With the disclosure of more than 1,100 pages of liquidator documents, it is also known who lent the money to Three Arrows:

https://www.docdroid.net/xKIqrjq/20220709-3ac-bvi-liquidation-recognition-1st-affidavit-of-russell-crumpler-filed-pdf

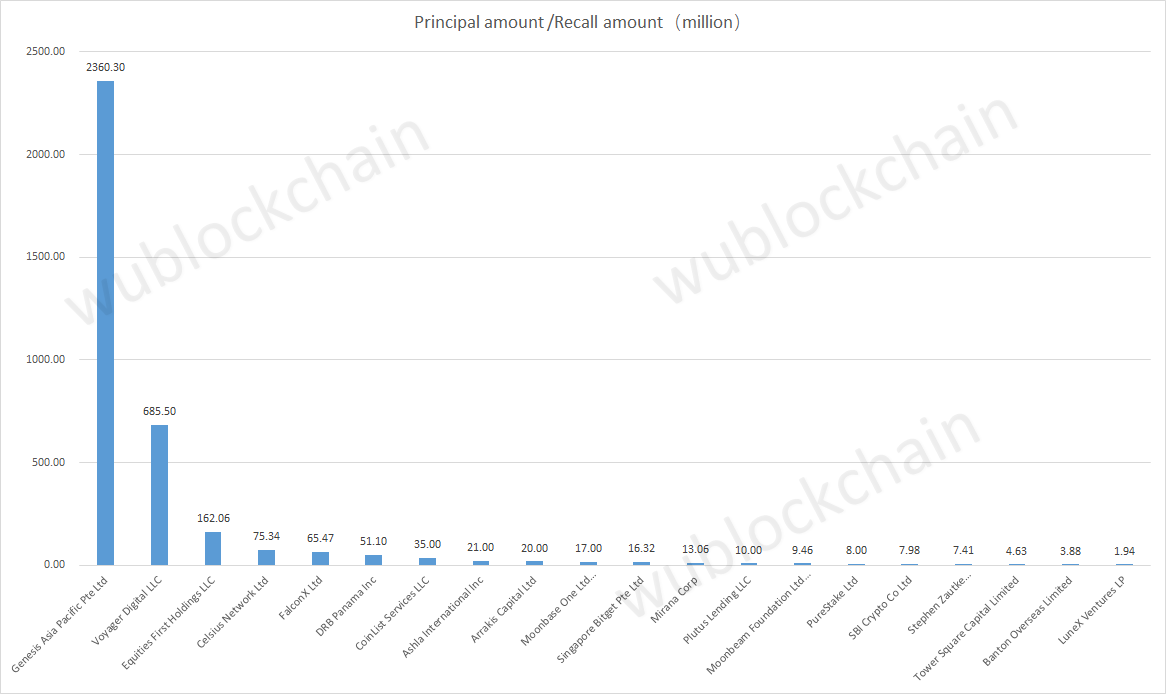

The total is $3.5 billion, and since most of them are secured loans, the total loss should be in the range of $1-1.5 billion. Some of the 32 institutional debtors disclosed in the filing are as follows (However, the amount of some institutions and retail investors is not disclosed in this document):

The largest creditor is Genesis Lending, which is owned by DCG. Genesis has always been known for its aggressive lending style, it was also one of the largest creditors of other institutions such as Babel Financial. Genesis has lent up to $2.36 billion. Fortunately, it is not an unsecured loan, the collateral of 3AC is GBTC, a total of 17,443,644 shares; 446,928 shares of Grayscale Ethereum Trust and 2,739,043.83 $AVAX and 13,583,265 $NEAR. There is still a shortfall of $462 million.

The second-ranked creditor is Voyager with an unsecured loan of nearly $1 billion (in March value) to Three Arrows Capital, currently worth $600 million. Ironically, Voyager emphasized in every financial report that, based on its due diligence, the company believes that the borrower is a high-quality financial institution with sufficient funds to meet its due debts.

The third-ranked creditor is the well-known Equities First in the hedge fund coummunity, with a loan amount of 160 million US dollars. Among other borrowers, the Chinese world is more familiar with Coinlist ($35 million); Bitget Exchange ($16.32 million); Mirana/Bybit Investment Department ($13 million); Hashkey ($440,000).

According to TheBlock, the creditors committee of Three Arrows Capital (3AC) has been established, consisting of five institutions, namely DCG, Voyager, CoinList, Blockchain.com and Matrixport. Blockchain.com does not appear in the above documents, but it said that it lent $700 million and incurred a loss of $270 million; Matrixport also did not appear in the above documents, and the loan amount and the loss amount are unknown.

Follow us

Twitter: https://twitter.com/WuBlockchain

Telegram: https://t.me/wublockchainenglish

Why isn't BlockFi in this list?