsequent votes.

10. Thumzup Considers Integrating DOGE Reward Payments in Mobile App link

Thumzup Media, a company associated with the Trump family, is considering integrating Dogecoin (DOGE) reward payments into its Thumzup app. The app currently offers cash rewards to users who share advertisers’ product content. Thumzup believes that integrating DOGE as an additional payment option can reduce fees and improve the settlement of small cross-border payments. CEO Robert Steele stated that exploring Dogecoin integration is a crucial next step in creating a scalable, low-friction reward engine, and if successful, this change may improve unit economics and attract a broader group of crypto-friendly creators.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish

Fantastic weekley roundup as usual, always look forward to these. The Thumzup DOGE integration for creator rewards is a practical use case that makes a lot of sense. Lower transaction fees and faster settlement for micro payments could actualy work well in the creator economy. That $500M Tempo raise at $5B valuation is wild though, stablecoin infrastructure is definately heating up. The OpenSea SEA token airdrop with 50% to community is generous compared to most token launches. Good stuff all around, thanks for compiling!