Weekly Project Updates: Pump Acquires Meme Trading Terminal Padre, Aster Launches Rocket Launch, Open-Source Protocol x402 Sees Surge in Activity, etc

1. Hyperliquid Open Interest Halves Post-Liquidation Incident; Traders’ “Revenge Trading” Fuels Surge in Liquidations link

Following a recent large-scale liquidation incident on the Hyperliquid platform, the Open Interest (OI) has plummeted by over $7.4 billion from approximately $13.8 billion, with nearly $3 billion coming from altcoins. A week later, the OI has recovered slightly but remains far below the pre-incident level. In the seven days prior to the incident, the platform’s average daily trading volume was about $10 billion. In the week after the liquidation, despite the OI dropping by more than 30%, the trading volume increased by 17%, indicating that some traders attempted to “recoup losses”. However, data shows that the average daily liquidation volume during this period rose by nearly 70%, resulting in further losses for most traders.

2. Pump Fun Announces Acquisition of Meme Trading Terminal Padre link

Pump Fun announced the acquisition of Meme trading terminal Padre. According to the data dashboard by @adam_tehc, since its launch in July 2024, Padre has accumulated a trading volume exceeding $1 billion completed by over 35,000 users, and captured more than $10 million in fees from the transactions.

3. Uniswap Foundation Awards Up to $9 Million Grant to Brevis for Trustless Routing Rebate Program link

The Uniswap Foundation has awarded a grant to Brevis for the development of the Router Rebate program, with a total amount of up to $9 million. The grant aims to provide gas rebates for routers integrated with v4 hooked pools. This system will fully implement the calculation and verification of rebates based on Brevis’s ZK Data Coprocessor and Pico zkVM.

4. Spark’s TVL Surges Over 15% in 7 Days, Topping $10 Billion link

The TVL (Total Value Locked) of DeFi blue-chip protocol Spark has increased by over 15% in the past 7 days, surpassing $10 billion and making it the sixth DeFi project with a TVL exceeding $10 billion in the current market. Additionally, Spark’s annualized fees amount to $273 million, with an annualized revenue of $27.26 million.

On-chain data shows that addresses associated with Justin Sun currently hold approximately $2.2 billion in assets, of which around 60% is deposited in Spark, 26% in Aave, and 14% in Morpho. Over the past 3 days, this address has withdrawn approximately $600 million from Aave and transferred it to Spark.

5. Aave Labs Announces Acquisition of San Francisco-Based Stable Finance link

Decentralized finance (DeFi) institution Aave Labs has announced the acquisition of San Francisco-based Stable Finance, with the transaction amount undisclosed. Stable is known for its mobile application that simplifies on-chain savings for stablecoins; its team and founder Mario Baxter Cabrera will join Aave Labs, where Cabrera will serve as Director of Product.

Aave Labs stated that this move will strengthen its layout of consumer-grade DeFi products. Stable’s technology will be integrated into Aave Labs’ future products, while its existing application will be phased out. It is reported that this marks Aave’s third talent-focused acquisition, following the acquisition of Sonar in 2022 and Family in 2023

.

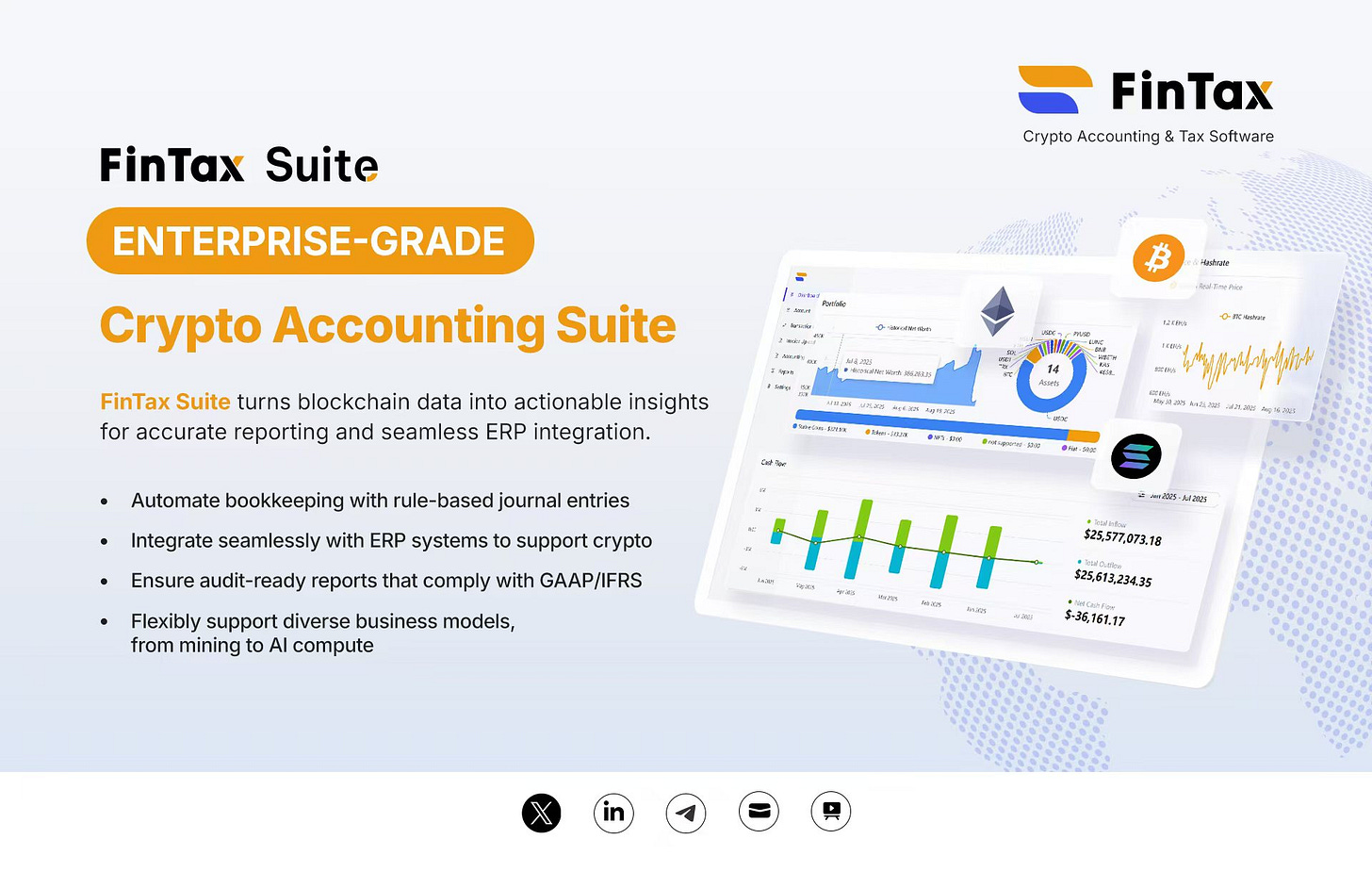

Sponsored by FinTax

6. Aster Launches New Platform Feature Rocket Launch, with APRO Oracle as Inaugural Project link

Decentralized exchange Aster has launched a new platform feature called Rocket Launch, aiming to provide liquidity support for early-stage crypto projects. Each event will have a reward pool composed of ASTER and partner project tokens. Participating project parties need to contribute funds and tokens; Aster will use the funds to repurchase ASTER tokens, which will be distributed together with project tokens to eligible users. The partner for the first event is APRO Oracle, a decentralized oracle project, with a total reward pool of $200,000 worth of ASTER tokens plus additional AT token rewards.

7. Berachain Proposes Launch of New Preconfirmation System link

Berachain is introducing a proposal for a new Preconfirmation System. This mechanism will achieve a more than 10-fold improvement in transaction confirmation speed and further strengthen Berachain’s technological advantages in high performance, fair ordering, and low latency. Designed based on the self-developed consensus client Beacon-Kit and execution client Bera-Reth, the mechanism does not require validators to run additional components, providing optional optimization for high-frequency applications and those susceptible to reorganisation.

8. Jupiter Generates ~$46 Million in Q3 Revenue; Plans to Launch Native Stablecoin, Prediction Market and New Launchpad link

Jupiter has released its Q3 Token Holder Report, stating that the platform generated approximately $46 million in revenue over the past three months. During the quarter, it launched three key offerings: the Ultra v3 trading engine, a lending protocol, and the innovative JLP mechanism. Additionally, Jupiter is advancing the development of its cross-chain hub Jupnet and jupVM, with plans to launch stablecoins, a prediction market, and a new launch platform in the coming months.

9. Ethereum Foundation Member binji Tweets About Arrival of x402 Season link

Binji, a member of the Ethereum Foundation, tweeted about “x402 Season” and cited the article “AI Agents Cannot Trust Each Other Without Blockchain” to provide an analysis.

The open-source protocol x402, launched by Coinbase’s Developer Platform, has seen a significant surge in activity over the past 7 days. The number of transactions reached 163,600 (up 701.7%), the transaction volume hit $140,200 (up 8,218.5%), and the number of buyers reached 31,000 (up 15,000%). This growth is mainly attributed to ping observer’s recent first token issuance using the x402 protocol. Currently, the market capitalization of PING tokens has soared to over $20 million, driving up the prices of related x402 concept tokens.

10. Vitalik Publishes Article Praising Sandeep and Polygon for Contributions to Ethereum Ecosystem link

Vitalik Buterin has published an article highly praising Polygon and its co-founder Sandeep Nailwal, stating that they have played a key role in the Ethereum ecosystem. Vitalik pointed out that Polygon made significant early investments in ZK-EVM research and development, promoted the technical implementation of the Jordi team, and built infrastructure such as AggLayer. He also commended Sandeep for his contributions to India’s public health through the CryptoRelief project, and for proactively returning a $190 million SHIB donation, which enabled the advancement of Balvi’s open-source anti-epidemic project. Vitalik expressed his hope that Polygon can directly adopt mature ZK technology in the future to bring complete security guarantees to its PoS chain.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish

Really comprehensive project update this week. The Hyperliquid liquidation incident and the subsequent drop in OI is concerning, especially with traders doing revenge trading that led to a 70% increase in daily liquidations. That's a textbook example of emotional trading making things worse. The Vitalik article about Sandeep and Polygon caught my attention tho, particularly the part about Sandeep proactively returning a $190 million SHIB donation to enable the advancement of Balvi's anti epidemic project. That's a massive contribution that often gets overlooked when people talk about the SHIB ecosystem. What Sandeep did with that donation, using it for India's public health and then returning it for open source medical research, shows the kind of thoughtfull leadership that seperates serious builders from opportunists. The x402 season hype is interesting too, with transaction volumes up over 8000% in a week, but I wonder how sustainable that growth is once the initial token issuance buzz fades.

Interesting - do you have podcast where you discuss this in detail?