Weekly Project Updates: Polygon Cuts Staff by Nearly 30%, Kaito Launches Creator Collaboration Model, Berachain's Lead Developer to Depart, etc

1. Polygon Cuts Staff by Nearly 30%, Pushes Forward Business Transformation Centered on Stablecoin Payments link

Polygon has recently implemented an internal layoff of approximately 30% of its workforce, though the company has not yet officially confirmed this move. The layoffs come amid Polygon’s business restructuring, as the firm has clearly shifted its core development focus to stablecoin payments and completed the acquisitions of Coinme and Sequence. Meanwhile, some Polygon employees and ecosystem members have disclosed their departures and team changes on social media, and Polygon Labs has not responded to requests for comment as of now.

2. Base Co-founder Jesse Pollak: Base App to Be Repositioned as “Trading-First” link

Jesse Pollak, co-founder of Base, stated in a post that the Base app will refocus its positioning to be “trading-first.” Moving forward, it will prioritize building trading functionalities, onboarding more high-quality assets onto the chain, and adopting a “finance-first” user interaction model. He noted that user feedback has centered on three key areas: the app was overly social-focused; it lacked sufficient high-quality tradable assets; and the information feed needed to cover a wider range of content, including applications, stocks, prediction markets, and social tokens.

3. ZKsync Releases 2026 Roadmap: Prividium, ZK Stack and Airbender link

ZKsync has unveiled its 2026 roadmap, centering on three core initiatives: Prividium, ZK Stack, and Airbender, as outlined by Matter Labs co-founder Alex Gluchowski. The roadmap marks a strategic pivot toward institutional adoption and real-world integration, with a focus on privacy by default, deterministic control, verifiable risk management, and native global market connectivity.

4. Only 3 Ethereum L2 Chains Generated Over $5,000 in Daily Fee Revenue on January 14 link

Per CryptoRank data, on January 14, only three Ethereum Layer 2 (L2) chains achieved daily fee revenue exceeding $5,000: Base (approximately $147,000), Arbitrum (approximately $39,000), and Starknet (approximately $9,000). Base accounted for nearly 70% of the total fee revenue generated by all Ethereum L2s, demonstrating a clear leading edge; the combined daily fee revenue of all other L2s was only slightly over $15,000.

5. Berachain Foundation: Eliminates Most Retail Marketing Teams; Lead Developer Alberto to Depart link

The Berachain Foundation released its 2025 year-end update, announcing it has laid off most of its retail-focused marketing team, with resources now redirected to fundamental development amid the ineffectiveness of “retail-first” strategies across the crypto sector since late 2024. The staff departures were conducted amicably, and the foundation confirmed that lead developer Alberto will be leaving to co-found a Web2 firm with former banking colleagues.

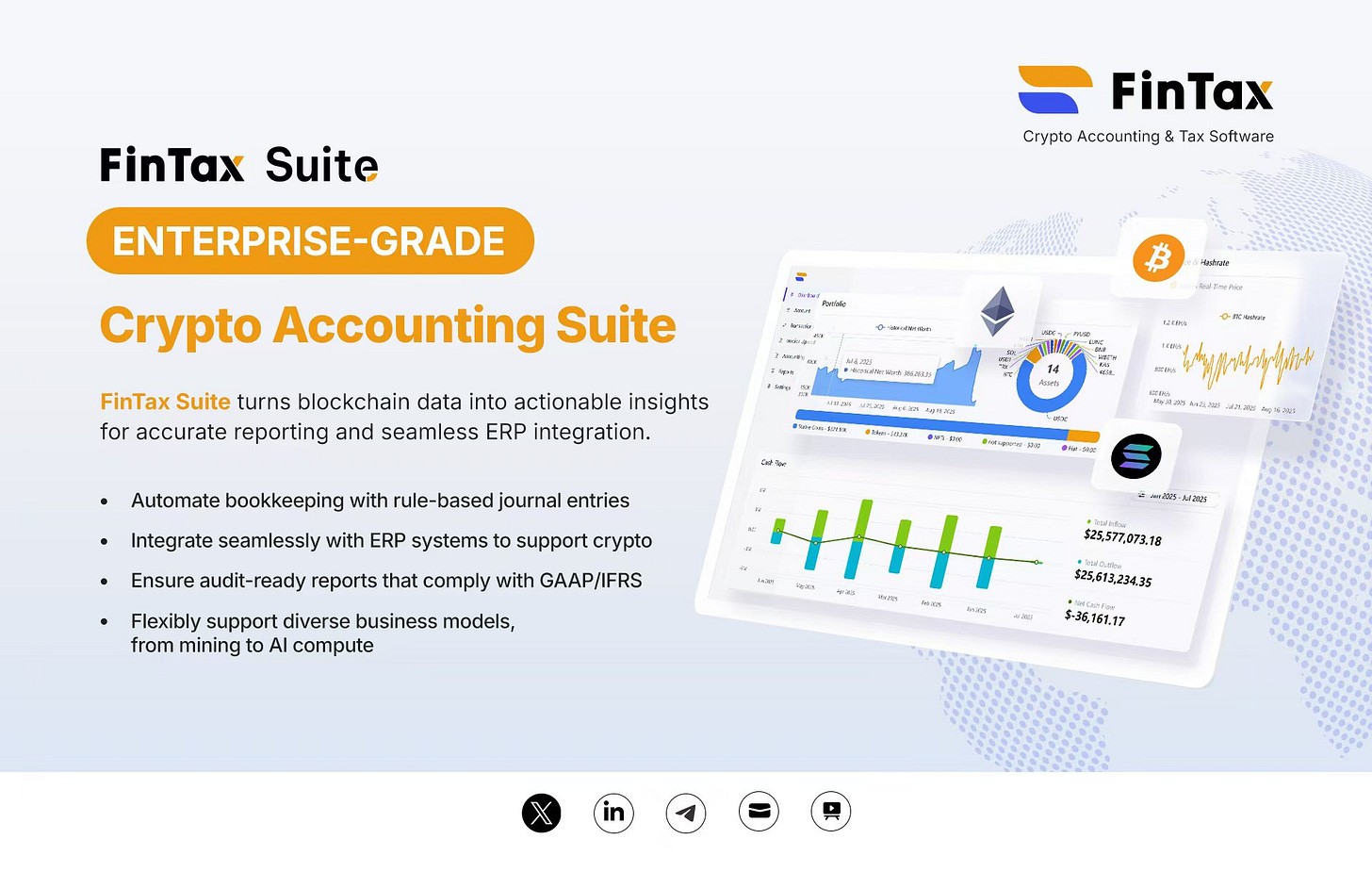

Sponsored by FinTax

6. Kaito Discontinues Yaps Incentive Mechanism, Launches Kaito Studio Creator Collaboration Model link

Yu Hu, founder of Kaito AI, announced the phased shutdown of Yaps and its incentive leaderboard, while launching Kaito Studio — a strategic pivot from a permissionless, open incentive distribution model to a curated, tiered creator collaboration and marketing ecosystem. This transition, driven by X’s (formerly Twitter) API policy change prohibiting reward-for-post apps and the InfoFi sector’s low-quality content challenges, reorients Kaito toward brand-creator partnerships with enhanced professionalism and precision.

7. Brevis and BNB Chain Expand Cooperation to Privacy Infrastructure link

Brevis has partnered with BNB Chain and 0xbow to launch the “Intelligent Privacy Pool” on BNB Chain in Q1 2026, integrating 0xbow’s Privacy Pools with Brevis’ ZK qualification verification to enable privacy-preserving compliance proofs without exposing sensitive data. Users can prove on-chain fund compliance via Brevis ZK Data Coprocessor or bind off-chain KYC through zkTLS, balancing privacy with anti-money laundering (AML) and counter-terrorist financing (CFT) requirements.

8. Aave’s Lending Share Rises to 51.3%, First Single Protocol to Exceed 50% Since 2020 link

As of January 14, 2026, Aave commands a 51.3% share of the DeFi lending market with a TVL of approximately $3.5833 billion, marking the first time a single lending protocol has exceeded 50% market share since 2020, according to DefiLlama. Morpho ranks second with $686.1 million in TVL (9.8%), followed by JustLend ($401.5 million, 5.8%), SparkLend ($381.1 million, 5.5%), and Maple ($272.4 million, 3.9%). The remaining protocols collectively hold just over $150 million in TVL, highlighting Aave’s dominant position.

9. OpenSea CMO: OS Mobile and Hyperliquid Perps Under Internal Testing; TGE to Be Launched link

OpenSea CMO Adam Hollander announced the platform is testing two new products — OS Mobile and Hyperliquid Perps — with an invite-only closed beta, while the foundation advances Token Generation Event (TGE) preparations that will “prioritize reference to” historical trading volume. He urged users to connect and link wallets on OpenSea for unified mobile asset management and to provide the foundation with a comprehensive on-chain history view for the upcoming TGE. The rewards program will continue until TGE, with 50% of each round’s transaction fees allocated to the reward pool, and Treasures data will also be a key consideration. The adjustments won’t affect existing core products like OpenSea Pro, API, or Launchpad.

10. Ethereum New Wallet Creation Hits All-Time High link

Driven by protocol upgrades, rising stablecoin activity, and improved market sentiment, Ethereum has hit all-time highs in new wallet creation: Santiment data shows ~327,000 daily new ETH wallets over the past week, with a single-day record of 393,000 on Sunday, and the total number of non-empty ETH wallets reaching 172.9 million, also an all-time high.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish