Weekly Project Updates: Ethereum Validator Exit Queue Drops to Zero, Optimism Proposes Using 50% of Revenue for Buybacks, WLFI Applies for U.S. National Trust Bank Charter, etc

1. Ethereum Staking Deposit Queue Rises to 1.759 Million ETH, Activation Waiting Time Reaches Approximately 30 Days; Validator Exit Queue Cleared link

The Ethereum Beacon Chain’s validator entry queue has soared to 1.759 million ETH (worth approximately $5.5 billion), marking its highest level since late August 2023. New stakers are required to wait around 30 days and 13 hours for their validators to be officially activated. Meanwhile, the exit queue has been completely cleared.

2. Base’s Lean Toward Zora in Creator Token Narrative Sparks Developer Doubts Over Resource Allocation link

Base’s strong push for creator coins, closely tied to the NFT marketplace Zora, has sparked backlash among some builders. While Zora-driven creator coin issuance in August briefly pushed Base’s daily token minting volume above Solana and boosted on-chain activity, multiple Base-native projects argue that the official marketing and social resources are overly concentrated on Zora-related narratives, sidelining other projects with existing user bases and historical contributions, and undermining incentives for continued building on Base.

3. ECC, Zcash’s Development Team, Announces Collective Resignation, Citing Governance Body’s Deviation From Project Mission link

On January 8, Josh Swihart, CEO of Electric Coin Company (ECC) — the core developer of Zcash — announced that the entire ECC team has departed its existing structure and plans to establish a new company, citing a “clear divergence” between the governance direction of Bootstrap (the nonprofit overseeing ECC) and Zcash’s core mission. Swihart stated that decisions by a majority of Bootstrap’s board over recent weeks have strayed from Zcash’s founding principles, and the team was forced to collectively resign after employment terms were unilaterally altered. He emphasized the new company will retain the original team and mission — building “unstoppable private money” — and stressed the incident is a governance conflict that will not impact the Zcash protocol itself.

4. PumpFun Launches Creator Fee Sharing Mechanism Supporting Multi-Wallet Allocation and Permission Transfer link

PumpFun has revamped its creator fee mechanism by introducing a creator fee-sharing feature, aiming to enhance the enforceability and transparency of fee distribution. Under the updated rules, token creators and CTO (Community Takeover) admins can proportionally allocate fees to up to 10 wallets after a token goes live, with support for transferring token ownership and revoking update authority. Configurations can be completed via PumpFun’s mobile or web interface. When any fee recipient initiates a withdrawal, the withdrawable status is triggered for all recipients simultaneously; unclaimed fees will be retained indefinitely and not reclaimed.

5. Optimism Foundation Proposes Using 50% of Superchain Revenue for OP Token Buybacks link

The Optimism Foundation has unveiled a proposal to allocate 50% of Superchain revenue toward repurchasing OP tokens, aiming to deeply align OP’s value with the Superchain’s success. If approved in the January 22 vote, the buyback program will launch in February; repurchased tokens will flow back to the treasury for potential future burning or use as staking rewards. The foundation also disclosed that it has collected 5,868 ETH in revenue over the past 12 months, all deposited into the governance treasury.

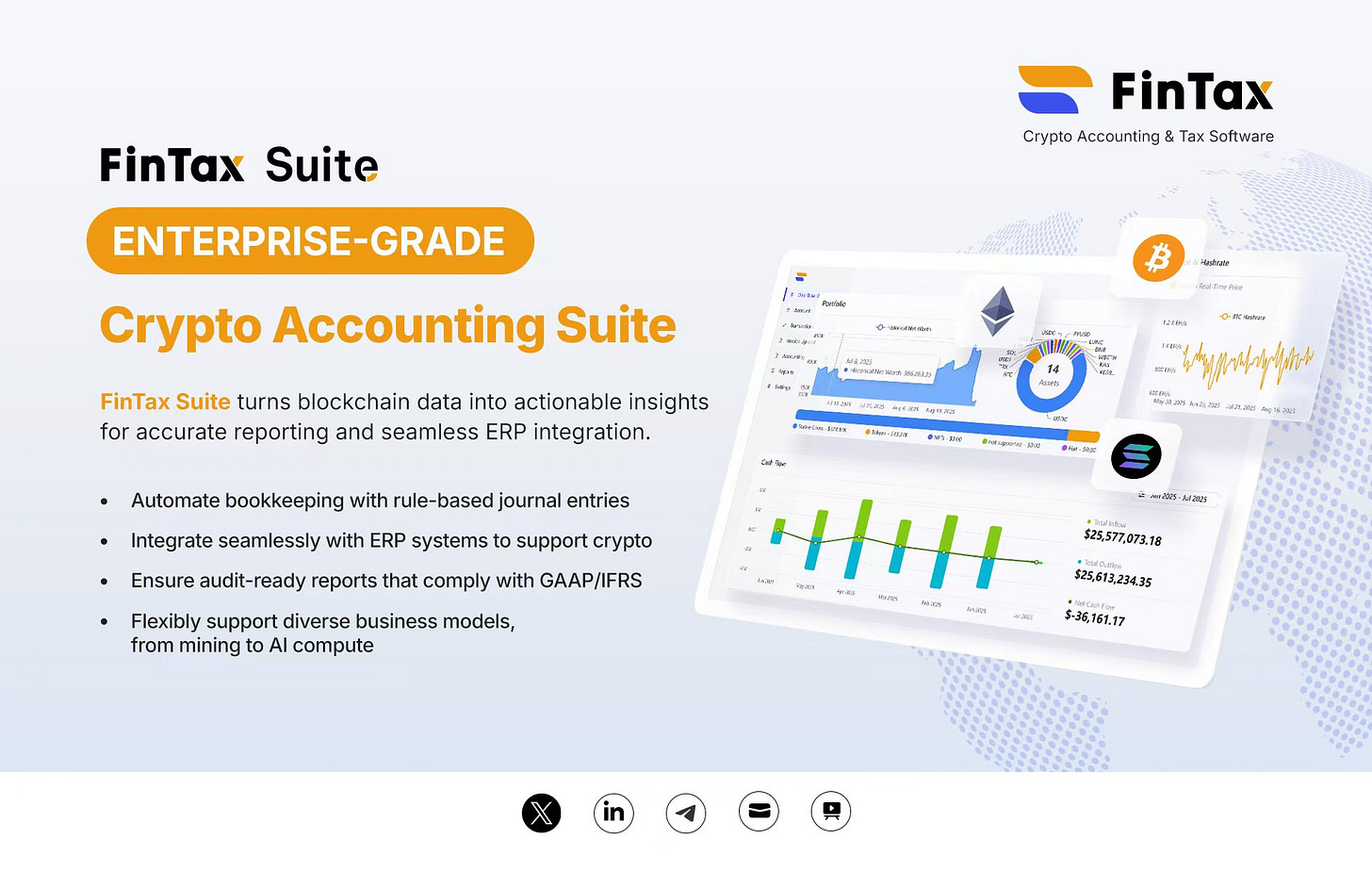

Sponsored by FinTax

6. World Liberty Trust Files Application With OCC for U.S. National Trust Bank Charter link

World Liberty Financial (WLFI) announced that its subsidiary WLTC Holdings LLC submitted a de novo application to the U.S. Office of the Comptroller of the Currency (OCC) on January 7, seeking a national trust bank charter for its proposed entity World Liberty Trust Company, National Association (WLTC). The goal is to directly issue and custody its USD1 stablecoin under federal regulatory oversight, with plans to gradually roll out crypto asset custody and stablecoin conversion services primarily targeting institutional clients.

7. Jito Launches IBRL Explorer: Disclosing Solana Block-Building Details to Public link

According to Jito’s announcement, it has launched the IBRL Explorer tool to publicly and transparently display the construction details within Solana blocks. The tool shows that behaviors such as “tail packing” and “Slot Timing Games” are prevalent in the Solana network, which may affect state propagation efficiency, increase latency and undermine network stability. Through three scoring mechanisms including Slot Time, Vote Packing and Non-Vote Packing, IBRL Explorer generates an IBRL score for each validator, aiming to improve block construction quality and overall network performance.

8. Infinex Issues Public Apology for Its Token Sale Scheme link

Infinex publicly apologized for its token sale plan, acknowledging that its previous design failed to balance retail investors, whales and fair distribution, resulting in low participation willingness. Infinex announced a number of adjustments to the sales mechanism: it will cancel the maximum investment cap of $2,500 per user, allowing users to independently decide the investment amount; it will switch from random allocation to “max-min fair distribution” to ensure equal allocation for all participants until the supply is exhausted, with any excess contributions to be refunded. Meanwhile, Patrons will still have priority access to allocation, and the specific priority method will be confirmed after the sale concludes.

9. Aave Labs: Exploring the Sharing of Off-protocol Revenue With AAVE Holders link

Aave Labs stated that, in light of recent community discussions, it is committed to exploring the sharing of a portion of revenue generated outside the protocol with AAVE token holders and plans to submit a formal proposal containing specific structural arrangements; at the brand level, the relevant plan will also establish necessary governance and risk constraints to support long-term development goals while safeguarding the interests of the DAO and token holders.

10. Data: Excluding Ethereum, Base, Solana and Plasma Account for 20% of Deposit Market Share Respectively link

The landscape of the DeFi lending market outside Ethereum has changed drastically compared to three years ago. Base, Solana, and Plasma each hold a 20% share of the deposit market, while Arbitrum and BNB Chain each account for approximately 10% of the market. Among them, Plasma has risen rapidly in a short period of time, and the key to its ability to maintain long-term value may lie in the successful implementation of Plasma One.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish