Weekly Project Updates: Consensys Plans to Launch IPO, EtherFi Proposes $50 Million Token Repurchase, Circle Launches Arc Blockchain Public Testnet, etc

1. Consensys Plans IPO, Names JPMorgan & Goldman Sachs as Lead Underwriters link

ConsenSys, the parent company of MetaMask, has selected JPMorgan Chase and Goldman Sachs as the lead underwriters for its IPO. Reports indicate that against the backdrop of an increasingly favourable policy environment, crypto companies are accelerating their preparations for going public.

2. Pump.fun Launches “Spotlight” Program to Boost Utility Token Listings link

Pump.fun announced the launch of its new program “Spotlight,” aiming to promote the development of the Internet Capital Markets (ICM). This initiative will focus on supporting Utility Token projects, centering on four core directions: enhancing project visibility, optimizing liquidity mechanisms, providing marketing and promotional support, and improving token economics and onboarding processes. Pump.fun stated that through Spotlight, it will help more high-potential projects achieve tokenization and build a genuine Internet Capital Market.

3. Aster Announces Tokenomics Upgrade, to Adjust Buyback Mechanism for S2 & S3 Phases link

Aster, a decentralized perpetual contract platform, announced the optimization of its tokenomics model, with adjustments to the buyback mechanisms for the S2 and S3 phases to enhance the long-term value of ASTER tokens. Fifty percent of all buyback funds will be directly burned to reduce the total token supply; the remaining 50% will be redirected to locked airdrop addresses to lower the circulating supply and reserve quotas for future airdrops, which will be used to reward real users and long-term holders. Currently, the official has disclosed two major buyback addresses.

4. Ether.Fi Proposes Up to $50 Million Token Buyback Program link

The Ether.Fi community has put forward a proposal to utilize up to $50 million of treasury funds for token buybacks when the price of ETHFI drops below $3. This initiative aims to boost market confidence and reduce the circulating supply. The foundation stated that if the price remains persistently below this threshold, it will expand the buyback scale and increase the proportion of protocol revenue allocated to repurchases. Currently, the voting process has kicked off, with a duration of 4 days.

5. WLFI to Distribute 8.4 Million WLFI Tokens to Eligible Users link

WLFI, a project associated with the Trump family, announced that two months after the launch of the points program for its stablecoin USD1, participating centralized exchanges will distribute a total of 8.4 million WLFI tokens as rewards to eligible users. The first batch of distribution platforms includes Gate, KuCoin, LBank, HTX, Flipster, and MEXC. Previously, users earned points by trading USD1 trading pairs and holding USD1 on partner exchanges, with specific distribution standards formulated and implemented independently by each exchange.

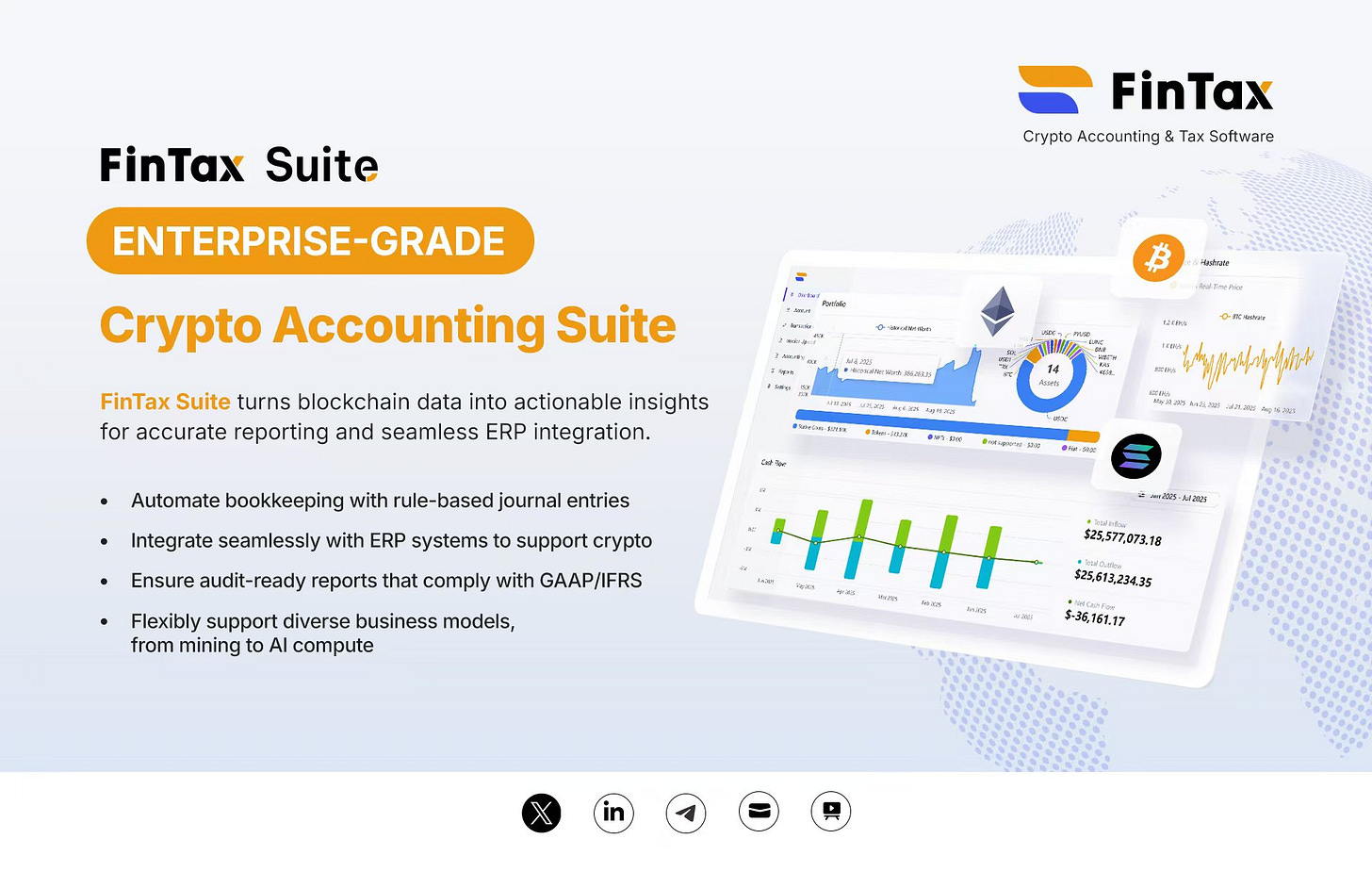

Sponsored by FinTax

6. Ondo Finance Launches Ondo Global Markets on BNB Chain link

Ondo Finance announced the official launch of its global platform, Ondo Global Markets, on BNB Chain. This expansion allows BNB Chain users to directly access over 100 tokenized U.S. stocks and ETFs, and integrates with ecosystem projects such as PancakeSwap.

7. MegaETH Presale: Over 20 Entities Bypass $186,000 Cap via Multiple Wallets link

In less than one hour, the public sale of MegaETH, an Ethereum Layer 2 network, has raised over $200 million, representing a 4x oversubscription. Data from Etherscan, a blockchain explorer, shows that the public sale contract address of MegaETH has generated more than 5,100 transactions.

However, the presale of MegaETH has been marred by Sybil activity, with over 20 entities using multiple wallets to bypass the maximum allocation limit of $186,000. For instance, the wallet address 0x9f5c withdrew funds from Kraken and distributed them to three newly created addresses, subsequently investing a total of $600,000 through these four addresses combined. Bubblemaps, an on-chain analytics platform, stated that despite Echo conducting KYC (Know Your Customer) verification for all users, some participants still attempted to make multiple investments using different identities.

8. Circle Launches Arc Blockchain Public Testnet with BlackRock, Visa Among Participants link

Circle, the issuer of USDC, announced the official launch of the public beta version of its payment-oriented blockchain Arc, which has attracted participation from institutions including BlackRock, Visa, HSBC, AWS, and Anthropic. Positioned to onboard real-world financial activities onto the blockchain, Arc supports US dollar-denominated fees, sub-second settlement, and optional privacy controls. Circle stated that Arc will gradually move toward decentralization in the future, opening up validator nodes and governance rights to the public.

9. TON Foundation Unveils MemeRepublic to Replace Memelandia link

TON Foundation has announced the launch of MemeRepublic, replacing Memelandia — a cultural hub for meme coins and community tokens launched in April 2024 . TON Foundation stated that Memelandia declined due to critical issues such as overly complex and ambiguous rules, repeated reward claims, and outdated infrastructure . Designed to address these pain points, MemeRepublic will introduce a $1 million fund, allocating $50,000 in direct purchasing power and $50,000 in liquidity to the top-performing token each week over a 10-week period.

10. Vitalik Praises ZKsync’s Contributions to Ethereum Ecosystem link

ZKsync has announced the launch of the Atlas upgrade, transforming Ethereum into its real-time capital hub. This landmark update delivers over 15,000 TPS (Transactions Per Second), sub-second ZK (Zero-Knowledge) final confirmation, and near-zero transaction fees, while enabling real-time liquidity interoperability between Layer 1 (L1) and Layer 2 (L2) networks . A revolutionary shift in the capital structure of L1 and L2 ecosystems, Atlas allows ZKsync-based chains to directly access Ethereum’s liquidity without the need for independent liquidity pools, thereby establishing Ethereum as an institutional-grade real-time settlement center . Vitalik Buterin, co-founder of Ethereum, praised the upgrade, noting that ZKsync has done “underrated yet extremely valuable work” within the Ethereum ecosystem.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish