WuBlockchain Weekly: NYSE Develops Tokenized Securities Trading Platform, US Banking Industry Opposes Stablecoin Yields, Strategy Makes Large-Scale Bitcoin Purchases, etc

1. New York Stock Exchange (NYSE) Announces Development of Tokenized Securities Trading and On-Chain Settlement Platform link

The New York Stock Exchange (NYSE) has announced that it is developing a platform for tokenized securities trading and on-chain settlement, for which it will seek regulatory approval. The platform intends to support 24/7 trading of U.S. stocks and ETFs, fractional share trading, stablecoin-based fund settlement, and instant delivery, integrating the NYSE’s existing matching engine with a blockchain settlement system. As planned, tokenized stocks will have the same dividend and governance rights as traditional securities. Meanwhile, Intercontinental Exchange (ICE), the parent company of the NYSE, is collaborating with banks such as BNY Mellon and Citigroup to explore tokenized deposit and clearing infrastructure to support cross-time zone and round-the-clock fund and margin management.

2. American Bankers Association (ABA) Makes “Prohibition of Stablecoin Yields” a Top 2026 Priority link

The American Bankers Association (ABA) has identified “curbing interest/yield/rewards offered by payment stablecoins” as its top 2026 policy priority, citing concerns that stablecoins could become substitutes for bank deposits, undermining the deposit base and lending capacity of community banks. Brian Moynihan, CEO of Bank of America, previously stated that up to $6 trillion in deposits could flow into “interest-bearing stablecoins”.

3. Trump Says He Will Sign Crypto Bill as Soon as Possible link

At the World Economic Forum in Davos, US President Donald Trump stated that he has made crypto policy a key agenda item, with Congress advancing broader crypto market structure legislation that he hopes will be signed “soon” to further drive the development of the crypto industry. Trump noted that his support for crypto legislation stems from both political considerations and geopolitical competition factors, emphasizing that the United States must maintain its edge in critical technological fields such as crypto and AI.

4. U.S. Treasury Secretary Scott Bessent: U.S. to Continue Advancing Strategic Bitcoin Reserve Plan link

During the World Economic Forum in Davos, Switzerland, U.S. Treasury Secretary Scott Bessent reaffirmed that President Donald Trump is committed to establishing the United States as a global leader in cryptocurrency innovation and will continue advancing the Strategic Bitcoin Reserve Initiative. “The policy of this administration is to incorporate seized Bitcoin into our digital asset reserves upon completion of relevant judicial proceedings,” Bessent stated. “Therefore, in our view, the first step in building the Bitcoin reserve was to halt Bitcoin sales — and we have already done that; next, we can proceed to further increase such assets and seized proceeds.”

5. Bermuda Government Announces Partnership with Coinbase and Circle to Promote “Full On-Chain” Economic System link

The Government of Bermuda has announced a partnership with Coinbase and Circle to develop a blockchain-based “fully onchain” economic system. It plans to pilot stablecoin payments in government departments, promote the use of USD Coin (USDC) among local merchants, and support financial institutions in adopting tokenization and other digital financial tools. The plan was unveiled during the World Economic Forum Annual Meeting. The partners will provide infrastructure and technical support to the government, banks, insurance institutions, small and medium-sized enterprises (SMEs), and consumers, while also conducting digital finance education and facilitating technical onboarding.

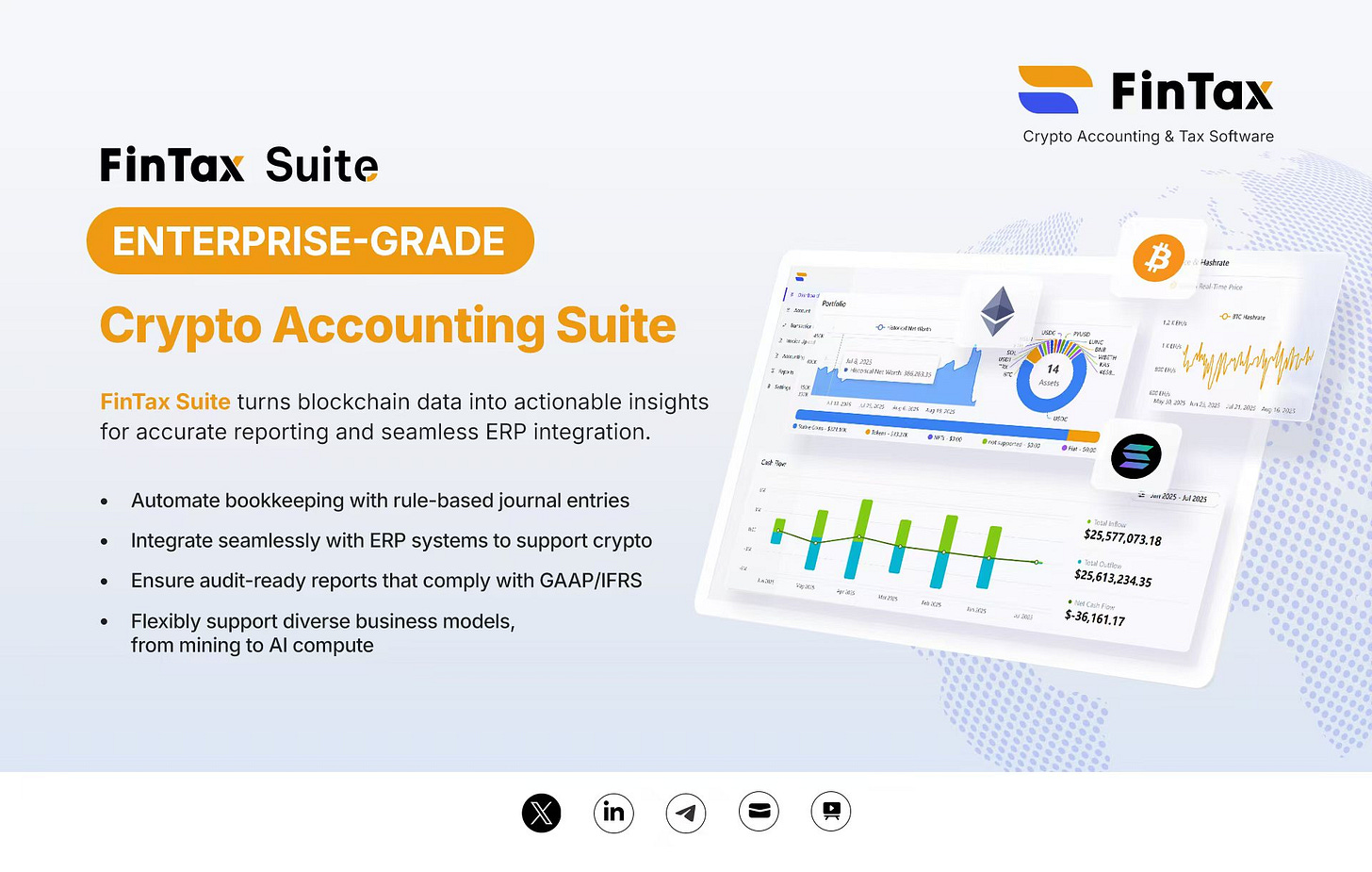

Sponsored by FinTax

6. Trump Family Wealth Reaches $6.8 Billion, with Crypto Assets Accounting for One-Fifth link

The Trump family has a net worth of $6.8 billion, with crypto projects adding approximately $1.4 billion to their wealth over the past year, accounting for roughly one-fifth of their total fortune. Key sources include World Liberty Financial ($390 million from token sales and $500 million from the Alt5 Sigma transaction), the Trump memecoin (valued at $280 million), and American Bitcoin Corp. (Eric Trump’s stake worth $114 million). The USD1 stablecoin has a circulating supply exceeding $3 billion, while Trump Media’s stock price has plummeted 66% over the past 12 months.

7. Ethereum Co-Founder Vitalik Buterin: 2026 Will Be a Year to “Reclaim Lost Ground in Computational Self-Sovereignty” link

Vitalik Buterin, co — founder of Ethereum, stated in a post that 2026 will be “the year to reclaim lost ground in computing self — sovereignty”, and this applies far beyond the blockchain sector. He advocated reducing the amount of data entrusted to centralized services. Buterin shared that in 2025, he almost fully switched to Fileverse, a decentralized encrypted document platform, and made Signal his primary messaging tool. For 2026, he has replaced Google Maps with OpenStreetMap and Gmail with ProtonMail, adding that the ideal scenario is to directly use end — to — end encrypted communication tools. He also mentioned that he continues to explore local large — language model (LLM) setups, though the “last — mile” user experience and energy consumption remain problematic.

When responding to the community’s skepticism about his shift from popular mainstream tools to niche decentralized alternatives, Buterin argued that the mindset of only chasing “tools used by everyone” was exactly what led to the creation and ultimate failure of Liberty Reserve. He stressed the need to resist blind reliance on “mainstream tools”, especially centralized products that “hoover up user data and may have backdoors accessible to multiple forces”. He emphasized that choosing a more principled path, building and using tools that safeguard users’ self — sovereignty and freedom, is crucial to embodying the spirit of Bitcoin.

8. PwC: Institutional Crypto Asset Adoption Has Entered an Irreversible Phase link

In its Global Crypto Regulation Report 2026, PwC pointed out that institutional adoption of crypto assets has reached a “point of no return,” and the focus of discussions has shifted from whether to adopt them to how to integrate them into existing systems. The report stated that stablecoins, tokenized cash, and on-chain settlement tools are being used by banks, asset management institutions, and payment companies in practical business scenarios such as internal transfers, cross-border payments, and corporate treasury management. Crypto technology is no longer primarily used for trading or speculation but is gradually being embedded into basic financial processes such as payments and settlements.

9. Strategy Makes Large-Scale Bitcoin Purchases Worth Approximately $2.13 Billion for 22,305 BTC link

Strategy announced that it has purchased 22,305 BTC for approximately $2.13 billion, at an average price of about $95,284 per coin. As of January 19, 2026, Strategy holds a total of 709,715 bitcoins, with an aggregate investment of around $53.92 billion and an average cost of roughly $75,979 per coin.

10. Robert Kiyosaki: Doesn’t Care About the Rise or Fall of Gold, Silver and BTC, Will Continue Buying link

Robert Kiyosaki, author of Rich Dad Poor Dad, stated on social media that he pays no mind to the short-term price fluctuations of gold, silver, Bitcoin, or even Ethereum. He explained that as U.S. national debt continues to mount and the purchasing power of the U.S. dollar keeps declining, he focuses more on long-term monetary trends rather than price swings. Kiyosaki further claimed that in his view, the current fiscal and monetary system is dominated by “highly educated yet incompetent individuals.” For this reason, he will keep buying gold, silver, Bitcoin, and Ethereum to grow his wealth.

Fundraising

Cork closed a $5.5 million seed — round financing, led by a16z and CSX. link

Argentine fintech firm Pomelo completed a $55 million Series C financing. link

Dutch crypto platform Finst announced the completion of an €8 million Series A financing. link

Warden Protocol declared the completion of a $4 million strategic financing, with a valuation reaching $200 million. link

ZBD, a Bitcoin payment and gaming payment infrastructure company, announced the closure of a $40 million Series C financing. link

Superstate, a fintech and tokenization company, announced the completion of an $82.5 million Series B financing. link

Learn more, check out crypto-fundraising.info.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish

The convergence of traditional finance institutions like NYSE with blockchain infrastructure marks a pivotal shift in how securities markets will operate. The banking industry's pushback on stablecoin yields reveals their concern about deposit outflows, which could accelerate if regulatory clarity emerges this year. Bermuda's full on-chain economic system pilot could serve as an important test case for larger economies considering similar moves.